Introduction: Interest Rate and Option Trading

Option trading is an intriguing financial strategy that allows individuals to make calculated bets on the future direction of an underlying asset’s price. Among the diverse factors influencing option prices, interest rates hold significant sway. Delving into the intricacies of option trading interest rate is paramount for savvy investors seeking to maximize their returns.

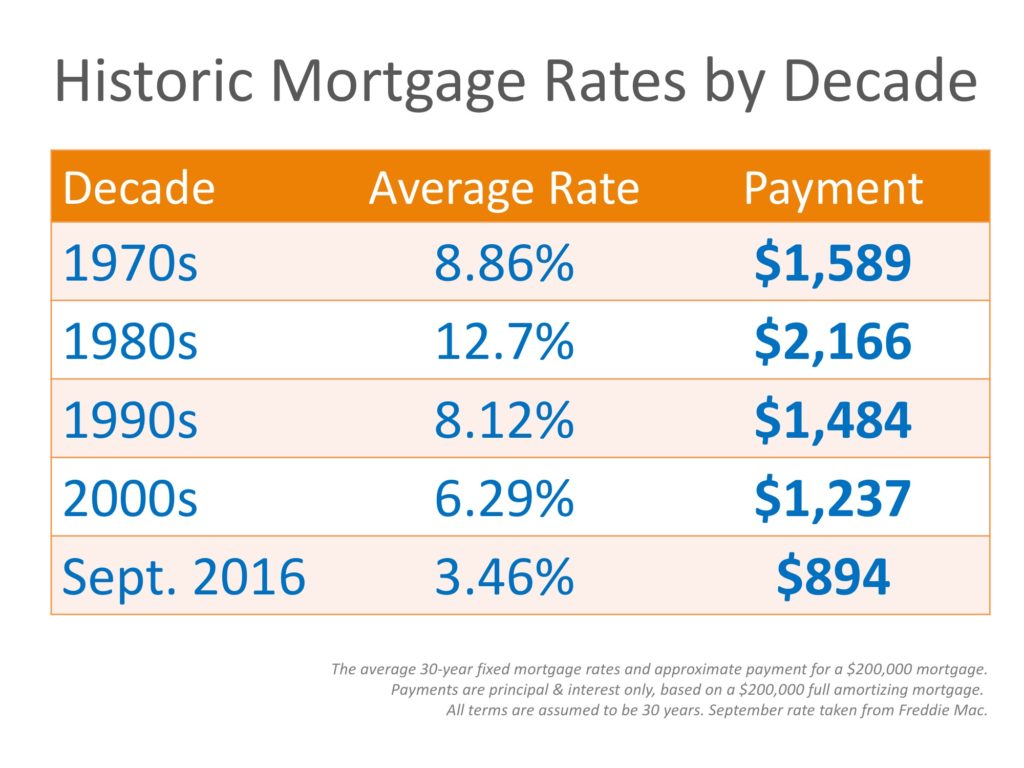

Image: www.slideshare.net

Understanding the mechanics of option pricing is crucial. The value of an option is not solely determined by the price of the underlying asset; the interest rate environment also plays a pivotal role. Interest rates influence the time value of money, which affects the value of time-sensitive financial instruments like options. This comprehensive guide will delve into the multifaceted relationship between option trading interest rate, providing you with a solid understanding of this complex topic.

Option Premium

Option premium, representing the purchase price of an option, is impacted by various factors. Interest rates are among the most influential, alongside volatility, strike price, and time to expiration. As interest rates rise, the time value of money increases, leading to higher premium costs for options with longer expirations. Conversely, when interest rates fall, time value decreases, reducing the premium for longer-term options.

To illustrate, consider two hypothetical stock options with identical strike prices and expiration dates but different interest rate environments. In a low-interest rate environment, the time value of money is minimal, resulting in a lower premium for the longer-term option. Conversely, in a high-interest rate environment, the time value of money is amplified, resulting in a higher premium for the longer-term option.

Option Strategy Impact

Interest rate fluctuations impact various option strategies differently. Call options typically benefit from rising interest rate environments, as higher rates lead to increased option premiums. Conversely, put options tend to favor falling interest rate environments, as lower rates diminish premiums.

For example, if you anticipate a sharp rise in interest rates, it may be advantageous to purchase a long call option. The increasing interest rates would enhance the time value of the option, potentially amplifying your profits. However, if you speculate an approaching reduction in interest rates, you might consider purchasing a long put option, as the decreasing time value would diminish the premium, positioning you to benefit from falling asset prices.

Expert Advice

Before embarking on option trading, it is wise to seek guidance from experienced professionals. Consult with a qualified financial advisor who can expertly assess your risk tolerance, investment goals, and financial situation, tailoring a personalized strategy that aligns with your specific needs and aspirations.

Remember that option trading involves inherent risks, and losses are possible. Thoroughly educate yourself on the intricacies of option trading, including the impact of interest rates and other pertinent factors. Additionally, practice prudent risk management techniques, such as setting clear profit and loss targets and understanding the potential consequences of your trades.

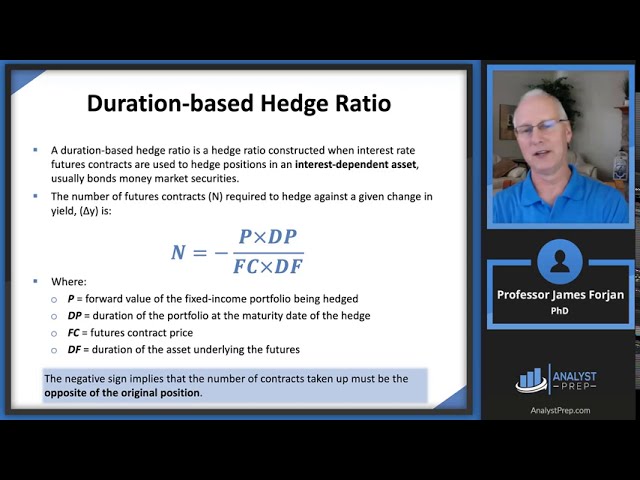

Image: analystprep.com

FAQ on Option Trading Interest Rate

Q: How do interest rates affect option pricing?

A: Interest rates influence the time value of money, which affects the value of time-sensitive financial instruments like options.

Q: Which interest rate environment is more favorable for call options?

A: Call options generally benefit from rising interest rate environments due to increased option premiums.

Q: What impact do interest rates have on the value of long put options?

A: Falling interest rates benefit long put options by reducing option premiums, leading to potential gains from decreasing asset prices.

Option Trading Interest Rate

Image: leighqcathleen.pages.dev

Conclusion

Option trading interest rate is a complex yet critical aspect of this dynamic financial strategy. Understanding the interplay between interest rates and option pricing is indispensable for investors seeking to maximize their returns and minimize risks.

Are you an aspiring option trader interested in delving further into the world of option trading interest rate? If so, reach out to a seasoned financial advisor, and passionately embark on your journey toward financial success.