In the realm of financial markets, options trading presents a unique opportunity to manage risk and enhance potential returns. Understanding the intricate world of option trading Greeks is the key to navigating this complex landscape. These Greeks, like the ancient Greek philosophers, each offer profound insights into the behavior of options contracts under varying market conditions.

Image: www.paytmmoney.com

Delving into the Option Trading Greek Lexicon

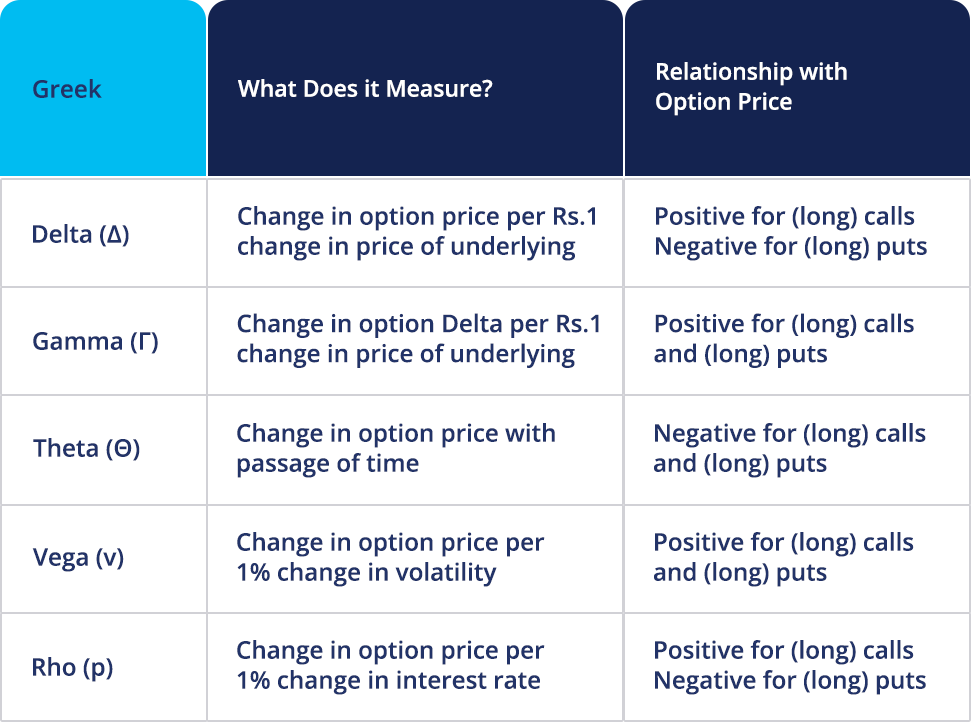

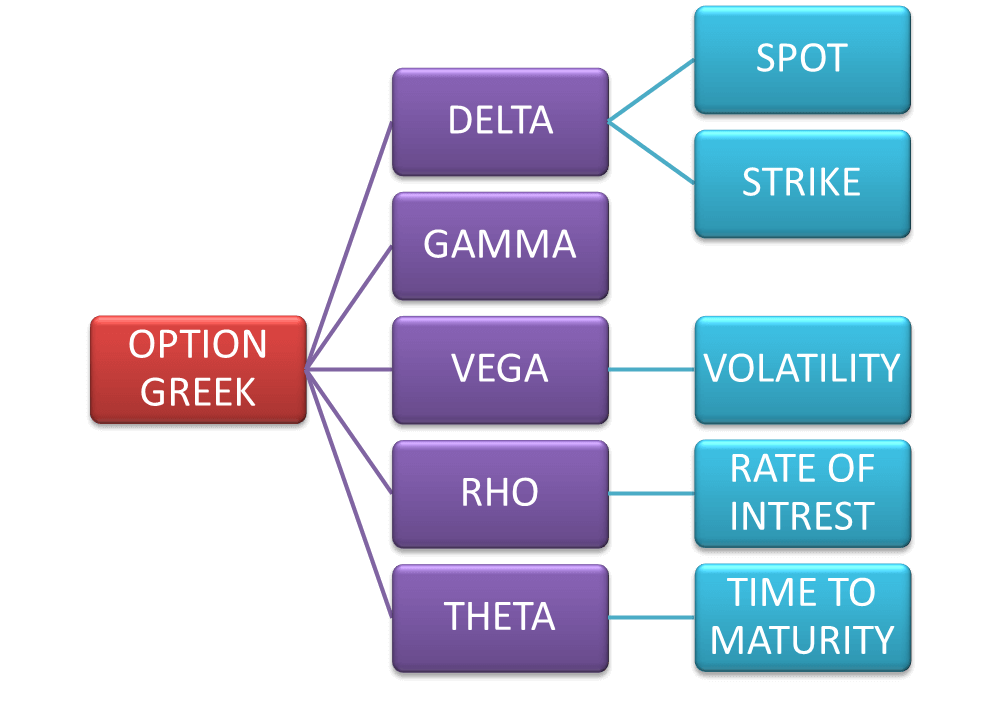

Option trading Greeks are mathematical measures that quantify the sensitivity of an option’s price to changes in various factors. The most prominent Greeks include:

- Delta: Measures the rate of change in an option’s price for every $1 change in the underlying asset’s price.

- Theta: Represents the decay in an option’s value as time passes.

- Gamma: Indicates the change in an option’s delta for every $1 change in the underlying asset’s price.

- Vega: Calculates the change in an option’s price for every 1% change in volatility.

- Rho: Measures the impact of interest rate changes on an option’s price.

Mastering Greek to Enhance Trading Decisions

Comprehending option trading Greeks empowers traders to:

- Quantify the potential gain or loss associated with an option position.

- Adjust positions to manage risk by balancing opposing Greeks.

- Identify and capitalize on trading opportunities by monitoring Greek values.

- Develop and implement sophisticated trading strategies that account for market dynamics.

Expert Insights: Deciphering the Greek Code

“Greek analysis provides a Rosetta Stone for options traders,” explains Dr. James Chen, a renowned expert in quantitative finance. “By unraveling the secrets of these metrics, traders gain the ability to make informed decisions, avoid pitfalls, and increase their chances of success.”

Image: tradingfuel.com

Actionable Tips: Unleashing the Greek Advantage

- Leverage Delta to gauge the potential impact of underlying asset price movements on option positions.

- Monitor Theta closely to manage the time decay associated with options contracts.

- Utilize Gamma to anticipate and prepare for changes in an option’s sensitivity to underlying asset price fluctuations.

- Keep an eye on Vega to assess the impact of volatility on option pricing, especially in uncertain market conditions.

- Be aware of Rho’s influence when interest rate changes are anticipated, as they can significantly affect option values.

Option Trading Greek

Conclusion: The Greek Oracle of Options Trading

By embracing the wisdom of option trading Greeks, traders transform themselves into astute navigators of the financial markets. Armed with this knowledge, they can unlock the true power of options trading, leveraging risk-adjusted returns and achieving financial success. May these Greeks guide you on your trading journey, illuminating the path to informed decisions and profitable outcomes.