Image: marketxls.com

Introduction:

The world of investments can be daunting for beginners, but it doesn’t have to be. Option trading has emerged as a popular way to navigate the financial markets, and with platforms like Robinhood making it more accessible, investors of all levels can participate. In this comprehensive guide, we’ll unpack the intricacies of option trading in Robinhood, empowering you with the knowledge and strategies to navigate this dynamic marketplace.

Demystifying Option Trading

Options are financial instruments that convey the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. Essentially, they offer flexibility and the potential for outsized returns while also carrying a degree of risk. Understanding the types of options (call and put) and the key terms (strike price, premium, and expiration date), is crucial for successful trading.

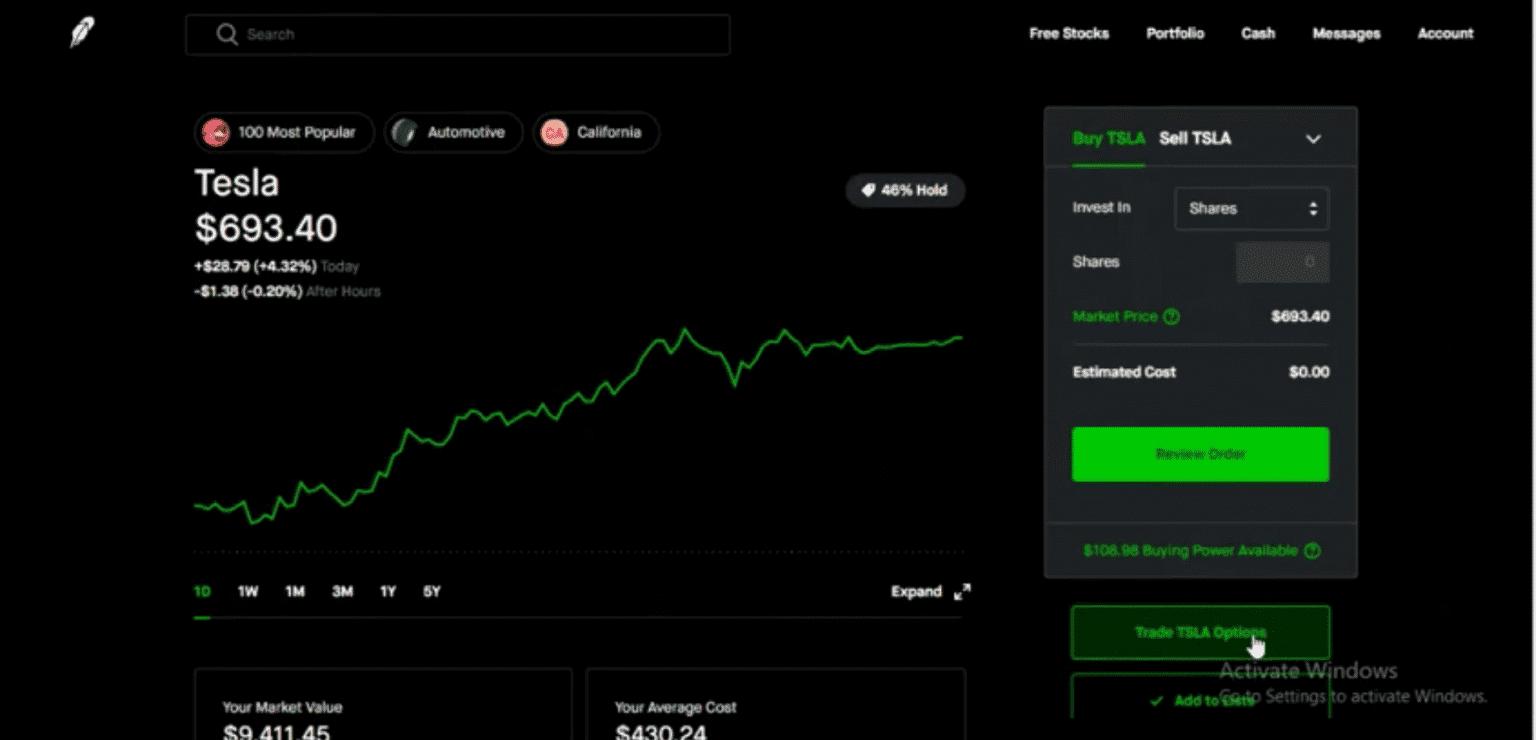

Getting Started with Robinhood

Robinhood’s user-friendly platform makes option trading accessible to a wider audience. To get started, simply create an account and link your funding source. Once your account is verified, you can navigate to the options tab and select the underlying asset you wish to trade. Robinhood offers a range of underlying assets, including stocks, ETFs, and indices.

Understanding Option Strategies

Option trading involves employing different strategies to capitalize on market movements. Commonly used strategies include:

- Covered Call: Selling a call option against an underlying asset you own to generate income.

- Protective Put: Buying a put option to hedge against potential losses on an underlying asset you own.

- Bull Call Spread: Buying a lower-strike call option and selling a higher-strike call option to profit from a moderate rise in the underlying asset’s price.

- Bear Put Spread: Selling a higher-strike put option and buying a lower-strike put option to profit from a moderate decline in the underlying asset’s price.

Expert Insights and Actionable Tips

Seasoned traders emphasize the importance of diligent research, understanding your risk tolerance, and starting small. Expert trader Peter Lynch advises, “Invest in what you know and understand.”

Conclusion

Option trading in Robinhood can be a powerful tool for investors, but it’s essential to approach it with a thorough understanding of the market, options strategies, and potential risks. By embracing these principles and leveraging the insights of experts, you can navigate the world of options trading with greater confidence and potentially enhance your financial outlook. Embrace the opportunity to sharpen your skills and unlock the potential of this dynamic marketplace.

Image: thebrownreport.com

How To Use Option Trading In Robinhood

Image: bitnation.co