In the fast-paced world of finance, where fortunes are made and lost in a heartbeat, harnessing the power of options trading can be the ultimate game-changer. And when it comes to maximizing returns, trading earnings using options presents a compelling opportunity that can elevate your investment prowess to new heights. This comprehensive guide will delve into the intricacies of trading earnings using options, empowering you with the knowledge and strategies to navigate this lucrative realm with confidence.

Image: optionstradingiq.com

What is Options Trading?

Options, in the financial context, are unique financial instruments that provide traders with an additional layer of flexibility and versatility beyond traditional stocks and bonds. They grant the holder the right, but not the obligation, to buy or sell an underlying asset (such as a stock) at a specified price on or before a designated date. This non-committal nature empowers traders to speculate on the direction of the market without incurring the full cost of ownership.

Understanding Earnings Trading

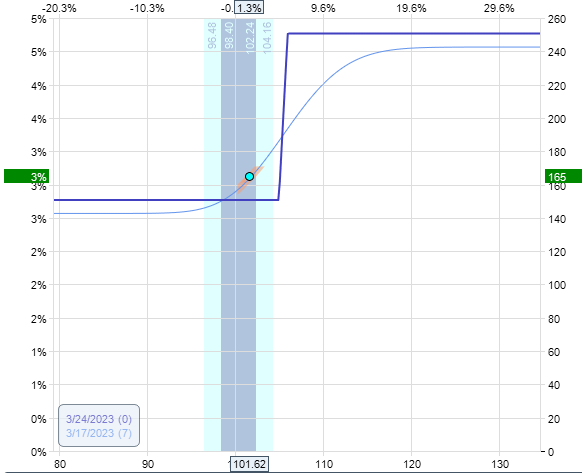

Trading earnings involves utilizing options to capitalize on the price movements of a company’s stock following the release of its financial results, known as earnings announcements. These announcements often trigger significant market reactions, creating potential trading opportunities for savvy investors. By analyzing the company’s performance, industry trends, and market sentiment, traders can anticipate the potential impact of earnings on the stock price and position themselves accordingly.

How to Profit from Earnings Trading

Harnessing the power of options in earnings trading requires a well-defined strategy. Here are two primary approaches employed by experienced traders:

-

Outright Purchase: This involves buying an option that directly aligns with your earnings prediction. If your forecast materializes, the option’s value will rise, yielding profitable returns.

-

Spreading: A more risk-averse approach is to employ spreads, which combine multiple options to limit potential losses. By establishing a range of prices where you believe the stock will trade, you can create a wider safety net while still capturing substantial profits.

Image: www.youtube.com

Strategies for Success

Navigating earnings trading using options effectively demands a disciplined approach. Here are some tips to enhance your chances of success:

-

Thorough Research: Conduct in-depth research on the company, its industry, and the macroeconomic landscape. Seek out multiple perspectives to form a comprehensive understanding.

-

Option Selection: Carefully choose options that align with your trading strategy and risk tolerance. Factor in variables such as strike price, time to expiration, and implied volatility.

-

Hedging: Employ hedging techniques to mitigate risk. Consider purchasing options on the opposite side of your trade to limit potential losses.

-

Emotional Control: Trading earnings can be emotionally charged. Maintain discipline, control your emotions, and stick to your trading plan regardless of the market’s fluctuations.

Trading Earnings Using Options

Image: tradeoptionswithme.com

Conclusion

Trading earnings using options is a potent strategy that can turbocharge your investment portfolio when executed with precision and understanding. By embracing the concepts outlined in this article, you can unlock the potential of this financial instrument and position yourself as a formidable player in the highly dynamic world of options trading. Remember, knowledge is power, and the financial markets are no exception. Equip yourself with the insights and strategies presented herein, and may the scales of fortune tip in your favor.