As a crypto enthusiast, I couldn’t resist the allure of Bitcoin options trading. When I first encountered this novel market, I was instantly intrigued by the potential for both gains and hedging strategies. Embarking on a journey to unravel its complexities, I carefully navigated the intricacies of options trading, unearthing valuable insights that I am eager to share with fellow traders and investors.

Image: www.usfunds.com

Delving into Bitcoin Options

Options, in the world of finance, are contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predefined price (strike price) before a set expiration date. In the realm of Bitcoin options trading, this underlying asset is the flagship cryptocurrency itself.

Function of Options

Options serve two primary functions. Firstly, they provide a powerful tool for risk management, enabling traders to protect their portfolios against market volatility and potential losses. Secondly, options offer vast potential for profit generation through speculation and hedging strategies, catering to both conservative and aggressive traders.

Navigating the Markets

The Bitcoin options market is a vast and dynamic landscape, with numerous exchanges and brokers catering to diverse trading needs. Each platform boasts its unique advantages and disadvantages, so careful evaluation is essential before selecting a trading destination.

Image: www.btc-echo.de

Types of Exchanges

Bitcoin options exchanges can be broadly categorized into two types: regulated and unregulated. Regulated exchanges adhere to strict government guidelines, providing a degree of protection and security for traders. Unregulated exchanges, on the other hand, operate with fewer restrictions, often offering higher leverage and a broader range of trading products.

Choosing a Broker

Brokers play a crucial role in facilitating Bitcoin options trading. They provide access to multiple exchanges, offer trading platforms, and offer educational resources. When selecting a broker, due diligence is paramount, considering aspects such as fees, execution speed, customer support, and the range of trading instruments offered.

Trends and Developments

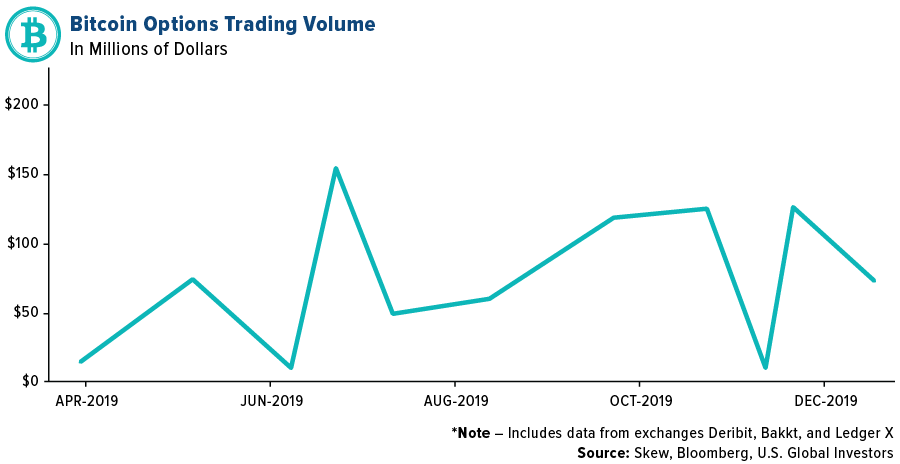

The Bitcoin options market is constantly evolving, embracing new trends and developments. One notable trend is the increasing institutional participation, bringing added liquidity and sophistication to the market. Additionally, the advent of decentralized options exchanges, leveraging blockchain technology, is providing traders with innovative and potentially disruptive alternatives.

Expert Tips for Success

Based on my experience and insights gathered from industry experts, I’ve compiled essential tips to enhance your Bitcoin options trading success:

- Comprehensive Research and Education: Immerse yourself in the complexities of Bitcoin options trading. Familiarize yourself with fundamental concepts, risk management strategies, and market dynamics.

- Risk Management First: Never overlook the significance of risk management. Establish clear stop-loss levels to safeguard your capital and adopt a disciplined trading approach.

- Discipline and Patience: Successful options trading requires immense discipline and patience. Avoid emotional decision-making and adhere to your predefined strategies.

- Capital Allocation: Prudent allocation of capital is paramount. Only trade with a portion of your portfolio that you are prepared to potentially lose.

FAQs on Bitcoin Options Trading

To address common questions surrounding Bitcoin options trading, I’ve compiled a brief FAQ:

- Q: What is Bitcoin options trading?

A: Bitcoin options trading involves the buying and selling of contracts that grant the buyer the option, but not the obligation, to buy or sell Bitcoin at a specific price on or before a particular date.

- Q: How do I get started with Bitcoin options trading?

A: To begin, select a reputable Bitcoin options exchange or broker and open an account. Familiarize yourself with their trading platform and fees, and start with small trades as you gain experience.

- Q: What are the risks involved in Bitcoin options trading?

A: Bitcoin options trading carries significant risks, including the potential for significant financial loss. Unforeseen market movements, volatility, and leverage can amplify these risks.

Bitcoin Options Trading Markets Brokers Exchanges

Image: mssgstaffing.com

Conclusion

Bitcoin options trading presents an exciting opportunity for traders and investors to explore the realm of cryptocurrencies. By equipping yourself with knowledge, carefully navigating the market, and adhering to sound trading principles, you can harness the potential for success while mitigating risks. Are you ready to delve into the captivating world of Bitcoin options trading?