Introduction

In the realm of options trading, understanding the concept of theta is crucial for successful decision-making. Theta, the Greek letter symbol for time, signifies the rate of decay or erosion of an option’s value over time. As each day passes, the value of an option gradually depreciates, making it essential for traders to factor in theta decay when considering their trading strategies.

Image: globaltradingsoftware.com

What is Options Trading Theta?

Theta measures the sensitivity of an option’s value to the passage of time. An option’s value is directly proportional to the remaining time until expiration and inversely proportional to the passage of time. In simpler terms, it means that as time goes by, the value of an option will steadily decline until it reaches zero at expiration. This decay process is known as time decay or theta decay.

Importance of Theta in Options Trading

Theta plays a significant role in options trading as it impacts the pricing and behavior of options. Understanding theta allows traders to make informed decisions regarding position sizing, holding periods, and trading strategies. For buyers of options, theta acts as a constant reminder that time is their enemy, reducing the value of their options with each passing moment. Conversely, option sellers rely on theta to generate profit by capitalizing on the gradual loss in value over time.

Factors Affecting Theta

The rate of theta decay depends on various factors, including:

- Time to Expiration: The closer an option gets to its expiration date, the faster its value erodes due to increased theta decay.

- Option Type: Call options lose more value to theta than put options because there’s more upside potential with call options.

- Volatility: The implied volatility of the underlying security influences theta decay, with higher volatility leading to slower decay.

- Interest Rates: Low interest rates result in higher theta decay, while high interest rates lead to lower decay rates.

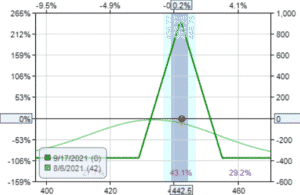

Image: www.financialtrading.com

Strategies for Managing Theta

To mitigate the negative effects of theta decay, traders can employ several strategies:

- Trading Short-Term Options: Time decay has a more significant impact on long-term options. Traders can reduce theta decay by trading options with shorter expirations, ideally within 30 to 45 days.

- Selling Theta: Traders can profit from theta decay by selling options. By selling options, traders receive a premium up front and capitalizing on the natural decline in value over time.

- In-the-Money Options: In-the-money options, particularly those with deep ITM, are less susceptible to theta decay as they have intrinsic value that partially offsets the time decay.

- Choosing Higher Volatility Options: Options with higher implied volatility tend to have higher values that decay at a slower rate, reducing theta’s impact on the option’s value.

Options Trading Theta

Image: optionstradingiq.com

Conclusion

Understanding theta is crucial for options traders to maximize profits and reduce losses. By embracing the concept of time decay, traders can make informed decisions regarding their trading approach. Whether buying or selling options, knowing how time affects the value of options will empower traders to strategically navigate the markets and achieve their financial goals.