Introduction

The world of finance is vast and complex, with countless intricacies hidden beneath its surface. Options trading, in particular, stands out as a highly specialized field within the broader landscape. As a prominent financial institution, JPMorgan Chase (JPMC) has a deep-rooted presence in various areas of finance, including options trading. In this comprehensive article, we will delve into the intricate operations of JPMC and explore the extent of its involvement in options trading, unraveling the significance of this topic for both individual investors and the financial landscape at large.

Image: www.tradingview.com

JPMorgan Chase: A Financial Powerhouse

Established in 1799, JPMC has grown into one of the largest and most respected financial institutions globally. With operations spanning across 60 countries and employing over 270,000 individuals, JPMC boasts an unparalleled reputation for providing a comprehensive array of financial services. These services encompass investment banking, asset management, commercial and consumer banking, and, of significant note, options trading.

JPMC’s Extensive Options Trading Operations

JPMC is a major player in the global options trading market, catering to a diverse clientele that includes institutional investors, hedge funds, and individual traders alike. The firm’s expertise in options trading stems from its profound understanding of market dynamics, coupled with its robust infrastructure and advanced trading platforms.

JPMC offers a comprehensive suite of options trading services, encompassing both vanilla and exotic options strategies. It facilitates trades across a multitude of underlying assets, including stocks, indices, commodities, and currencies. The firm’s unparalleled liquidity and efficient execution capabilities make it a formidable force in the options trading arena.

The Importance of Options Trading

Options trading plays a pivotal role in managing risk and enhancing returns within investment portfolios. Options provide investors with the flexibility to adapt to various market scenarios, enabling them to hedge against potential losses, speculate on price movements, and capitalize on market volatility.

For instance, an investor expecting a stock’s price to surge could purchase a call option, providing them with the right to purchase the stock at a predetermined strike price within a specified time frame. On the other hand, if an investor anticipates a stock’s decline, they could opt for a put option, allowing them to sell the stock at the strike price before its expiration.

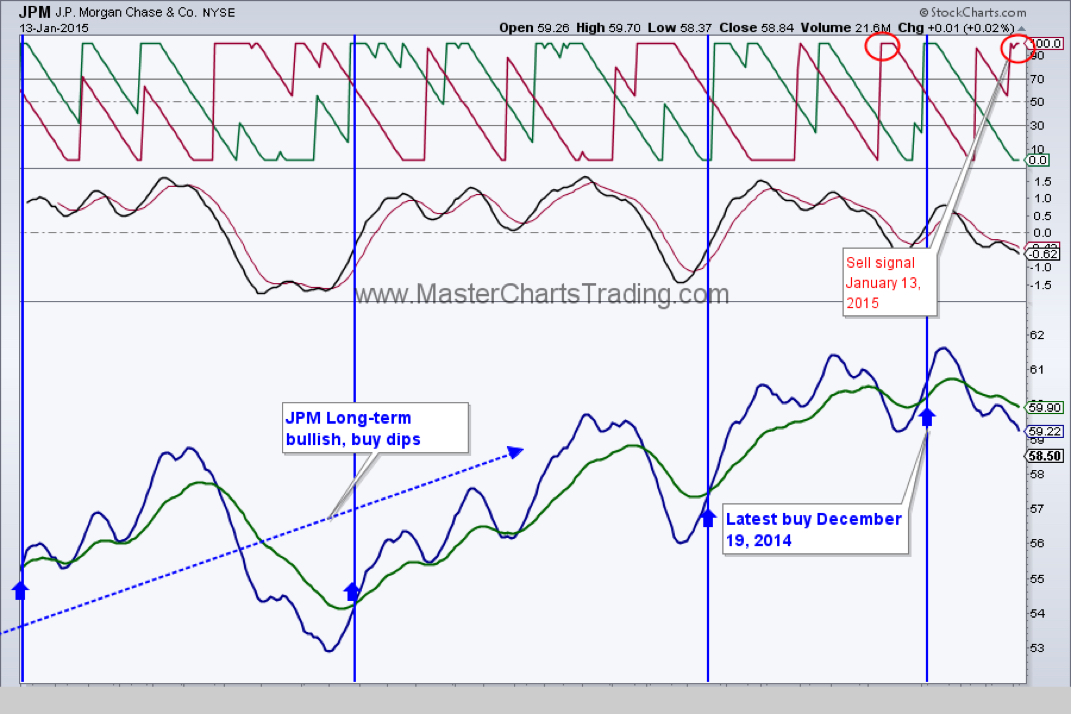

Image: www.masterchartstrading.com

JPMC’s Role in Market Stability

JPMC’s substantial involvement in options trading contributes significantly to stabilizing the broader financial markets. By providing liquidity and facilitating efficient trade execution, the firm helps reduce market volatility and ensures orderly price discovery.

Furthermore, JPMC actively participates in market-making activities, offering competitive quotes and facilitating trades for other market participants. This role enhances price transparency and promotes market efficiency, creating a more conducive environment for investors and traders alike.

Does Jpmc Work In Options Trading

Image: capital.com

Conclusion

JPMC stands as a preeminent player in the realm of options trading, offering a comprehensive suite of services to a global clientele. The firm’s expertise, infrastructure, and market-making activities make it a driving force in promoting stability and efficiency within financial markets. Understanding JPMC’s pivotal role in options trading empowers investors and traders alike with valuable insights into the intricacies of this complex financial instrument. It is through such in-depth examinations of major players like JPMC that we gain a deeper appreciation for the intricate workings of the global financial system, enabling us to make more informed investment decisions and navigate the markets with greater proficiency.