Introduction

In the fast-paced world of finance, option market making is a specialized trading strategy that plays a crucial role, providing liquidity, reducing volatility, and facilitating risk management. Whether you are a seasoned professional or a newcomer exploring the intricacies of the financial markets, understanding option market making trading and risk analysis is essential for navigating this complex arena. This comprehensive guide will provide you with a thorough understanding of this specialized trading technique, help you identify opportunities, and equip you with the analytical tools to mitigate risks.

Image: teletype.in

The Art of Option Market Making

Option market making involves continuously quoting bid and ask prices for options contracts, allowing traders to buy or sell these contracts at any given moment. Market makers act as intermediaries between buyers and sellers, bridging the gap between supply and demand and ensuring a smooth, functioning market. Their primary goal is to profit from the spread between the bid and ask prices, known as the market maker’s spread. This role requires a deep understanding of option pricing models, volatility analysis, and risk management strategies.

Option Pricing and Volatility

At the heart of option market making lies the ability to accurately price options. Black-Scholes and its variants are widely used models for this purpose, taking into account factors such as the underlying asset’s price, time to expiration, strike price, and volatility. Volatility is a key parameter in option pricing, as it represents the expected magnitude of price fluctuations in the underlying asset. Market makers must continuously assess and monitor volatility, adjusting their pricing strategies accordingly.

Market Dynamics and Hedging

Option market makers operate within dynamic and often unpredictable market conditions. They must constantly monitor changes in market sentiment, order flow, and news events that can influence option prices. To mitigate risks, market makers employ hedging strategies, such as delta hedging and gamma hedging, to reduce their exposure to adverse price movements in the underlying asset. Hedging involves buying or selling additional options or underlying assets to offset potential losses.

Image: www.slideshare.net

Risk Analysis in Option Market Making

Risk management is paramount in option market making. Market makers must constantly evaluate and manage the risks inherent in their trading activities. These risks can be categorized into various types: delta risk, gamma risk, vega risk, and theta risk. Each of these risks arises from different factors and requires tailored risk management strategies.

Stress Testing and Scenario Analysis

Stress testing involves simulating extreme market conditions and assessing the potential impact on a market maker’s portfolio. Scenarios can include sudden drops in the underlying asset’s price, spikes in volatility, or changes in interest rates. By conducting stress tests, market makers can identify potential weaknesses and vulnerabilities and adjust their trading strategies accordingly.

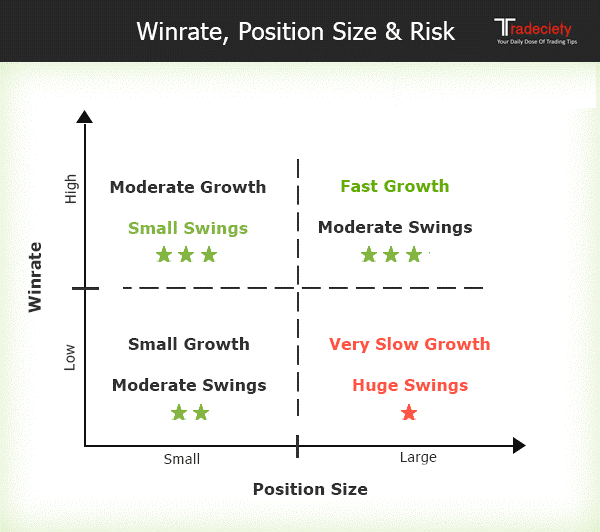

Risk Appetite and Portfolio Optimization

Risk appetite is a critical factor in option market making. Market makers must define their tolerance for risk and manage their portfolio accordingly. Portfolio optimization techniques aim to balance risk and return, considering factors such as correlation between options contracts, option duration, and overall market exposure. By optimizing their portfolio, market makers can reduce their overall risk exposure while maximizing potential returns.

Option Market Making Trading And Risk Analysis Pdf

Image: tradeciety.com

Conclusion

Option market making trading and risk analysis are essential pillars in the financial markets. This comprehensive guide provided an in-depth understanding of the nuances of option market making, the importance of option pricing models, and the significance of risk management strategies. Whether you are exploring new trading opportunities or seeking to enhance your risk analysis capabilities, this guide serves as a valuable resource. Embrace the complexities of option market making and empower yourself to navigate the ever-changing financial landscape with confidence.