Envisioning Financial Stability

In the tumultuous ocean of financial markets, it’s essential to equip yourself with strategies to navigate the choppy waters and safeguard your investments. Among these strategies, options trading emerges as a valuable tool for mitigating risks and potentially enhancing returns. One such approach in this arsenal is the strategic purchase of puts, a derivative instrument that provides a safety net against market downturns. In this comprehensive guide, we’ll embark on a journey to understand the intricacies of buying puts, demystifying this powerful hedging technique.

Image: fintrakk.com

Unveiling Options Trading: The Basics

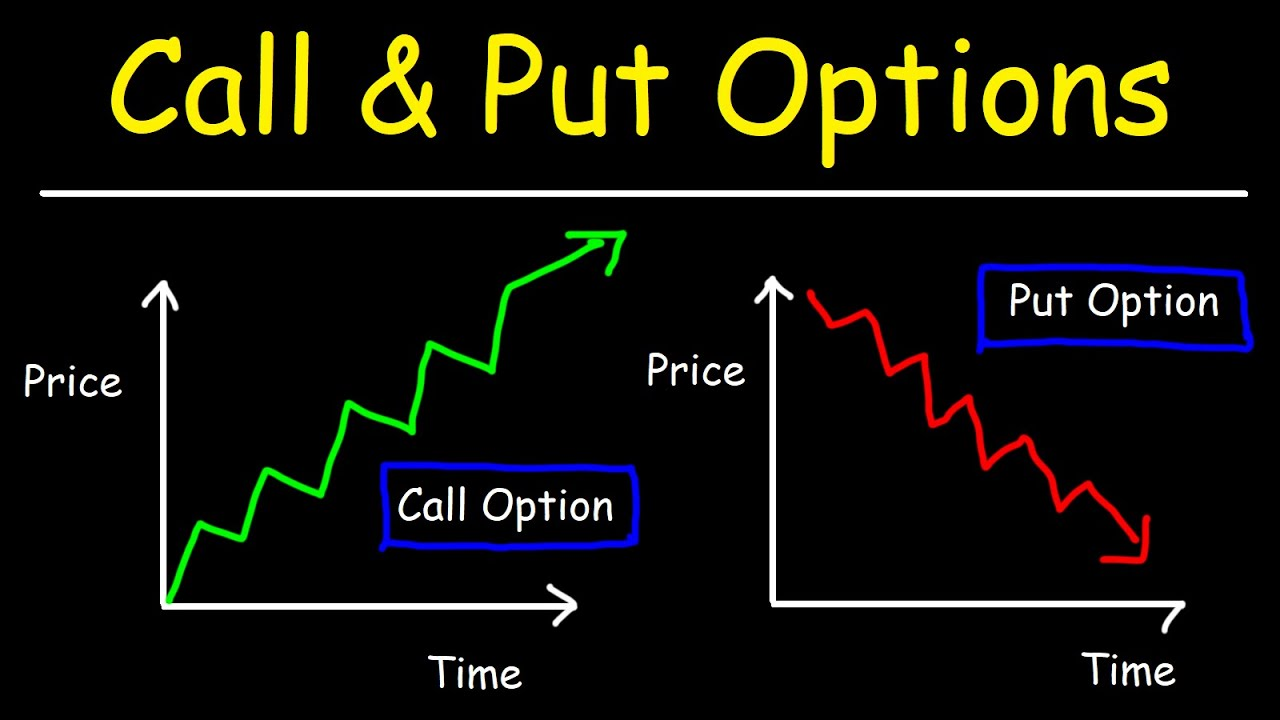

Options trading delves into the realm of contracts, granting the buyer (holder) a right but not an obligation towards an underlying asset. Within this framework, two primary options exist: calls and puts. Calls bestow upon their holder the right to purchase an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). Conversely, puts grant the holder the right to sell an underlying asset at a predefined strike price on or before the expiration date.

The Nuances of Buying Puts

When purchasing puts, you’re essentially acquiring a protective hedge against potential losses in the underlying asset’s value. This strategy becomes particularly valuable if you anticipate a downturn in the market or specific security. By exercising the put option, you effectively sell the underlying asset at the strike price, regardless of the actual market price, potentially mitigating losses or locking in gains.

For instance, let’s consider buying a put option on a stock currently trading at $100 with a strike price of $95 and an expiration date in two months. If the stock price plummets to $80 before the expiration date, you can exercise your put option and sell the stock for $95, generating a profit of $15 per share ($95 – $80). Conversely, if the stock price rebounds to $110, allowing the option to expire worthless, your maximum loss is limited to the premium paid for the put option.

Navigating the Options Market: Practical Tips

-

Determine the underlying asset: Identify the stocks, indices, or commodities you want to protect.

-

Set the strike price: Select a strike price that aligns with your risk tolerance and profit potential.

-

Choose the expiration date: Consider the time frame of your investment and market volatility when selecting the expiration date.

-

Assess the premium: The premium is the price you pay for purchasing the put option. It’s essential to weigh the potential rewards against this cost.

-

Manage your portfolio: Don’t let put options become the sole focus of your investment strategy. Integrate them thoughtfully into a diversified portfolio.

/call-and-put-options-definitions-and-examples-1031124-v5-8566395195f0403aaf5b4ad9e5cc9364.png)

Image: elearningensup.gifafrique.com

Expert Perspectives on Options Trading

“Options trading, including the strategic use of puts, provides a vital risk management tool for investors navigating volatile markets. By thoughtfully incorporating options into their portfolios, investors can proactively mitigate losses and enhance their overall financial resilience,” advises Dr. Mark Fisher, a renowned financial expert.

“It’s crucial to remember that options trading is not without its risks. Always conduct thorough research, understand the complexities involved, and seek professional guidance if needed,” cautions Professor Emily Carter of the Wharton School of Business.

Options Trading Buying Puts

Image: tradewithmarketmoves.com

Conclusion: Mastering the Art of Options Trading

Buying puts in options trading empowers you with a powerful tool to protect your investments and navigate market uncertainties. By embracing this hedging strategy, you gain an added layer of confidence as you traverse the financial landscape. Remember to approach options trading with a well-informed mindset, seeking guidance from reliable sources. With meticulous planning and a solid understanding of the mechanics involved, you can harness the potential of puts to safeguard your financial future.