In the realm of financial markets, where risk and reward intertwine, the art of interest rate options trading beckons traders and investors alike. Options, powerful instruments that grant the right but not the obligation to buy or sell an underlying asset at a predetermined price, play a pivotal role in interest rate markets. This article delves into the labyrinthine world of interest rate options trading, navigating its complexities and deciphering its allure.

Image: studylib.net

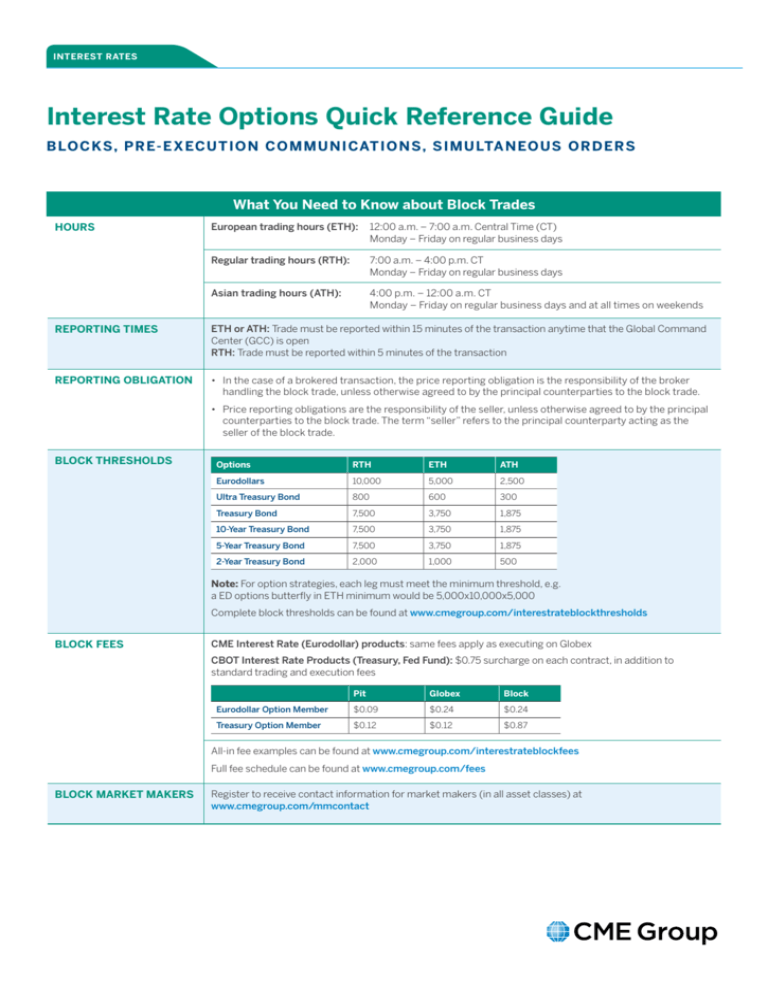

Interest rate options are financial contracts that derive their value from fluctuations in interest rates. By speculating on the future direction of interest rates, traders can harness the potential for substantial gains. Understanding the intricacies of these options requires a foundational comprehension of their core concepts and mechanics.

