In the intricate world of option trading, understanding the break-even point is paramount. It serves as a pivotal marker, outlining the precise point where an option strategy garners neither gains nor losses. Achieving break-even signifies a delicate balance between the premium cost and the subsequent profit or loss. Let’s delve into the intricacies of option trading break-even, empowering you with the knowledge to strategize effectively.

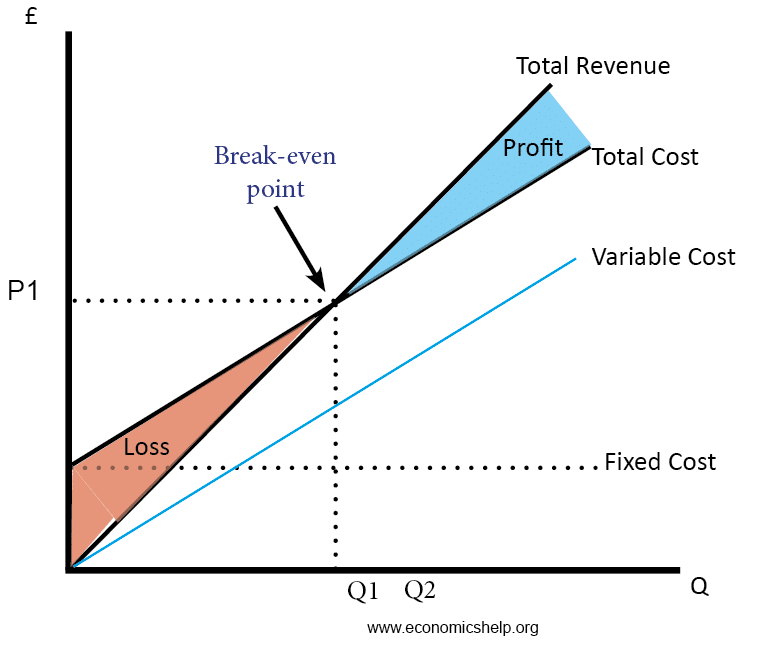

Image: ellengrofranco.blogspot.com

Calculating the Break-Even Point with Precision

The break-even point for an option trade hinges on several crucial factors: the option type, the strike price, and the premium paid. The formula for calculating the break-even point varies depending on whether you’re dealing with a call or a put option.

Break-Even Point for Call Options

Break-Even Price = Strike Price + Premium Paid

For instance, consider a call option with a strike price of $50 and a premium of $5. The break-even point would be $50 + $5 = $55. This implies that to reap profits, the underlying asset’s price must rise above $55 by the option’s expiration date.

Break-Even Point for Put Options

Break-Even Price = Strike Price – Premium Paid

Let’s say you have a put option with a strike price of $60 and a premium of $4. The break-even point would then be $60 – $4 = $56. For profitability, the underlying asset’s price should fall below $56 by the option’s expiration.

