Do you ever wonder how seasoned option traders consistently turn a profit? It all boils down to mastering the break-even point—the crucial equilibrium where option premiums and trading costs balance out. Understanding this pivotal concept empowers you to trade options with greater precision and profitability.

Image: www.youtube.com

Navigating the Break-Even Point

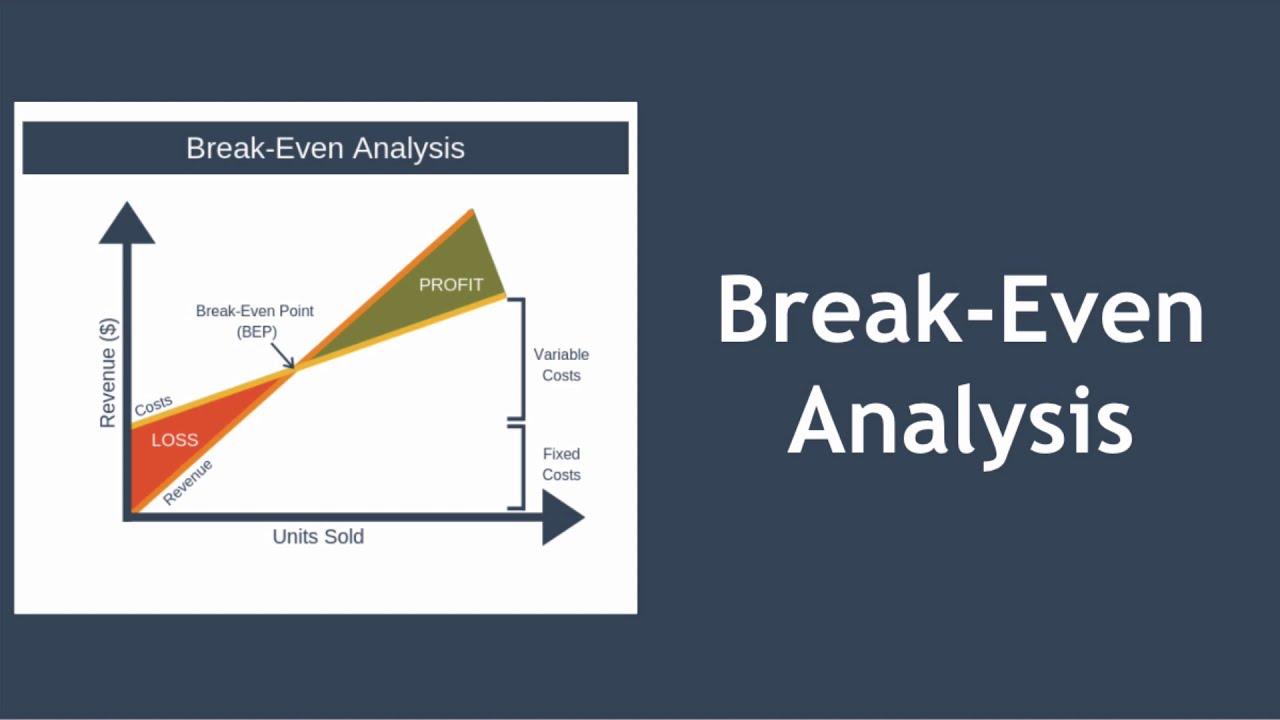

The break-even point in option trading represents the price at which the option holder neither gains nor loses any money. It is calculated as the strike price plus (or minus, for put options) the net premium paid. Achieving this point is a delicate balancing act, as any variation in the underlying security’s price will determine whether a profit or loss is realized.

Grasping the break-even point unveils a plethora of opportunities for astute option traders. By leveraging this knowledge, they can:

- Fine-tune entries and exits: Comprehending the break-even point allows traders to execute precise entries and exits, maximizing their profitability and limiting potential losses.

- Optimize risk management: Identifying the break-even point enables traders to set stop-loss orders strategically, mitigating risk and ensuring portfolio protection.

- Evaluate option strategies: Analyzing the break-even point helps traders evaluate the viability of different option strategies, identifying those that align with their risk tolerance and profit targets.

Expert Tips for Mastering the Break-Even Point

Seasoned option traders share these valuable insights to help you dominate the break-even point:

- Scrutinize volatility: Volatility is the lifeblood of option trading. Studying historical volatility and implied volatility provides traders with invaluable insights into potential price movements, impacting the break-even point.

- Factor in time decay: Time decay, aka theta, exerts a significant influence on option prices. Understanding how time decay affects the break-even point is essential for successful option trading.

- Monitor underlying trends: Keeping a watchful eye on the underlying asset’s price movements is paramount. By analyzing charts and technical indicators, traders can anticipate price fluctuations and adjust their break-even point accordingly.

FAQ on the Break-Even Point

Q: How do I calculate the break-even point for a call option?

A: Break-even point = Strike price + Net premium (Premium paid – Premium received)

Q: What happens if the underlying security’s price exceeds the break-even point?

A: If the underlying security’s price rises above the break-even point for a call option (or falls below the break-even point for a put option), the option holder stands to profit.

Q: Can I use the break-even point to determine profitability?

A: While the break-even point provides a valuable reference, it’s crucial to consider other factors like time decay and volatility to assess overall profitability.

Image: tradeasy.tech

Break Even Point Option Trading

Image: www.youtube.com

Conclusion

Embracing the power of the break-even point can elevate your option trading to new heights. By internalizing the principles outlined in this article, you can approach option trading with greater confidence, precision, and profitability. Remember, knowledge is the ultimate weapon in the financial markets.

Are you ready to delve deeper into the fascinating world of the break-even point in option trading? If so, I invite you to continue exploring our comprehensive resources and engage with our community of expert traders.