Are you intrigued by the allure of options trading but hesitant to risk your hard-earned capital? Enter thinkorswim’s options trading paper money – a revolutionary platform that empowers you to explore the intricacies of this financial realm without any monetary risks. In this comprehensive guide, we will delve into the world of options trading paper money, explaining its significance, functionality, and how it can propel you toward real-world success.

Image: fotografeime.blogspot.com

Unveiling the Essence of Thinkorswim Options Trading Paper Money

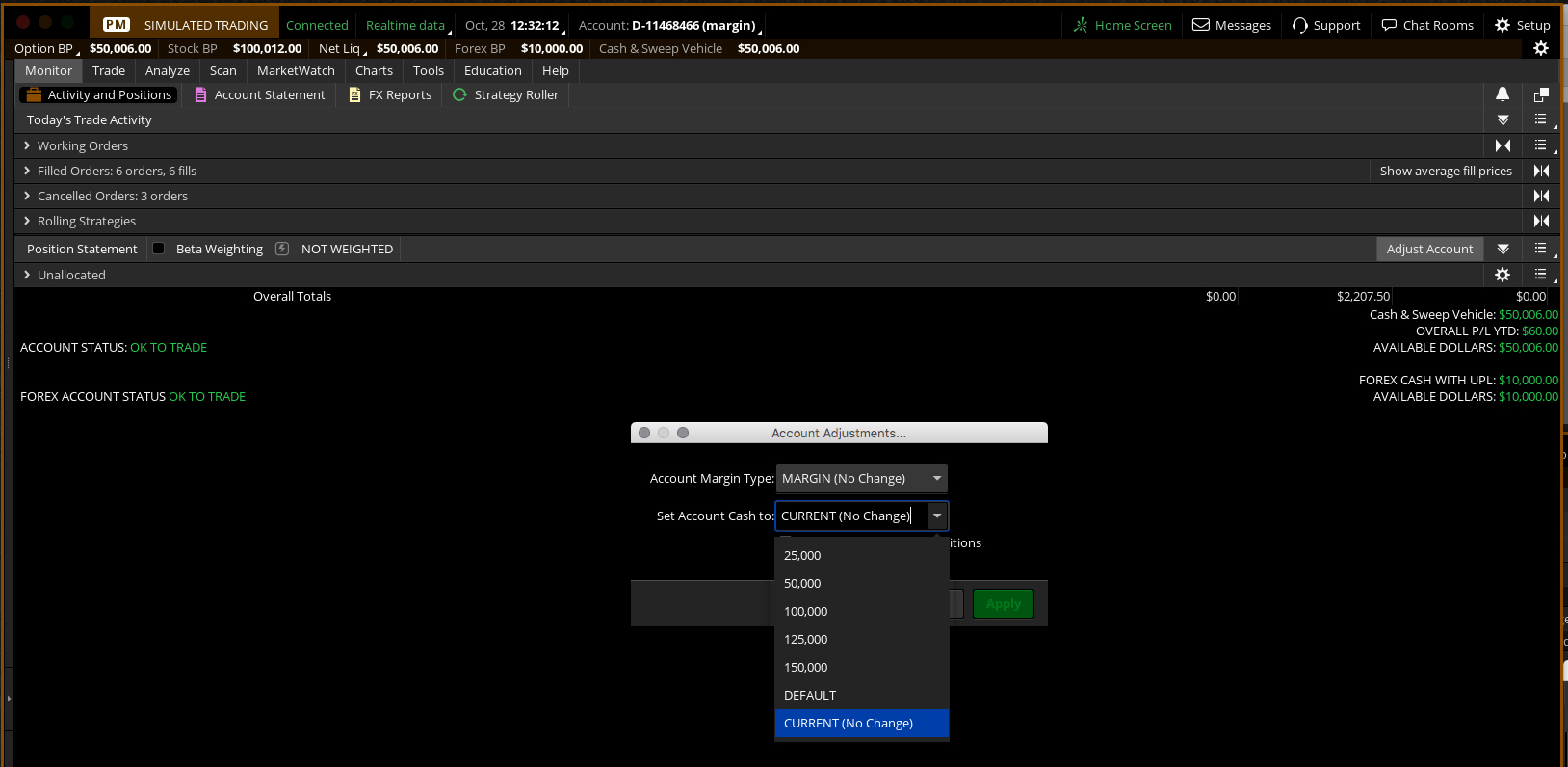

Thinkorswim, the renowned trading platform by TD Ameritrade, offers a unique paper money account that mimics live trading conditions but utilizes virtual funds instead of real capital. This feature allows traders to hone their skills, test strategies, and gain invaluable experience in a risk-free environment.

The concept of paper money trading is analogous to that of a driving simulator. Just as aspiring drivers can practice their maneuvering skills without endangering themselves or others, options paper money trading enables aspiring traders to navigate the complex landscape of options markets without the threat of financial loss.

Benefits of Utilizing Thinkorswim’s Options Paper Money

The advantages of thinkorswim’s paper money trading extend beyond financial protection. Traders can explore the platform’s robust tools, analyze market data, and execute simulated trades, all without the emotional and psychological burdens associated with real money. This stress-free environment fosters a conducive learning space where traders can:

- Master Options Strategies: Paper money trading provides a platform to experiment with various options strategies, such as covered calls, cash-secured puts, and iron condors, without any financial consequences.

- Test Trading Plans: Traders can craft intricate trading plans and assess their effectiveness in the paper money environment. This iterative process allows them to refine their strategies before transitioning to live trading.

- Evaluate Options Market Behavior: Paper money trading provides a sandbox-like environment where traders can observe the dynamics of options markets and gain an intuitive understanding of how factors such as volatility, time decay, and market sentiment influence option prices.

- Build Confidence and Discipline: Successful paper money trading instills confidence and reinforces the importance of discipline and risk management. These qualities are essential for navigating the turbulent waters of live options trading.

