Introduction

In the realm of retirement planning, Roth IRAs stand out as a powerful tool for tax-advantaged savings. While traditional IRAs offer tax-deferred growth, Roth IRAs provide tax-free growth and tax-free withdrawals in retirement. This unique advantage has made them immensely popular among those seeking to maximize their savings. However, the allure of Roth IRAs goes beyond their tax benefits; they also present a fascinating opportunity for investors to tap into the world of options trading, including the intriguing strategy of trading uncovered options.

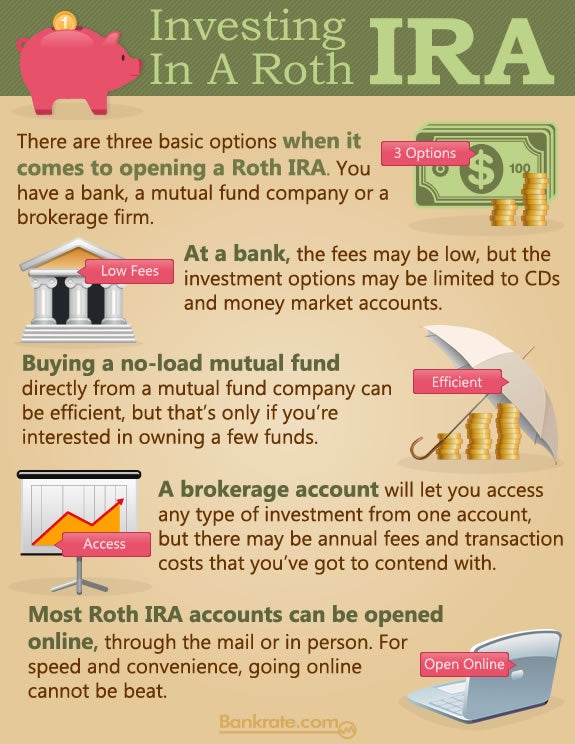

Image: www.bankrate.com

Uncovered options trading, a strategy that pushes the boundaries of financial planning, involves selling or buying options without owning or shorting the underlying asset. This approach can unveil a world of possibilities but demands a comprehensive understanding of options markets and entails significant risks. In this article, we delve into the intricacies of trading uncovered options within Roth IRAs, unraveling the potential rewards and potential perils associated with this strategy.

Exploring the Mechanics of Uncovered Options Trading in Roth IRAs

Uncovered options trading involves engaging in options transactions without securing ownership (in the case of selling a call option) or shorting (in the case of selling a put option) the underlying asset. This approach hinges on speculating on the price movements of the underlying asset, aiming to capture premiums earned from option sales.

Roth IRAs, with their tax-advantaged status, offer a compelling platform for uncovered options trading. Notably, any gains realized from options trading within a Roth IRA are tax-free, providing investors with an attractive environment to explore this strategy.

Advantages of Uncovered Options Trading in Roth IRAs

-

Enhanced Growth Potential: Uncovered options trading has the allure of significant profit potential. By speculating on the price movements of underlying assets, investors can generate premiums that contribute to the growth of their IRA portfolios. This strategy offers a means to potentially accelerate retirement savings, albeit with its inherent risks.

-

Tax-Free Growth: As previously mentioned, Roth IRAs offer tax-free growth and tax-free withdrawals in retirement. This tax-advantaged environment extends to gains realized from options trading within these accounts, creating an attractive opportunity for investors to maximize their returns.

-

Hedging Strategies: Uncovered options trading can also serve as a hedging mechanism within a Roth IRA. By selling put options against existing positions within the account, investors can hedge against potential downturns, potentially reducing overall portfolio risk.

Risks Associated with Uncovered Options Trading in Roth IRAs

-

Unlimited Loss Potential: Unlike covered options trading, where the maximum loss is limited to the premium received, uncovered options trading exposes investors to potentially significant losses. In the event of unfavorable price movements, losses can exceed the premiums collected, potentially leading to substantial drawdowns in the IRA portfolio.

-

Complex and Volatile Markets: Options trading, in general, is a complex endeavor, subject to the vagaries of volatile markets. Uncovered options trading amplifies these risks, as it involves speculating on price movements without the safety net of holding or shorting the underlying asset.

-

Suitability Considerations: Uncovered options trading is not suitable for all investors. It requires a deep understanding of options markets, risk tolerance for potentially significant losses, and the ability to closely monitor market movements.

Image: investluck.com

Essential Considerations for Successful Uncovered Options Trading in Roth IRAs

-

Thorough Research and Education: Embarking on uncovered options trading within a Roth IRA demands thorough research and education. Investors must possess a firm grasp of options markets, trading strategies, and risk management techniques before engaging in this complex strategy.

-

Realistic Expectations: Uncovered options trading has the allure of substantial gains, but it’s crucial to maintain realistic expectations. Significant profits are not guaranteed, and potential losses can exceed the premiums collected.

-

Close Monitoring: Options markets are highly dynamic, and prices can fluctuate rapidly. Investors must closely monitor market movements and regularly assess their positions to make informed decisions and adjust strategies as needed.

Trading Uncovered Options In Roth Ira

Image: www.summaglobal.com

Conclusion

Trading uncovered options within Roth IRAs can be a powerful tool for investors seeking to maximize their retirement savings. This strategy offers the potential for significant gains, enhanced growth potential, and tax-free returns. However, it’s imperative to approach uncovered options trading with a sound understanding of the risks involved and to adopt a diligent risk management approach. Investors who embrace thorough research, maintain realistic expectations, and monitor their positions closely can harness the power of uncovered options trading to potentially accelerate their retirement savings and achieve their long-term financial goals.