Introduction

Harnessing the power of options trading has long been a strategy reserved for professionals and seasoned investors. However, with advancements in online brokerages and educational resources, volume options trading is now accessible to all. This comprehensive guide is meticulously crafted to empower you with a deep understanding of volume options trading, enabling you to navigate this dynamic market with confidence.

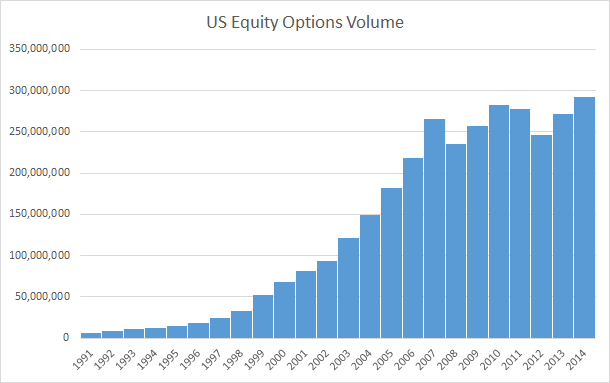

Image: www.businessinsider.com

What is Volume Options Trading, and Why is it Important?

Options trading involves the interplay of contracts that bestow the right, not the obligation, to buy or sell an underlying asset at a specified price and time. These contracts, known as options, confer flexibility and potential leverage, making them a vital instrument for savvy investors seeking additional profit and enhanced risk management.

The History and Significance of Volume in Options Trading

The concept of volume in options trading traces its roots back centuries, serving as a critical indicator of market sentiment and trading activity. High volume, characterized by numerous buyers and sellers, typically signifies substantial interest and price volatility. Understanding volume patterns allows traders to gauge market consensus, identify trading opportunities, and predict future price movements.

Types of Options and their Applications

Options come in two primary forms: calls and puts. Calls grant the buyer the right to purchase an underlying asset, while puts grant the right to sell. Calls are ideal for bullish investors, while puts benefit bearish investors. Both calls and puts can be employed for hedged positions, speculating on price movements, and generating income through option premiums.

Image: estradinglife.com

Basics of Option Premiums and Payoffs

Option premiums represent the price of the options contract, embodying the inherent value and time value. Intrinsic value reflects the difference between the strike price and the current price of the underlying asset, while time value measures the remaining life of the option contract. Payoffs, the profit or loss derived from an option trade, are determined by complex calculations involving variables such as the strike price, underlying asset price, premium, and expiration date.

U.S. Volume Options Trading: Regulatory Landscape and Leading Exchanges

Options trading in the United States is overseen by the Securities and Exchange Commission (SEC), ensuring transparency, investor protection, and market integrity. Leading exchanges such as the Chicago Board Options Exchange (CBOE) and the International Securities Exchange (ISE) facilitate efficient volume options trading and provide a robust marketplace for various asset classes.

Strategies and Techniques for Volume Options Trading

Volume options trading offers a wide landscape of strategies and techniques, ranging from simple to complex. Covered calls, cash-secured puts, and bull call spreads are widely adopted strategies that yield potential returns while mitigating risks. Moreover, technical analysis, including candlestick patterns and moving averages, assists traders in identifying trading opportunities and assessing market trends.

Expert Insights and Practical Tips for Success

Seasoned options traders emphasize the significance of risk management and emotional control. They advocate for meticulous due diligence, thorough research, and a comprehensive understanding of underlying assets and market dynamics. Setting clear profit targets, employing stop-loss orders, and regularly reviewing trading performance are crucial for long-term profitability.

Volume Options Trading

Image: www.optiontradingtips.com

Conclusion

Venturing into the realm of volume options trading demands a confluence of knowledge, skill, and strategic thinking. Embodied in this comprehensive guide are the fundamental principles, techniques, and expert insights to empower you to make informed decisions. Embrace the dynamic, multifaceted world of options trading and unlock its potential for augmented returns and enhanced risk management.