Essential Features to Enhance Your Trading

Thinkorswim’s options paper money trading platform is not merely a replica of the live trading interface. It incorporates a range of advanced features that enhance the trading experience and accelerate learning:

- Interactive Education: The platform offers a plethora of educational resources, including webinars, tutorials, and in-depth strategy guides, to empower traders with the knowledge they need to succeed.

- Trading Replay: This feature enables traders to review their simulated trades, identify areas for improvement, and optimize their strategies.

- Simulated Trading Commissions: Paper money trading incorporates realistic trading commissions, mirroring the expenses incurred during live trading. This instills a sense of cost consciousness and helps traders allocate capital efficiently.

- Community Support: Traders can connect with a vibrant community of fellow traders, share experiences, and learn from the insights of seasoned veterans.

Image: www.youtube.com

Thinkorswim Options Trading Paper Money

Image: thestocksreport.com

Transitioning from Paper Money to Live Trading

While paper money trading is an invaluable learning tool, it is essential to recognize that it is a simulation and does not fully replicate the psychological and emotional experiences of real trading. To achieve long-term success, traders must eventually transition to live trading. The following tips can facilitate this transition:

- Set Realistic Expectations: Understand that the transition to live trading may involve setbacks and challenges. Manage expectations and approach the journey with patience and a willingness to learn.

- Trade with Small Sums: When transitioning to live trading, start with small sums of capital to limit potential losses and build confidence gradually.

- Control Emotions: It is human nature to experience emotions such as fear and greed when trading with real money. Develop coping mechanisms to manage these emotions and avoid making impulsive decisions.

- Seek Professional Guidance: Consider seeking guidance from a financial advisor or mentor who can provide unbiased perspectives and support throughout your trading journey.

Thinkorswim’s options trading paper money is an innovative tool that has democratized access to options trading education. By leveraging its capabilities, aspiring traders can develop a solid foundation and increase their chances of success in the real world of options trading. Embrace the opportunities it offers, hone your skills, and embark on a rewarding journey toward financial independence.