Interest rates are the lifeblood of the financial markets, influencing a vast array of assets and investment strategies. As central banks contemplate raising interest rates to combat rising inflation, options traders are scrutinizing the potential impact on their trades. This article delves into the intricacies of options trading in a rising interest rate environment, providing insights and strategies to navigate these ever-changing market dynamics.

Image: www.slideshare.net

Understanding the Impact of Rising Interest Rates on Options

Interest rates play a significant role in options pricing and trading dynamics. When interest rates rise, the value of short-term fixed-income securities increases. Consequently, traders may perceive reduced appeal in options strategies such as covered calls and cash-secured puts, which involve selling options while simultaneously holding the underlying asset.

Furthermore, higher interest rates can lead to increased borrowing costs, potentially impacting traders’ cash flow and overall return expectations. This can affect decisions related to option premiums and margin requirements, as traders may need to adjust their risk-reward tolerance.

Strategies for Options Trading in a Rising Rate Environment

While rising interest rates present challenges, options traders can employ specific strategies to mitigate risks and capitalize on potential opportunities. Here are a few considerations:

-

Focus on Time Decay and Premium Erosion: As interest rates rise, the value of time premium in options contracts may erode more rapidly. Options traders should focus on strategies that prioritize premium retention and minimize the impact of time decay. Consider using options with shorter durations or utilizing diagonal spreads that simultaneously buy and sell options with different expiries.

-

Favor Calls over Puts: In a rising rate environment, call options (rights to buy an underlying asset) may offer advantages over put options (rights to sell). As interest rates increase, demand for assets often rises, benefiting traders who hold call options. Conversely, put options may face increased volatility as traders anticipate downside price movements.

-

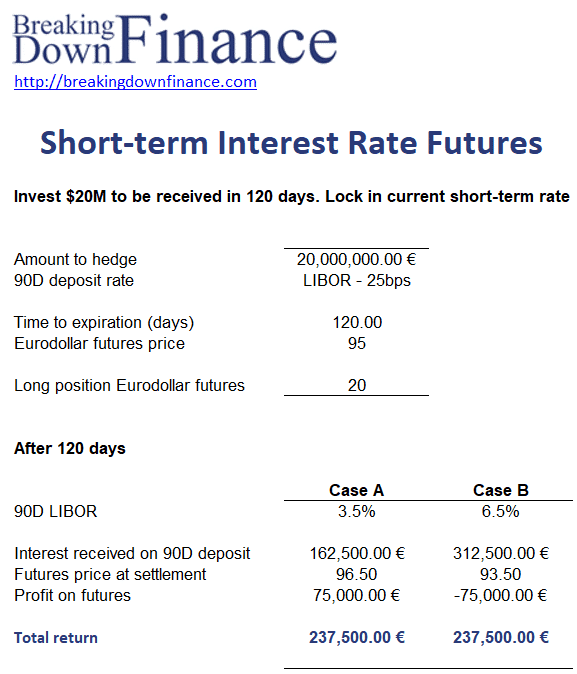

Explore Interest Rate-Linked Options: Certain types of options, such as interest rate swaps and bond futures options, provide more direct exposure to interest rate movements. Traders seeking tailored exposure to shifts in the yield curve may benefit from exploring these instruments.

-

Monitor Implied Volatility and Trade Adjustments: Interest rate changes can influence implied volatility, which is a key determinant of option pricing. Traders should closely monitor implied volatility levels and adjust their trading strategies accordingly. consider pin risk strategies to mitigate the impact of large swings in volatility.

Image: www.pinterest.com

Options Trading When Interest Rates Expected To Rise

Image: breakingdownfinance.com

Conclusion

Options trading in a rising interest rate environment requires a nuanced understanding of market dynamics. By carefully considering the impact of interest rates on option pricing and trading behaviors, traders can adapt their strategies and seek out opportunities that align with the emerging market landscape. The strategies outlined above provide a starting point for exploration, empowering traders to navigate these dynamic market conditions and potentially achieve success.