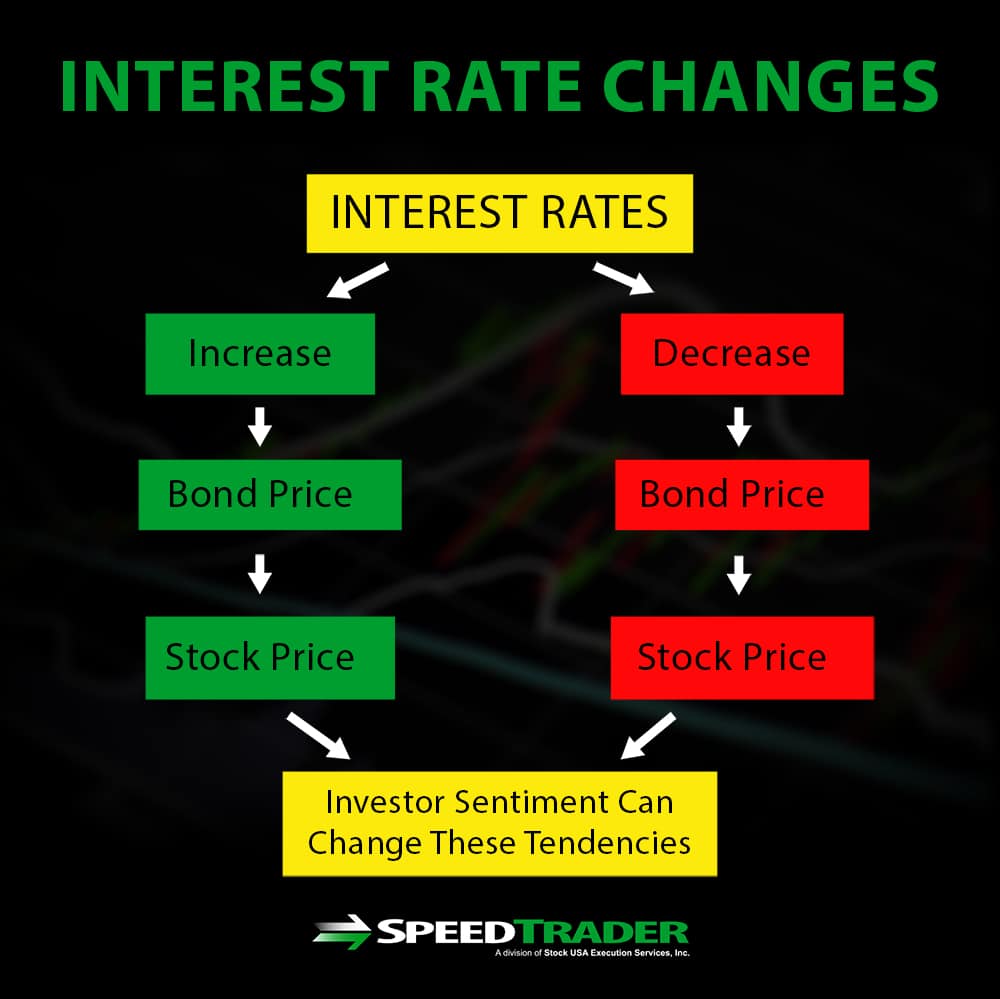

Conceptually, interest rate options empower their holders with the flexibility to either purchase (call option) or dispose (put option) of an underlying interest rate-linked asset at a set price on or before a specified date. Call options confer the right to acquire the asset, while put options grant the right to divest it. For instance, if an investor anticipates a rise in interest rates, they may opt to purchase a call option, granting them the prerogative to acquire a bond at a predetermined price, regardless of the prevailing market rate. Conversely, an expectation of decreasing interest rates may prompt an investor to purchase a put option, enabling them to offload the bond at the specified price.

The allure of interest rate options trading lies in its versatility. These options serve diverse purposes, ranging from risk management to speculation. Hedging strategies, a common application, utilize interest rate options to mitigate risks associated with interest rate fluctuations. By purchasing options with opposing positions, traders can effectively offset potential losses in the underlying asset.

Speculation, the adrenaline-fueled pursuit of profit, is another compelling reason why traders flock to interest rate options. By leveraging their knowledge and market insights, traders seek to capitalize on predicted shifts in interest rates. This speculative dimension adds an element of thrill to the already captivating world of financial trading.

The interest rate options market presents a dynamic landscape, constantly evolving in response to economic conditions and market forces. To navigate this intricate terrain, traders must arm themselves with a comprehensive understanding of the nuances that govern these options. From grasping the relationship between interest rates and option prices to comprehending the mechanics of option premiums, a deep knowledge base is essential for success in this domain.

An in-depth comprehension of market trends and economic indicators is also crucial for astute interest rate options traders. Dissecting macroeconomic data, deciphering central bank policies, and anticipating geopolitical events that may influence interest rate movements empowers traders to make informed decisions.

Seasoned interest rate options traders possess an unparalleled ability to unravel the complexities of the market and exploit the opportunities it presents. They capitalize on their proficiency in calculating option premiums, deftly utilizing pricing models to assess the fair value of options contracts. Armed with this knowledge, they can identify mispriced options, creating opportunities for profitable trades.

In conclusion, interest rate options trading epitomizes the fusion of financial acumen and strategic decision-making. By understanding the nuances of these options and the dynamics of the broader market, traders can harness their potential for both risk management and speculative gain. Whether seeking to mitigate risks or embark on the exhilarating pursuit of profit, the world of interest rate options beckons those with a thirst for financial adventure.

Image: speedtrader.com

Interest Rate Options Trading