Welcome to the world of options trading, where strategies and possibilities converge on the popular Metatrader 4 (MT4) platform. Whether you’re a seasoned trader or just dipping your toes into the market, this guide will provide invaluable insights and empower you to make informed trading decisions.

Image: www.babypips.com

Options trading offers a tantalizing blend of risk and reward, allowing traders to speculate on the future direction of an asset without the obligation to buy or sell. MT4, with its intuitive interface and advanced tools, provides an ideal environment for exploring this dynamic market segment.

Unveiling the Options Trading Universe

Options are derivative contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date).

The buyer of an option pays a premium to the seller, who assumes the obligation to fulfill the contract if exercised. This premium reflects the market’s assessment of the likelihood that the option will expire in the money, meaning that it will be profitable to exercise.

Exploring the Mechanics of MT4 Options Trading

MT4 offers a comprehensive suite of features tailored to the needs of options traders. Its intuitive order management system allows you to place a wide range of option orders, including market, limit, and stop orders.

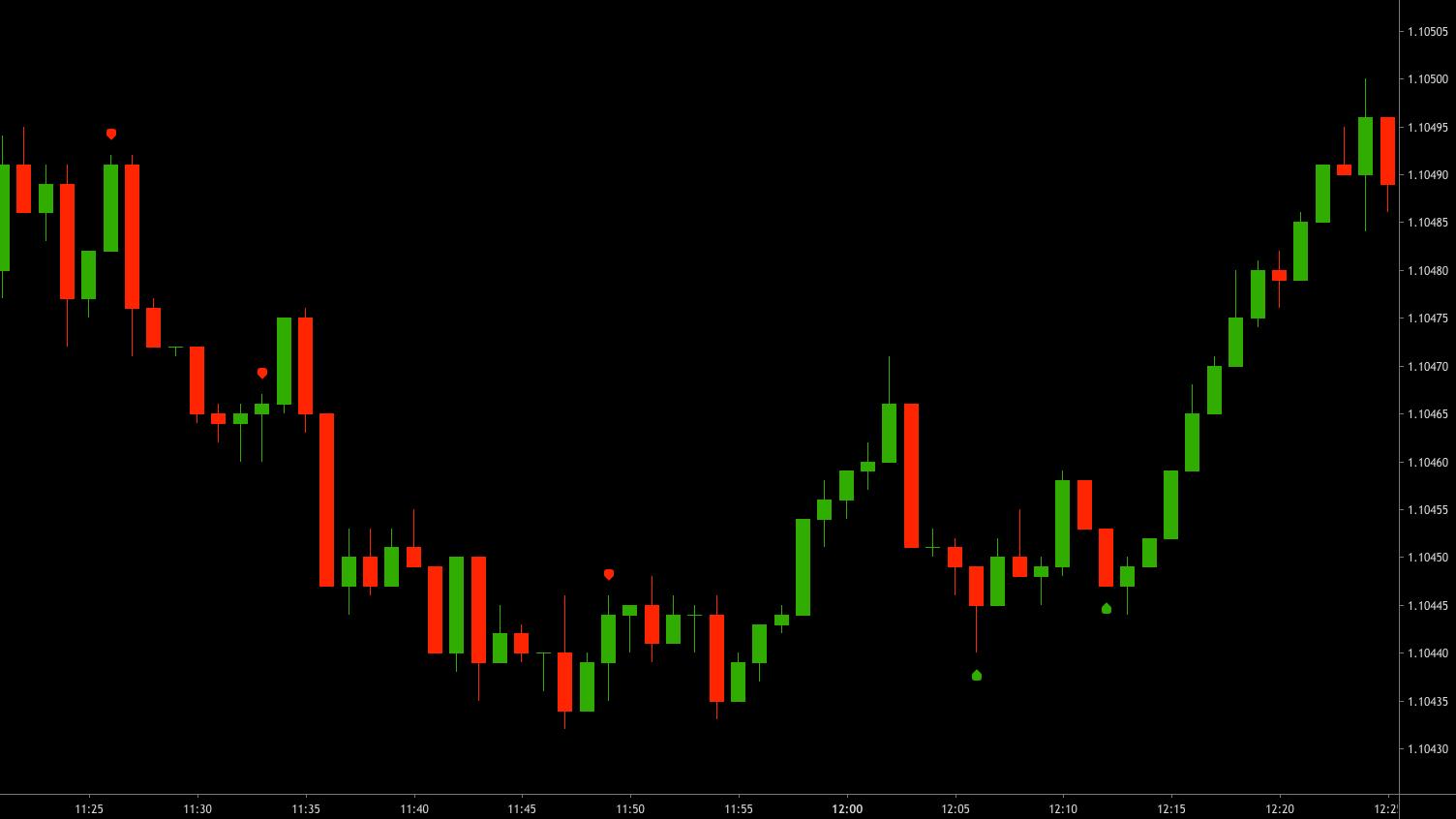

Moreover, MT4 provides real-time charting and technical analysis tools, enabling you to monitor market movements and identify potential trading opportunities. The platform also integrates with various data feeds, delivering up-to-date quotes and market insights.

The Edge: Tips and Expert Insights

- Embrace Risk Management: Options trading involves inherent risk. Define your risk tolerance and implement appropriate risk management strategies to mitigate potential losses.

- Master Volatility: The volatility of the underlying asset significantly influences option premiums. Monitor volatility levels to gauge market sentiment and make informed trading decisions.

Maximize Strategy Diversification: Employ a combination of options strategies to diversify your portfolio and reduce overall risk. Consider strategies such as covered calls, protective puts, and straddles.

Image: tradingwalk.com

Frequently Asked Questions

Q: What are the key differences between call and put options?

A: Call options provide the right to buy, while put options offer the right to sell the underlying asset.

Q: How do I determine the profitability of an option?

A: The profitability of an option depends on the difference between the strike price and the market price of the underlying asset at expiration.

Options Trading Mt4

Image: cryptonaute.fr

Conclusion

The realm of options trading on MT4 offers boundless opportunities for experienced and aspiring traders alike. By embracing the concepts outlined in this guide, you can unlock the potential of this dynamic market. Remember, sound risk management, a deep understanding of volatility, and strategic diversification are key to navigating this exhilarating investment arena.

Are you ready to delve into the exciting world of options trading with MT4? Let the journey begin!