As a seasoned options trader, I’ve witnessed firsthand the transformative power of backspreads. These versatile strategies can unlock significant profit potential while mitigating risk, making them an indispensable tool in my trading arsenal. Embark on this enlightening journey as we delve into the intricacies of option trading backspreads, unveiling their history, nuances, and practical applications.

Image: www.projectfinance.com

Navigating Option Trading Backspreads

Defining the Backspread Strategy

An option trading backspread involves simultaneously buying one option and selling another of the same underlying asset. By structuring the options with different strike prices and expiration dates, traders can create a defined risk and reward profile tailored to their trading objectives.

Consider a bullish backspread, where we buy a lower-strike call option (right to buy) and sell a higher-strike call option. This strategy capitalizes on a moderate increase in the underlying asset’s price while limiting potential losses if the underlying price remains stagnant or falls.

Types of Backspreads: Customizing Risk and Reward

Backspreads offer a diverse range of variations, including:

- Bull call spread: Profitable in rising markets,

- Bear put spread: Ideal for falling markets,

- Bull put spread: Suitable for modestly rising or sideways markets,

- Bear call spread: Profitable in modestly falling or sideways markets.

The choice of spread type depends on the trader’s market outlook and risk tolerance.

Image: optionshawk.com

Maximizing Gains with Backspreads

Advantages of Incorporating Backspreads

Backspreads offer a myriad of benefits for traders:

- Risk-defined strategies: Maximum risk is determined at trade entry, mitigating downside potential,

- Enhanced profit potential: Backspreads can capture market movements effectively, leading to higher returns,

- Income-generating opportunities: Selling options premiums generates income,

- Versatility: Backspreads can be tailored to suit various market conditions and trading styles.

Trading Backspreads Effectively

To execute successful backspread trades, consider the following tips:

- Choose the right stock: Understand the underlying asset’s volatility, liquidity, and market trends,

- Determine the appropriate strike prices: Select strike prices that align with the projected price movement,

- Set a clear exit strategy: Define target profit levels and stop-loss orders for risk management,

- Manage risk diligently: Monitor market conditions and adjust the strategy as needed to protect profits,

- Consider the trading costs: Factor in option premiums, commissions, and other expenses.

Frequently Asked Questions (FAQs) on Backspreads

Q: What are the risks associated with backspreads?

A: While backspreads limit downside risk, they come with inherent risks, such as unlimited potential loss in the case of a substantial price movement in the underlying asset.

Q: How do backspreads compare to other option strategies?

A: Backspreads offer a lower risk-reward profile than naked options or spreads with higher leverage but with a corresponding increase in potential profit.

Q: Can I use backspreads in any market condition?

A: Backspreads can be effective in both trending and range-bound markets but are particularly suitable for markets with moderate price movements.

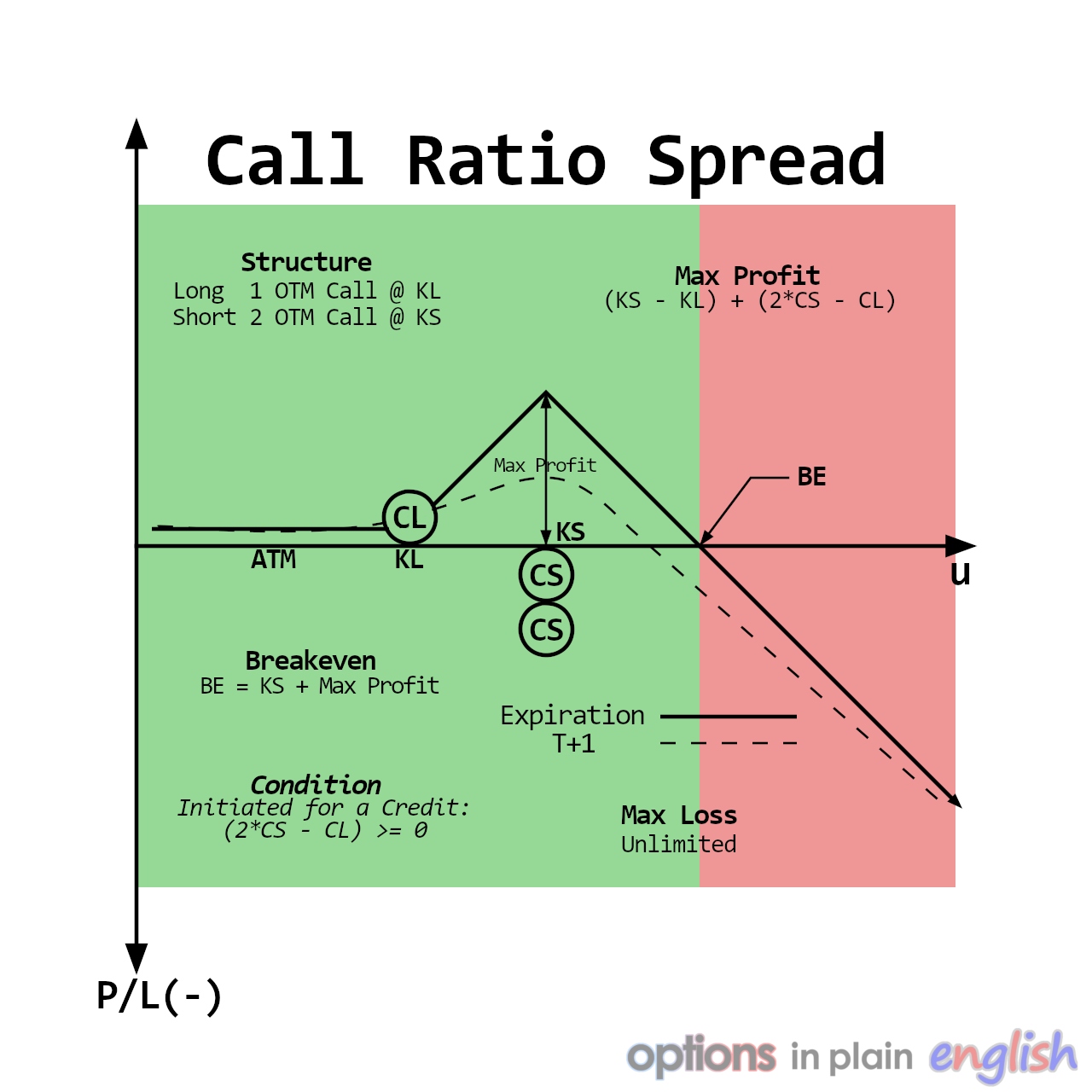

Option Trading Backspreads

Image: optionsinplainenglish.com

Unlocking Trading Success with Backspreads

Option trading backspreads empower traders with a powerful tool for navigating market fluctuations and capturing profit potential. By embracing the concepts and strategies outlined in this article, you can elevate your trading knowledge and gain a competitive edge in the financial markets.

Are you ready to delve deeper into the world of option trading backspreads? Engage with our expert team today to discover how backspreads can transform your trading journey.