Introduction

The Robinhood app has become a popular platform for trading stocks and other financial instruments. One of the most popular options on Robinhood is the ability to trade options, which can be a great way to generate income or hedge against risk. However, it is important to understand how options work before you start trading them on Robinhood or any other platform.

Image: www.warriortrading.com

In this article, we will provide a comprehensive guide to trading options call on the Robinhood app. We will cover the basics of options trading, how to place an options trade on Robinhood, and some tips for successful options trading.

What Are Options?

Options are a type of financial instrument that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a certain date. The underlying asset can be a stock, ETF, index, or other financial instrument.

There are two main types of options: calls and puts. A call option gives the holder the right to buy the underlying asset at the strike price on or before the expiration date. A put option gives the holder the right to sell the underlying asset at the strike price on or before the expiration date.

How to Place an Options Trade on Robinhood

To place an options trade on Robinhood, follow these steps:

Log in to your Robinhood account.

Search for the underlying asset you want to trade.

Click on the “Options” tab.

Select the type of option you want to trade (call or put).

Select the strike price and expiration date.

Enter the number of contracts you want to trade.

Click on the “Buy” or “Sell” button.

Tips for Successful Options Trading

Here are a few tips for successful options trading:

Do your research. Before you start trading options, it is important to do your research and understand how they work. There are many resources available online and in libraries that can help you learn about options trading.

Understand the risks. Options trading can be a risky investment, and it is important to understand the risks involved before you start trading. You should only trade options with money that you can afford to lose.

Start small. When you first start trading options, it is a good idea to start small. This will help you to minimize your risk and learn the ropes before you start trading larger amounts of money.

Use a stop-loss order. A stop-loss order is an order that automatically sells your options if they reach a certain price. This can help you to limit your losses in the event of a market downturn.

