Introduction

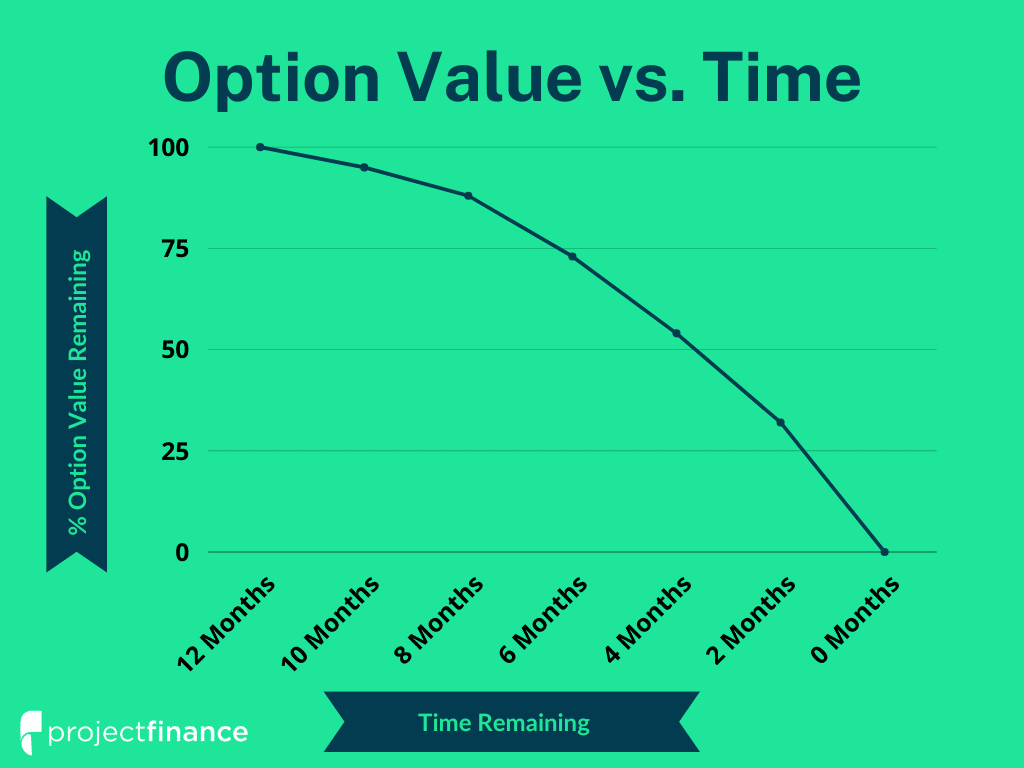

Theta is a crucial concept in options trading that represents the rate of decay in an option’s value over time. Options buyers lose value as time passes, while option sellers gain. Understanding theta is essential for traders to develop sound option trading strategies and minimize risks.

Image: www.projectfinance.com

Theta: Definition, History, and Meaning

Theta measures the time decay component of an option’s premium. It indicates how much an option’s value decreases each day as it nears its expiration date. The concept of theta originated from the Black-Scholes model, which is a mathematical formula used to price options. In the model, theta is denoted by the Greek letter Θ.

Comprehensive Explanation of Theta

Understanding theta requires a grasp of several variables influencing its value. These include time to expiration, option type (call or put), option strike price, underlying asset’s volatility, and interest rates. As the time to expiration decreases, theta’s absolute value increases, indicating a more rapid decay in option value. In-the-money options (ITM) exhibit higher theta than out-of-the-money options (OTM) because ITM options have intrinsic value, which decays faster. Higher strike prices generally result in higher theta values. Increased volatility leads to higher theta values, as the option premium has more time value to erode. Interest rates impact theta indirectly by influencing the risk-free rate used in option pricing models.

Latest Trends and Developments in Theta

The impact of theta on option trading strategies has garnered significant attention recently. Various trading techniques have emerged to leverage or mitigate time decay. For instance, option sellers employ short-term strategies, such as selling monthly options, to capture the rapid time decay near the expiration date. Option buyers, on the other hand, might employ spread strategies or utilize options with longer time to expiration to reduce the effects of theta.

Image: www.youtube.com

Tips and Expert Advice for Options Traders

-

Consider theta when selecting options to trade: Opt for options with sufficient time to expiration to manage the impact of theta decay.

-

Monitor the Greeks: Use options analytics tools to track theta and other Greeks to gauge the impact of time decay on your positions.

-

Employ appropriate strategies: Utilize strategies that align with your risk tolerance and trading goals, considering theta’s impact.

-

Seek professional guidance: Consult with experienced options traders or financial advisors to navigate the complexities of theta and enhance your trading strategies.

FAQ on Theta

Q: Why does theta increase as the expiration date approaches?

A: As the option nears its expiration, time value becomes more dominant in its pricing. The decay of time value accelerates as the expiration date draws closer, resulting in a higher theta value.

Q: How do I calculate theta?

A: Theta can be calculated using the Black-Scholes model, which takes various factors into account, including stock price, strike price, time to expiration, risk-free rate, and volatility.

What Is A Low Theta In Options Trading

Image: johnnyafrica.com

Conclusion

Theta is a multifaceted concept in options trading that requires thorough understanding to maximize trading success. By grasping theta’s impact on option prices, traders can devise well-informed strategies that navigate time decay and achieve optimal outcomes.

Are you interested in learning more about the impact of theta on options trading? Join our interactive discussion forum for engaging discussions and expert insights.