Introduction:

In the realm of options trading, the thrill of hitting the strike price is an exhilarating experience. However, when you’re practicing on Thinkorswim paper money and nothing happens after you hit the strike, it can be frustrating. Don’t worry, you’re not alone. In this article, we’ll unravel the mystery behind this phenomenon and guide you through the intricacies of options trading on Thinkorswim paper money.

Image: www.youtube.com

Understanding Options Trading on Thinkorswim Paper Money:

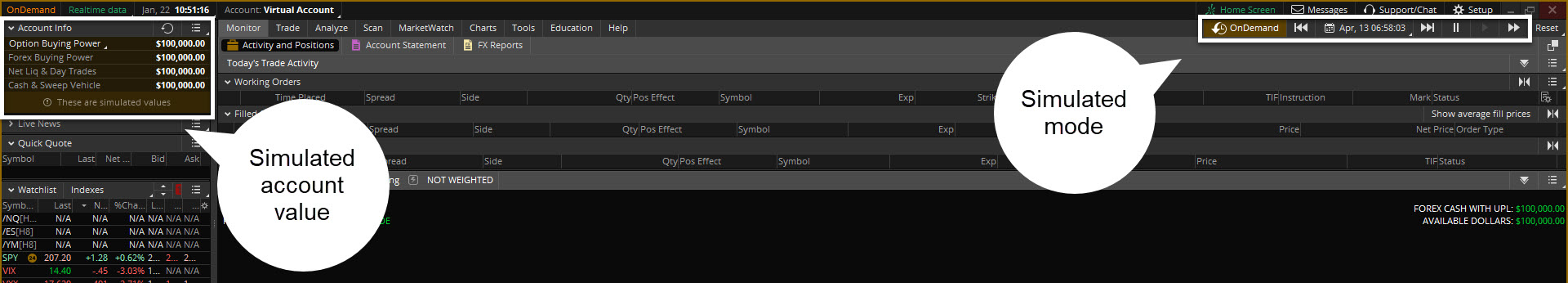

Thinkorswim paper money is a virtual trading platform that allows you to simulate options trading without risking real capital. It provides traders with a safe environment to practice strategies, test hypotheses, and gain valuable experience. However, unlike real-life trading, paper money trading does not involve the actual execution of orders or the movement of funds.

Why Nothing Happened When You Hit the Strike on Paper Money:

When you purchase an option on Thinkorswim paper money, you are not establishing a real-world contract with an underlying asset. Instead, you are simply simulating the behavior of an option in a hypothetical market. As such, when you hit the strike price on paper money, no real-life transaction takes place, and no profit or loss is realized.

1. No Option Premium Paid:

Unlike live trading, you do not pay any premium to purchase options on paper money. In real life, the premium paid is what gives you the right, but not the obligation, to exercise the option. Since there is no risk involved in paper money trading, there is no need for a premium to be paid.

Image: www.youtube.com

2. No Settlement or Exercise:

When you hit the strike price in real-life options trading, you have the option to exercise it, which involves selling the underlying asset if you hold a call option or buying it if you hold a put option. On Thinkorswim paper money, there is no settlement or exercise process. The options simply expire at the end of their term, without any actions taken.

3. Educational Purpose Only:

Thinkorswim paper money is primarily designed for educational purposes. It allows traders to learn about options trading concepts, practice strategies, and test different scenarios without the risk of financial loss. It’s not meant to replicate the exact conditions of live trading, where real money is on the line.

Tips for Leveraging Thinkorswim Paper Money Effectively:

While Thinkorswim paper money may not provide the exact experience of live trading, it can still be a valuable tool for learning and improvement. Here are some tips for getting the most out of your paper money experience:

1. Understand the Limitations:

Always remember that paper money trading is not the same as real-life trading. There are certain limitations and differences to be aware of.

2. Simulate Real-Life Conditions:

To make your paper money experience more realistic, try to simulate real-life conditions as much as possible. Research market trends, set realistic profit targets, and manage risk accordingly.

3. Test Strategies and Scenarios:

Use paper money to experiment with different trading strategies and scenarios. This allows you to see how they perform under various conditions without risking real capital.

4. Build Confidence and Skills:

Paper money trading can help you build confidence and develop your skills. The more you practice, the more comfortable you will become with options trading concepts.

Trading Options Thinkorswim Paper Money Hit Strike Nothing Happened

Image: zulassung-pieske.de

Conclusion:

If you’re wondering why nothing happened when you hit the strike on Thinkorswim paper money, it’s because paper money trading is designed purely for educational purposes. It does not involve real-life orders or financial transactions, so you won’t experience any profits or losses. However, by understanding the limitations and using paper money effectively, you can gain valuable insights and enhance your options trading skills. Remember to approach paper money trading as a learning opportunity and always consult trusted resources for accurate information before making real-world decisions.