Introduction

Options trading has long been the domain of seasoned investors and financial experts. However, with the advent of commission-free options trading platforms like Robinhood, retail investors are flocking to this sophisticated instrument in droves. This article is your comprehensive guide to commission-free options trading on Robinhood, equipping you with the knowledge and insights to navigate this exciting financial frontier.

Image: www.youtube.com

What is Options Trading?

Options are financial contracts that grant the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specified price on or before a certain date. This versatility allows options traders to execute complex strategies to hedge against risk, speculate on price movements, or generate income.

Robinhood and Commission-Free Options Trading

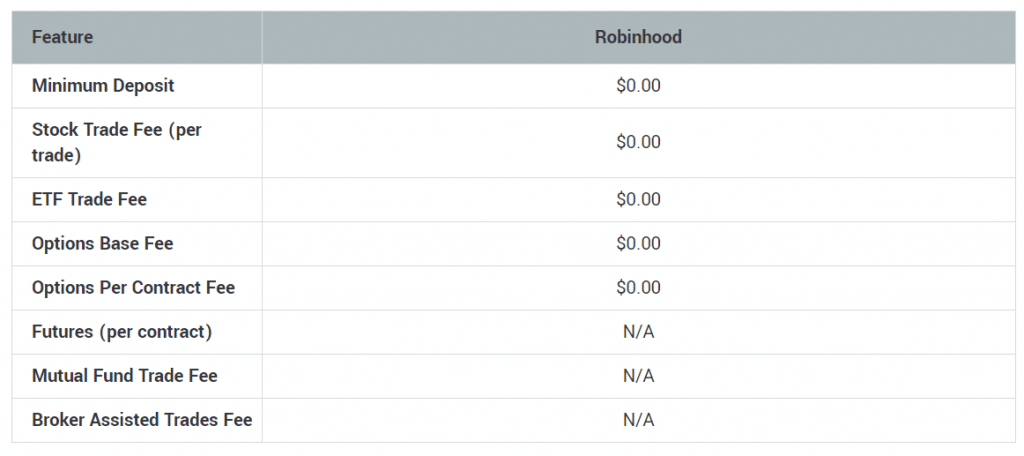

Robinhood disrupted the traditional options trading landscape by eliminating commissions, making this complex financial instrument accessible to everyday investors. Robinhood’s user-friendly platform permits users to trade both traditional options contracts and spread-based strategies seamlessly.

Key Concepts in Options Trading

To grasp options trading fully, it’s essential to understand fundamental concepts such as:

-

Strike Price: The predetermined price at which the underlying asset can be bought or sold.

-

Expiration Date: The date by which the option must be exercised or expires worthless.

-

Call Options: Grant the buyer the right to buy the underlying asset.

-

Put Options: Grant the buyer the right to sell the underlying asset.

-

Premium: The cost of purchasing an option contract, analogous to a rental fee.

Image: www.youtube.com

Real-World Applications of Options

Options trading provides a broad array of opportunities for investors:

-

Hedging Risk: Using options to safeguard existing investments against potential price fluctuations.

-

Speculating on Price Movements: Profiting from anticipated movements in the underlying asset’s price.

-

Income Generation: Selling options to collect income while potentially holding onto the underlying asset.

-

Spread-Based Strategies: Combining multiple options to create more complex and potentially lucrative strategies.

Understanding Options Greeks

Options Greeks are metrics that quantify the relationship between various factors affecting option pricing, such as time, volatility, interest rates, and more. Grasping these concepts is crucial for managing risk and positioning trades effectively.

Latest Trends and Developments

The options trading landscape is continuously evolving, with new strategies and enhancements emerging regularly. Staying abreast of these trends is paramount for successful trading.

Commission-Free Options Trading Robinhood

Image: marketxls.com

Conclusion

Commission-free options trading through platforms like Robinhood has opened the door to a world of financial opportunities for investors of all levels. However, before venturing into this realm, it’s imperative to arm yourself with knowledge and understanding. This guide provides a solid foundation to help you navigate the complexities of options trading successfully. Remember, education is the key to unlocking the full potential of these powerful financial instruments.