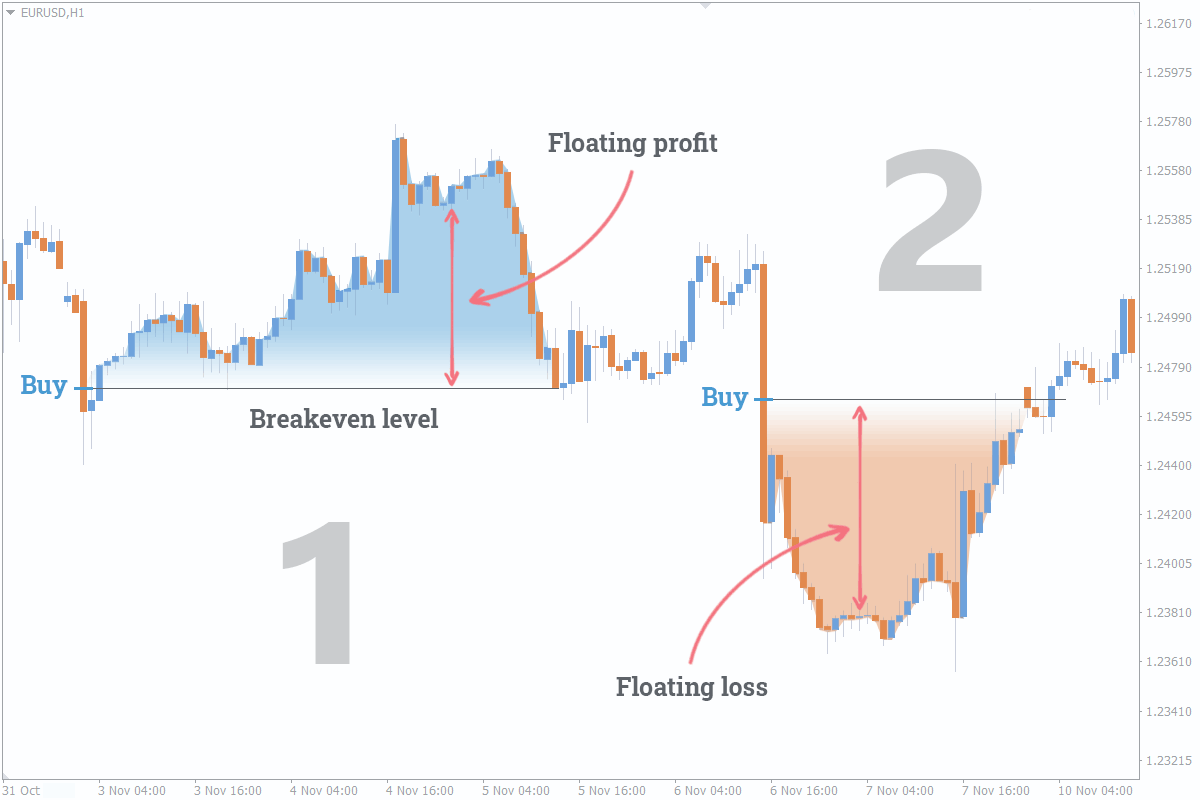

Image: fxssi.com

Unveiling the Significance of Break-Even Analysis

Understanding and leveraging break-even analysis is pivotal in option trading. It provides valuable insights into:

- Risk Assessment: By identifying the break-even point, traders can gauge the potential risks associated with an option strategy.

- Profitability Threshold: Break-even analysis helps establish the minimum price movement required for the option to yield profits.

- Optimal Trade Execution: Armed with break-even knowledge, traders can make informed decisions regarding the strike price and premium to maximize their chances of profitability.

Mastering the Break-Even Point for Success

Expert advice and tips can greatly enhance your option trading prowess. Follow these insights to capitalize on the break-even concept:

- Factor in Transaction Costs: Remember to incorporate brokerage fees and other trading costs into your break-even calculations.

- Consider Implied Volatility: Implied volatility plays a vital role in determining the premium. Be cognizant of its impact on the break-even point.

- Monitor Market Dynamics: Stay abreast of market trends, news events, and economic indicators that may influence the underlying asset’s price.

Option Trading Break Even

Frequently Asked Questions: Demystifying Option Trading Break-Even

Q: Can an option expire at break-even?

A: Yes, it is possible for an option to expire at the break-even point, resulting in neither profits nor losses.

Q: What is the relationship between the break-even point and profitability?

A: Profits are only realized when the underlying asset’s price exceeds the break-even point for call options or falls below it for put options.

Q: How can I minimize the impact of transaction costs on my break-even calculations?

A: Opt for brokers with competitive trading fees and consider trading larger positions to reduce the percentage impact of transaction costs.

Embracing the power of break-even analysis will empower you to make more informed and strategic decisions in the realm of option trading. Dive deep into the nuances and unlock the potential for profitable outcomes. Are you ready to elevate your trading game?