Diving into the world of options trading with Robinhood can be both exhilarating and daunting. Unlocking the potential of options requires a strategic approach and a thorough understanding of various trading strategies.

Image: marketxls.com

A Beginner’s Guide to Options Trading

Options contracts grant traders the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predefined price (strike price) before a specified date (expiration date). These derivatives offer a wide range of strategies to capitalize on market movements.

Covered Calls: This conservative strategy involves selling a call option on an underlying asset that you already own. You earn premium income from the sale of the option and benefit from any potential price increase in the underlying asset. However, you will not participate in gains that exceed the strike price of the option.

Cash-Secured Puts: Similar to covered calls, this strategy involves selling a put option on an underlying asset. However, you must maintain enough cash in your account to cover the potential purchase price of the underlying asset if the option is exercised. This strategy generates premium income, but also limits potential gains.

Bull Put Spread: This strategy requires you to buy a lower-strike call option and simultaneously sell a higher-strike call option with the same expiration date. You profit from a limited price increase in the underlying asset, but you have a limited risk since you collect a premium from selling the higher-strike call option.

Bear Put Spread: For a bearish outlook, you can buy a lower-strike put option and sell a higher-strike put option. This strategy benefits from a price decline in the underlying asset and generates premium income. However, your profit potential is capped, and you bear the risk of being assigned the obligation to sell the underlying asset if the put option is exercised.

Iron Condor: This strategy combines a bear put spread with a bull put spread. You sell two out-of-the-money call options at different strike prices and two out-of-the-money put options at different strike prices. You collect premium income from the sale of these options, but the profit potential is limited. This strategy aims to profit from a period of low volatility in the underlying asset.

Tips and Expert Advice for Options Trading

1. Understand Risk: Options can amplify both gains and losses compared to traditional stock trading. It’s crucial to assess your risk tolerance and limit your trading size accordingly.

2. Choose Your Strike and Expiration Dates Carefully: The strike price and expiration date of your options contract will determine the profit potential and risk associated with the trade.

3. Manage Volatility: Volatility is a key factor in options pricing. Understand the factors influencing volatility and how it can affect your trading strategies.

4. Use Options as a Supplement: Options can be a valuable tool for hedging risks or enhancing returns, but they should not constitute the entirety of your portfolio.

5. Seek Professional Guidance: If you’re new to options trading or have complex trading strategies, consider seeking advice from a financial advisor or experienced trader.

FAQ on Options Trading with Robinhood

How do I open an options trading account with Robinhood?

You must meet certain eligibility requirements and apply for options trading approval on the Robinhood platform.

What is the minimum capital required for options trading?

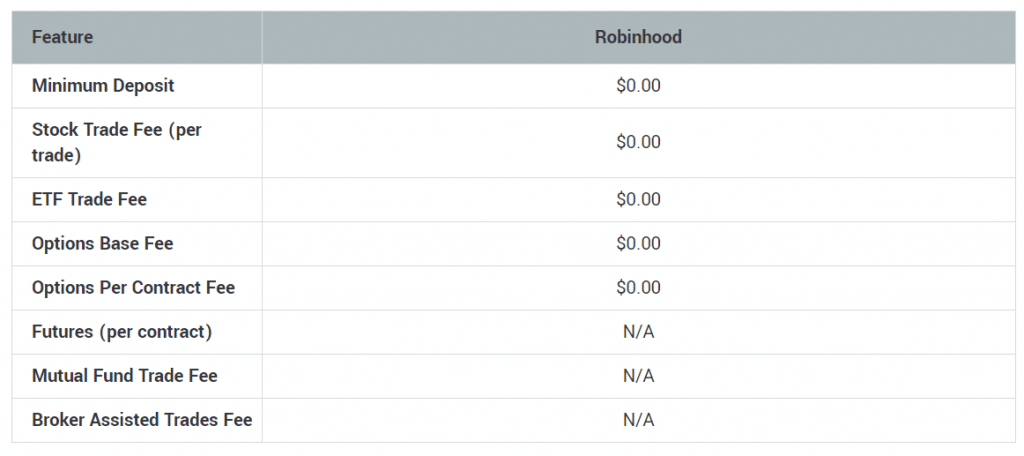

Robinhood does not have a minimum account balance requirement for options trading, but you must maintain sufficient funds to cover potential losses.

Are there any fees associated with options trading?

Robinhood charges a $0.15 per-contract fee for executing options trades.

How can I learn more about options trading strategies?

Many resources are available online, including the Robinhood Learning Center, webinars, and books dedicated to options trading.

Image: robinhood.com

Options Trading Strategies Robinhood

Image: www.youtube.com

Conclusion

Options trading offers a diverse range of strategies for investors to harness market opportunities. By understanding the basics, selecting appropriate strategies, and managing risk prudently, you can unlock the potential of options trading with Robinhood. Remember, options trading is not suitable for everyone, and it’s essential to seek education and guidance when necessary. Are you interested in exploring the world of options trading further?