Have you ever wondered how the intricate dance of options trading translates into the sometimes-daunting world of taxes? It can be a maze of deductions, capital gains, and seemingly endless regulations. But fear not, dear reader, for this comprehensive guide will equip you with the knowledge to confidently report your options trading activities on your tax return.

Image: www.thestreet.com

Understanding the tax implications of options trading is crucial for every investor, no matter your level of experience. This guide will delve into the intricacies of options tax reporting, clarifying the key concepts and providing practical examples to illuminate the process. Whether you’re a seasoned trader or a curious newcomer, this exploration will unravel the mysteries of options tax reporting, empowering you to manage your financial obligations with ease.

Understanding the Basics: Options Trading and Taxes

Before diving into the specifics of tax reporting, let’s clarify the terminology. Options trading involves contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset (like a stock) at a predetermined price within a specified timeframe. There are two main types of options:

- Calls: Give the holder the right to buy the underlying asset.

- Puts: Give the holder the right to sell the underlying asset.

The tax treatment of options trading hinges on whether the option is exercised (executed) or expires worthless. It is important to remember that while options trading offers flexibility and potential for higher returns, it also comes with increased complexity and potential tax liabilities.

Classifying Your Options: Determining Tax Treatment

The tax treatment of your options depends on whether they are considered short-term or long-term. This classification is based on the holding period.

Short-Term Options (Held Less Than a Year)

Options held for less than a year are categorized as short-term and are subject to ordinary income tax rates. This means the profits generated are taxed at your regular income tax bracket and losses can be deducted from your taxable income.

Image: naseemcallie.blogspot.com

Long-Term Options (Held for More Than a Year)

Long-term options, held for longer than a year, benefit from the lower capital gains tax rates. These profits are taxed at preferential rates, typically lower than your regular income tax bracket. Losses from long-term options can offset capital gains, offering a potential tax advantage.

Profit and Loss: A Deeper Dive

The profit or loss realized from options trading is calculated differently depending on the outcome. Let’s break down the scenarios:

Profits from Exercising Options

When you exercise an option, the profit is calculated as the difference between the strike price (the price at which you agreed to buy or sell the asset) and the current market price of the underlying asset, minus any premiums paid for the option contract.

Example: Exercising a Call Option

Imagine you buy a call option for $100 to purchase 100 shares of XYZ stock at a strike price of $50 per share. The current market price of XYZ stock is $60. You exercise the option. Your profit is calculated as follows:

- Market Price: $60 per share

- Strike Price: $50 per share

- Profit per share: $60 – $50 = $10

- Total Profit: $10 x 100 shares = $1000

- Net Profit: $1000 (total profit) – $100 (premium) = $900

This $900 profit would be considered either short-term or long-term capital gains, based on the option’s holding period.

Profits from Selling Options

The profit from selling an option (writing an option) is simply the premium you received for selling the contract. This premium is typically considered ordinary income and is taxed at your regular income tax bracket.

Losses from Exercised or Expired Options

If you lose money on an exercised option, the loss is calculated as the difference between the strike price and the current market price, plus any premium paid. This loss can potentially be offset against other capital gains or deducted against taxable income.

Example: Exercising a Put Option (Loss Scenario)

You purchase a put option for $50 to sell 100 shares of ABC stock at a strike price of $60 per share. The current market price of ABC stock drops to $45. You exercise the option.

- Strike Price: $60 per share

- Market Price: $45 per share

- Loss per share: $60 – $45 = $15

- Total Loss: $15 per share x 100 shares = $1500

- Net Loss: $1500 (total loss) + $50 (premium) = $1550

This net loss of $1550 can potentially be deducted from taxable income.

Losses from Expired Options

If your option expires worthless, the entire premium paid for the option is considered a capital loss. This loss can be offset against other capital gains or deducted against taxable income.

Reporting Options Trading on Your Tax Return

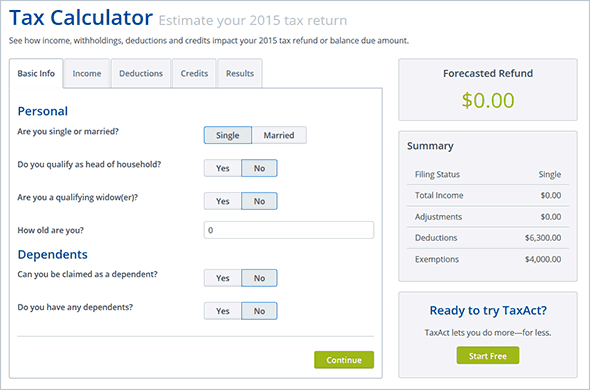

Now that you understand the basic tax implications, let’s delve into how to report options trading on your Form 1040.

Form 8949: Your Options Trading Reporting Tool

Form 8949 is your essential tool for reporting capital gains and losses from options trading on your tax return.

Schedule D: Reconciling Capital Gains and Losses

Once you’ve completed Form 8949, you’ll transfer the information to Schedule D, which summarizes your capital gains and losses and calculates the net capital gain or loss to be reported on Form 1040.

Important Considerations When Reporting Options Trading

Keep in mind these essential considerations for accurate and compliant reporting:

- Basis and Holding Period: Carefully track your cost basis (the original price you paid for the option) and holding period to classify options as short-term or long-term.

- Wash Sale Rules: Be aware of the wash sale rules, which prevent you from deducting losses if you repurchase a similar security within 30 days of selling it at a loss, as this may be considered a tax avoidance strategy.

- Documentation: Maintain thorough records of all your options trades, including dates, purchase and sale prices, premiums, and other relevant details.

Professional Guidance: When to Seek Help

While this guide provides a comprehensive overview, the intricacies of options tax reporting can be daunting for many individuals. If you find yourself overwhelmed or uncertain about your tax obligations, don’t hesitate to consult a qualified tax professional.

Tax professionals can provide personalized advice, help you optimize your tax strategy, and ensure you report your options trading activities accurately and efficiently.

How To Report Options Trading On Tax Return

Beyond the Basics: Additional Notes on Options Tax Reporting

While the core principles outlined above provide a solid foundation, the world of options tax reporting involves nuances specific to various trading strategies and scenarios. It’s essential to stay informed about the latest regulations and rules, and to seek expert guidance when necessary.

Remember, accuracy and thorough documentation are paramount. By carefully navigating the intricacies of options tax reporting and seeking professional assistance when needed, you can confidently manage your financial obligations and maximize your tax benefits.