Unlock the secrets of successful options trading with this comprehensive guide that offers a rich PDF document packed with essential information. In this extensively researched article, we will delve into various option trading patterns, explaining their significance, applications, and the factors that drive their effectiveness.

Image: www.newtraderu.com

Unveiling the Power of Options

Options, derivative financial instruments, provide traders with opportunities to speculate on the future price movements of underlying assets. They empower traders to potentially profit from both rising and falling markets, making them a versatile tool in active investing strategies. However, mastering the art of options trading requires a thorough understanding of various pricing models and trading patterns. This guide seeks to provide a comprehensive overview of key option trading patterns, equipping you with the knowledge to make informed decisions and enhance your potential for success in the markets.

Navigating the PDF Guide

In this comprehensive PDF document, we will cover a wide range of option trading patterns, ranging from simple to complex. We’ll provide clear explanations, real-world examples, and helpful illustrations to ensure a deep understanding of each pattern. This guide will be an invaluable resource for both novice and experienced traders seeking to refine their strategies.

Understanding Option Trading Patterns

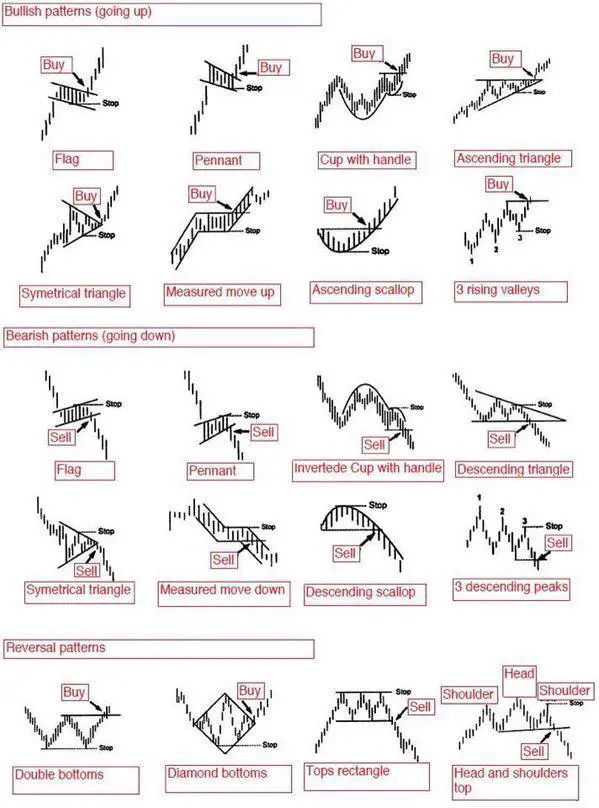

Option trading patterns are specific combinations of multiple option orders that collectively create a specific risk-reward profile. They are used by traders to speculate on market movements, maximize potential profits, or hedge their positions. There are countless option trading patterns, each with its unique characteristics, suitability for different market conditions, and potential profitability.

Image: www.pinterest.com

Essential Option Trading Patterns

In this guide, we will explore several essential option trading patterns, including:

- Bull Call Spread: A bullish strategy that involves buying a lower-strike call option and selling a higher-strike call option with the same expiration date.

- Bear Put Spread: A bearish strategy that involves selling a lower-strike put option and buying a higher-strike put option with the same expiration date.

- Iron Condor: A neutral strategy that involves buying and selling calls and puts at various strike prices with the same expiration date, creating a well-defined risk profile.

- Straddle: A neutral strategy that involves buying both a call and a put option with the same strike price and expiration date, benefiting from high volatility.

- Strangle: A neutral strategy that involves buying both a call and a put option with different strike prices but the same expiration date, also benefiting from high volatility.

Analyzing Option Trading Patterns

Each option trading pattern has specific characteristics that influence its effectiveness in different market conditions. Factors to consider when analyzing option trading patterns include:

- Trend Direction: Whether the underlying asset is in an uptrend, downtrend, or sideways trend.

- Volatility: The level of price fluctuations in the underlying asset.

- Implied Volatility: The market’s predicted level of volatility for the underlying asset.

- Time to Expiration: The amount of time remaining until the option contract expires.

- Technical Indicators: Technical analysis tools that help identify support and resistance levels and predict market direction.

Implementing Option Trading Patterns

Once you have identified and analyzed a suitable option trading pattern, it is essential to implement it with precision. This involves carefully selecting the appropriate strike prices, expiration dates, and quantities of contracts to meet your specific needs. Remember that options trading carries inherent risk, and you should always manage your positions carefully and consider your risk tolerance before executing a trade.

Option Trading Patterns Pdf

https://youtube.com/watch?v=ea50RvQ0Dcc

Conclusion

Option trading patterns are indispensable tools for active investors seeking to enhance their strategies and potentially increase their profitability in financial markets. This comprehensive guide provides a robust overview of various option trading patterns, equipping you with the knowledge to make well-informed decisions. Remember, patience, discipline, and a thorough understanding of market dynamics are key to successful options trading. By mastering these patterns, you can develop a robust framework for portfolio management and position yourself for success in the dynamic world of options trading.