Image: www.youtube.com

In the dynamic landscape of financial markets, the concept of options trading occupies a unique position. Among the intricate aspects of options, understanding Theta is paramount for successful navigation. In this comprehensive guide, we will delve into the essence of Theta, unveiling its significance and empowering you with actionable insights.

Theta: The Time Value Erosion Factor

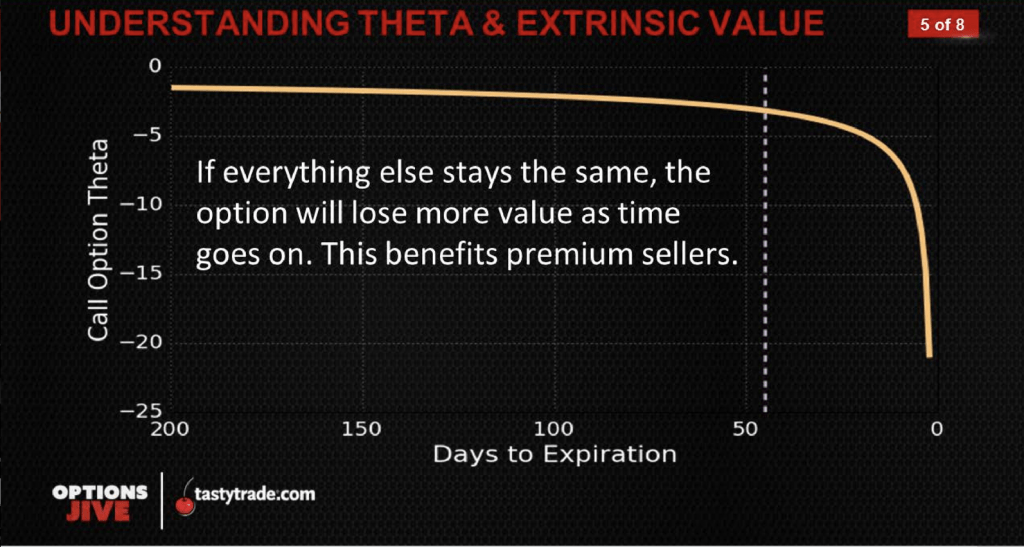

Theta represents the rate at which the time value of an options contract diminishes as it approaches expiration. As time passes, the intrinsic value of the option decreases, leading to a reduction in its overall value. Theta quantifies this time-based decay, serving as a vital metric for option traders.

The Dance of Time and Value

At its core, Theta reflects the underlying principle of time’s inexorable passage. Options contracts have a finite lifespan, expiring at a predetermined date. As this expiration date nears, the potential for the option to be exercised dwindles, diminishing its value over time.

Theta’s impact manifests in a linear fashion. With each passing day, the time value of an option erodes at a constant rate. This decay accelerates as the option approaches its expiration date, creating a sense of urgency for traders.

Implications for Options Traders

Understanding Theta is essential for options traders, as it directly influences their profit potential. Traders who purchase options must carefully consider the time value decay associated with the contract. Extending the time to expiration will reduce Theta’s impact, but it also necessitates a larger upfront premium. Conversely, shorter-term options offer reduced Theta decay, but their potential profit margins are often narrower.

Strategies for Theta Management

Seasoned options traders employ various strategies to mitigate Theta’s effects. One common approach is to hold options contracts with longer time to expiration. By purchasing options with a longer lifespan, traders can benefit from a slower rate of time value decay. Additionally, certain option strategies, such as spread trading, can be designed to neutralize Theta’s impact, allowing traders to focus on other variables such as volatility and price movement.

Expert Insights and Practical Tips

-

“Theta is a double-edged sword in options trading. While it can accelerate losses for some, it can also create opportunities for profit in a timely market,” says renowned options trader Scott Redler.

-

“Discipline is key when managing Theta,” advises seasoned investor Mark Douglas. “Plan your trades carefully, taking into account the time value decay factor.”

Conclusion

Theta, the time value erosion factor, plays a pivotal role in options trading. By understanding how Theta affects options contracts, traders can make informed decisions, optimizing their strategies to navigate the dynamic financial markets. Whether you are a seasoned trader or just starting your journey in options, mastering the concept of Theta will empower you to unlock its potential and harness the power of time in your trading endeavors. Remember, time is of the essence, and leveraging this knowledge will undoubtedly enhance your trading proficiency.

Image: luckboxmagazine.com

Options Trading Theta Explained

Image: mac.x0.com