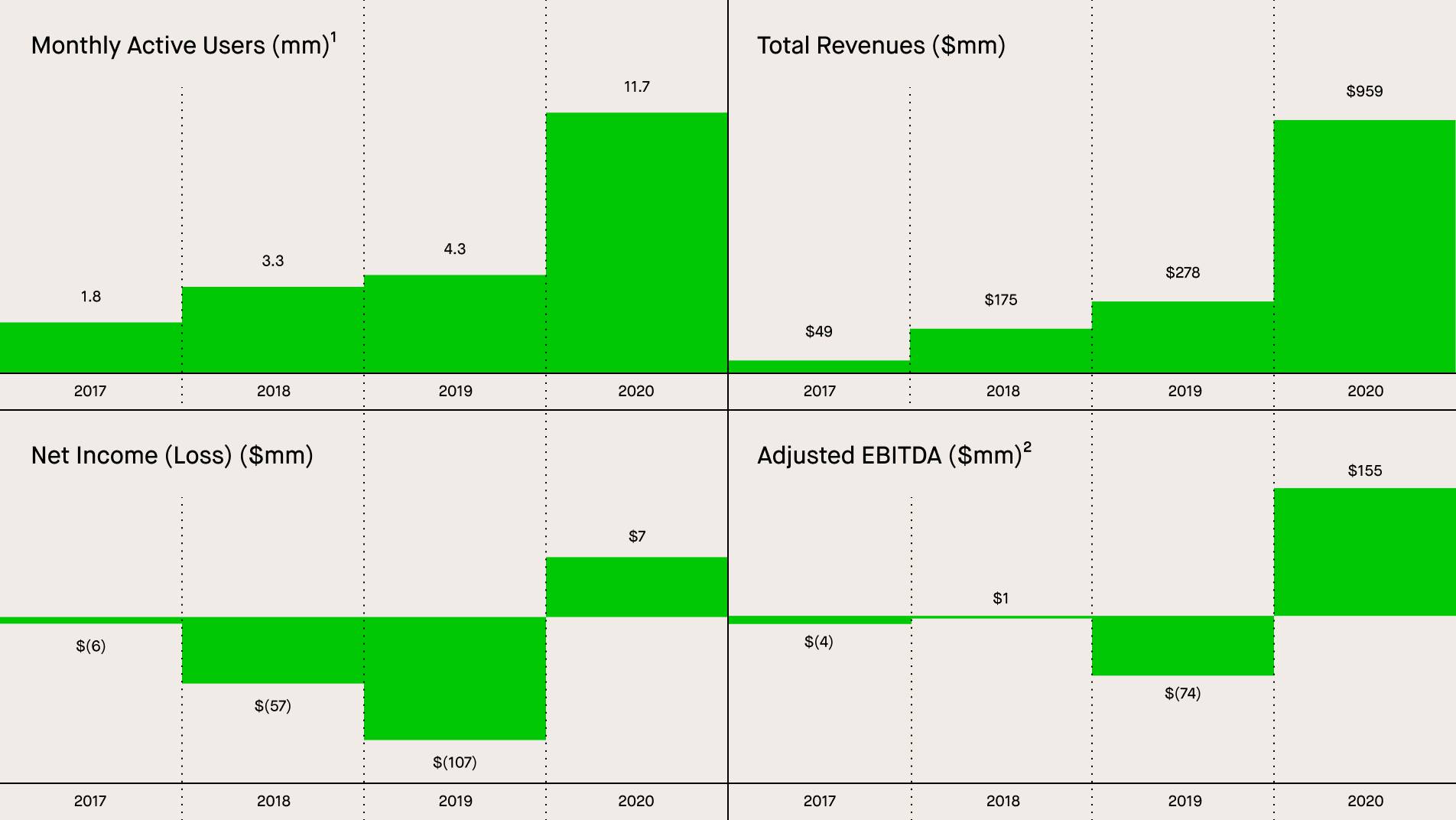

Image: www.cbinsights.com

Frequently Asked Questions

Q: What is the difference between a call option and a put option?

A: A call option gives the holder the right to buy the underlying asset at the strike price on or before the expiration date. A put option gives the holder the right to sell the underlying asset at the strike price on or before the expiration date.

Q: What is the strike price?

A: The strike price is the price at which the holder can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset.

Q: What is the expiration date?

A: The expiration date is the last date on which the holder can exercise the option.

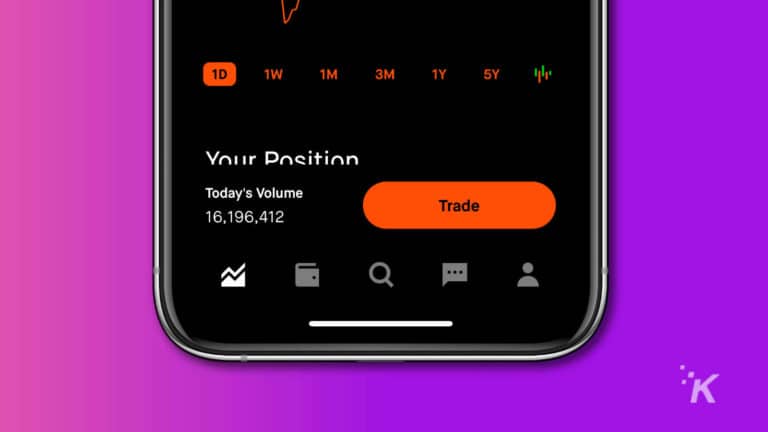

Trading Options Call On Robinhood App

Image: knowtechie.com

Conclusion

Options trading can be a great way to generate income or hedge against risk. However, it is important to understand how options work before you start trading them. In this article, we have provided a comprehensive guide to trading options call on the Robinhood app. We have also included some tips for successful options trading.

If you are interested in learning more about options trading, we encourage you to do some additional research. There are many resources available online and in libraries that can help you learn about this complex but potentially rewarding investment strategy.