Options trading, a world of strategic financial opportunities, is heavily influenced by Greek letters known as Greeks. These parameters offer vital insights into various aspects of option contracts and help traders make informed decisions to maximize their returns and manage risk.

Image: www.paytmmoney.com

Unlocking the Secrets of Greeks Options Trading

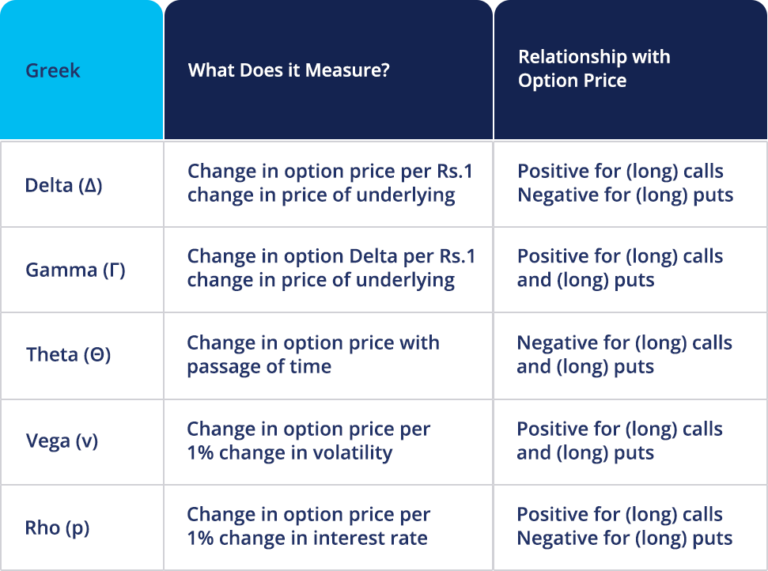

The Greeks are a set of variables that provide dynamic information about the sensitivity and performance of an option in response to market changes. Each Greek represents a distinct dimension of the option’s behavior, including delta, gamma, theta, vega, and rho.

1. Delta: Measuring Price Sensitivity

Delta measures how much the option’s price changes for every dollar change in the underlying asset’s price. It helps traders determine the overall direction and sensitivity of the option to the fluctuations of the underlying asset.

2. Gamma: Assessing Price Acceleration

Gamma represents the rate of change in delta with respect to the underlying asset’s price. It indicates how quickly the option’s sensitivity to the underlying asset’s price changes, thereby offering insights into potential acceleration or deceleration of its delta movement.

Image: www.adorebooks.in

3. Theta: Capturing Time Decay

Theta gauges the loss of option value over time. As the option approaches its expiration date, theta increases, indicating an accelerated loss of premium. Theta’s relevance is particularly crucial for short-term options due to the rapid decay of value as time passes.

4. Vega: Estimating Volatility Impact

Vega measures the option’s price sensitivity to changes in implied volatility. As implied volatility increases, so does the option’s price. Vega is a vital factor when evaluating the potential impact of market volatility on the option’s value.

5. Rho: Monitoring Interest Rate Effect

Rho assesses the option’s sensitivity to changes in interest rates. It measures the amount of premium lost or gained for every parallel shift in interest rates. Rho’s significance is particularly relevant for interest rate-sensitive options, such as bonds and currencies.

Navigating the Evolving Landscape of Greek Options Trading

The world of options trading is ever-evolving, driven by technological advancements, regulatory reforms, and shifts in market dynamics. Staying abreast of the latest trends and developments is paramount for successful navigation of this complex domain.

Recent breakthroughs in data analytics and AI have significantly enhanced Greeks calculations, providing traders with more refined and timely insights into option behavior. Additionally, regulatory changes and increased standardization across global markets have fostered greater transparency and efficiency in options trading.

Tips and Expert Insights for Informed Options Trading

- Comprehend the Power of Greeks: Develop a deep understanding of the Greeks and their interplay to analyze option performance and make informed trading decisions.

- Seek Professional Guidance: Consult with experienced financial advisors or brokers to gain valuable insights and strategies tailored to your unique investment objectives.

Empowering Traders through Greeks Expertise and Proven Strategy

By leveraging the insights derived from the Greeks and staying up-to-date on market trends, traders can significantly enhance their risk management and profit potential in options trading. As a seasoned blogger, I strongly encourage readers to explore the vast and dynamic world of options trading with a well-informed and strategic approach.

Frequently Asked Questions on Greek Options Trading

- Q: Why are Greeks essential for options trading?

A: Greek options trading provides crucial insights into the dynamic behavior of an option in response to market changes, enabling informed decision-making and risk management. - Q: How should I interpret the values of Greeks?

A: Greeks are mathematical parameters that require analysis in conjunction with the underlying asset’s characteristics and the trader’s investment strategy to derive meaningful insights. - Q: Are Greeks equally significant for all option strategies?

A: The relevance of Greeks can vary depending on the specific option strategy employed. Different Greeks may hold more or less weight in different scenarios.

Most Important Greeks Options Trading

Image: www.reddit.com

Conclusion: Embracing the Power of Informed Options Trading

Greek options trading empowers traders with the tools to make informed decisions, navigate market complexities, and capitalize on trading opportunities. By incorporating Greeks analysis into their strategies, traders can elevate their risk management, enhance their profit potential, and confidently navigate the world of options trading.

Whether you are a seasoned trader or just embarking on your options trading journey, I encourage you to delve deeper into the world of Greeks and unlock their full potential. With knowledge, strategy, and a touch of courage, you too can master the art of Greek options trading.

Are you intrigued by the world of options trading? Let me know in the comments below if you would like to learn more about this fascinating domain.