Unlocking the Potential of Option Contracts

The world of options trading offers a plethora of possibilities for savvy investors seeking both profit and risk management. At the heart of this arena lies the judicious selection of stocks that possess the traits conducive to successful option strategies. In this article, we will embark on a comprehensive journey, unraveling the intricacies of stock selection for options trading, equipping you with the knowledge and insights to navigate this dynamic market effectively.

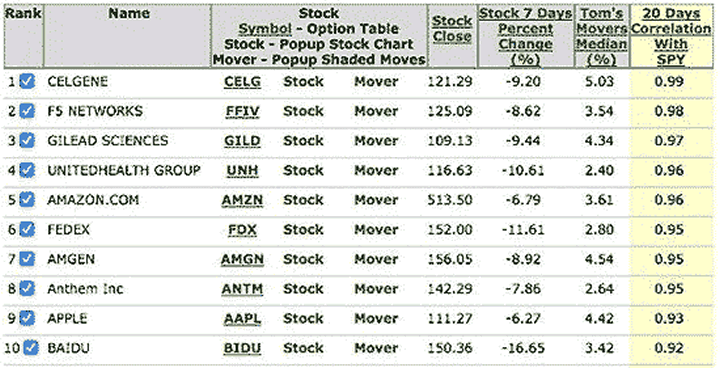

Image: www.marketoracle.co.uk

Understanding Options Contracts

An option contract grants the purchaser a right but not an obligation to buy (call option) or sell (put option) the underlying asset at a designated strike price on or before a specified expiration date. This flexibility allows traders to capitalize on market movements without committing to outright ownership of the stock.

Factors to Consider in Stock Selection

The choice of stocks for options trading hinges on a judicious evaluation of several crucial factors:

- Volatility: Stocks that exhibit significant fluctuations in price provide ample opportunities for options traders to profit from price movements. Measuring volatility through metrics like the historical volatility or implied volatility is crucial.

- Liquidity: The liquidity of a stock ensures that traders can promptly enter and exit positions without incurring substantial slippage. High-volume stocks with a healthy open interest in options provide seamless trade execution.

- Earnings Seasonality: Stocks that demonstrate predictable earnings patterns can offer lucrative options trading opportunities. Knowing when a company’s earnings are expected can aid in strategizing option trades to coincide with potential price swings.

- Company Fundamentals: While options trading primarily focuses on short-term price movements, it’s prudent to consider a company’s financial health, growth prospects, and any potential catalysts that might impact its stock price.

- Technical Analysis: Technical analysis can provide additional insights into stock behavior, identifying chart patterns, support and resistance levels, and momentum indicators that can inform options trading decisions.

Latest Trends and Developments

The options trading landscape is constantly evolving, with new innovations and regulatory changes shaping market dynamics. Here’s an overview of notable trends:

- Rise of Zero-Commission Brokers: The emergence of online brokerages offering commission-free options trading has lowered entry barriers and democratized access to options markets.

- Increased Retail Participation: Individual investors are increasingly embracing options trading as a means of enhancing portfolio returns and hedging risks.

- Regulatory Focus on Risk Management: Regulatory bodies are keen on ensuring that options trading is conducted responsibly, emphasizing the importance of understanding the risks associated with options strategies.

Image: tradeproacademy.com

Expert Tips for Success

Drawing on our experience as seasoned market analysts and options traders, here are some valuable tips to enhance your trading success:

- Start Small: Begin with small positions and gradually increase your trading size as you gain experience and confidence.

- Manage Risk Prudently: Utilize stop-loss orders to limit potential losses and always consider the Greeks (delta, gamma, theta, etc.) to fully comprehend the risk profile of your options positions.

- Educate Yourself Continuously: The world of options trading is perpetually evolving, necessitating continuous learning through books, webinars, and industry events.

- Leverage Technology: Employ automated trading platforms and tracking tools to enhance efficiency, monitor positions, and make informed trading decisions.

- Seek Professional Guidance: Consider working with a financial advisor or mentor who understands options strategies and can guide you through complex trading situations.

FAQs on Options Trading

Q: What is the difference between a bull call and a bear put spread?

A: A bull call spread involves buying a lower strike price call option and selling a higher strike price call option, profiting when the stock price rises. A bear put spread entails buying a higher strike price put option and selling a lower strike price put option, generating gains when the stock price falls.

Q: Which option strategy is suitable for beginners?

A: Covered calls or cash-secured puts offer lower risk for novice traders. In a covered call, you own the underlying stock and sell a call option against it. In a cash-secured put, you have sufficient funds in your account to purchase the underlying stock if the option is exercised.

Q: How can I minimize losses in options trading?

A: Effective risk management is paramount. Implement stop-loss orders, manage your position sizing, and thoroughly understand the Greeks to quantify the potential risks and rewards associated with your trades.

Best For Trading Options Stocks

Conclusion

The world of options trading presents a vast landscape filled with opportunities for savvy investors. By discerningly selecting stocks, skillfully employing trading strategies, and continuously refining your knowledge, you can unlock the potential of options trading to enhance your financial endeavors.

We invite you to explore our extensive library of articles, webinars, and trading resources to further deepen your understanding and confidently navigate the options market. Feel free to engage with us through the comments section below if any queries arise.