In the realm of finance, the concept of option trading has gained immense popularity due to its potential to generate significant rewards. However, one crucial aspect that often goes unnoticed is the importance of time value in option pricing. Understanding and harnessing the power of time value can unlock a world of opportunities for savvy traders. In this comprehensive guide, we will delve into the intricate world of option trading time value, equipping you with the knowledge and insights necessary to maximize your trading strategy.

Image: johnnyafrica.com

Deciphering the Essence of Time Value in Option Trading

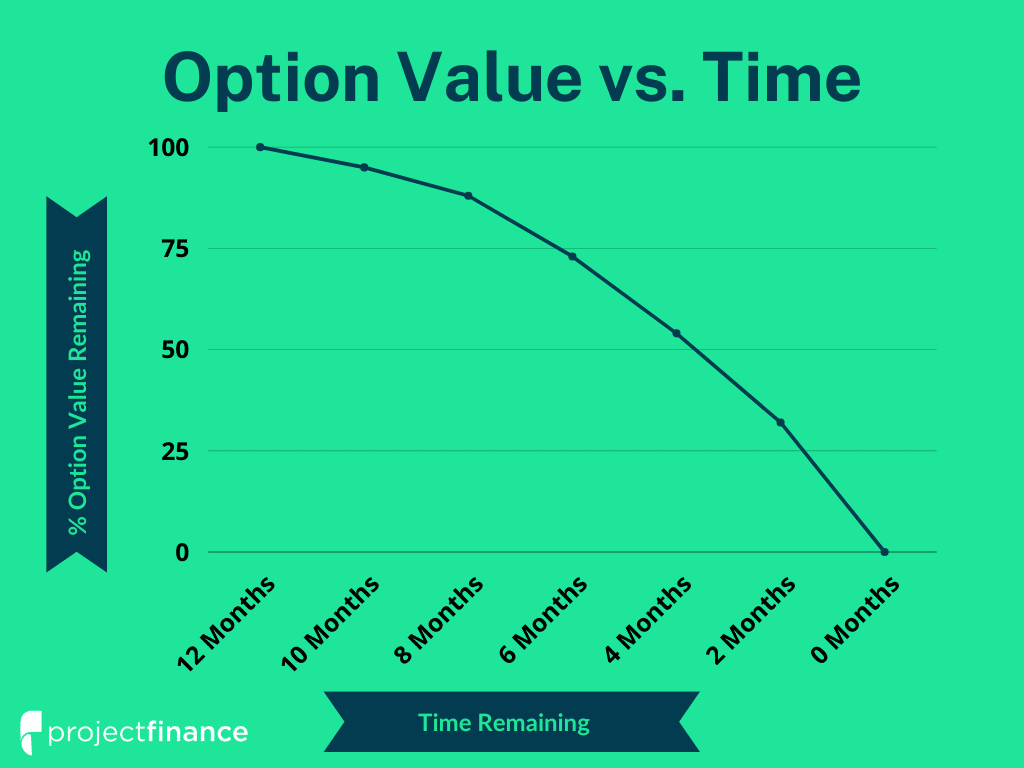

Time value refers to the intrinsic value of an option contract that stems from the remaining time until its expiration date. Unlike intrinsic value, which represents the difference between the underlying asset’s price and the strike price, time value encompasses the premium paid for the option’s potential future appreciation. The time value of an option diminishes as the expiration date approaches, making it a crucial factor in determining the option’s overall value.

Exploring the Factors Influencing Option Time Value

Various factors influence the time value of an option contract, including:

-

Time to Expiration: The longer the time remaining until expiration, the greater the time value.

-

Volatility: Higher volatility in the underlying asset leads to higher time value, as the option has a greater chance of expiring in the money.

-

Interest Rates: Increasing interest rates tend to increase time value, particularly for long-term options.

-

Dividend Yield: Stocks that pay dividends have lower time value due to the reduced potential for appreciation.

Leveraging Time Value to Enhance Trading Strategies

Understanding time value empowers traders to make informed decisions and develop effective trading strategies. Here are a few tips for utilizing time value to your advantage:

-

Trading Long Options with Time Value: Buying long-term options with significant time value enables traders to benefit from the potential increase in the underlying asset’s price while capturing the premium paid for time value.

-

Selling Short Options with Diminishing Time Value: Selling options that are short-term and nearing expiration can yield substantial gains as the time value decays rapidly.

-

Monitoring Time Decay and Adjusting Positions: Keeping a close eye on the time decay of option contracts is crucial. Traders should consider adjusting their positions or exiting trades as the expiration date approaches to minimize potential losses.

Image: www.projectfinance.com

Delving into Real-World Examples to Reinforce Understanding

To illustrate the practical implications of time value in option trading, let’s consider the following scenarios:

-

Example 1: An investor purchases a one-year call option on a stock that is currently trading at $50 with a strike price of $55. The option has a time value of $2. As time passes and the expiration date draws near, the time value will gradually decrease.

-

Example 2: A trader sells a three-month put option on a stock that is trading at $100 with a strike price of $95. The option has a time value of $1. As the expiration date approaches, the time value will decline rapidly, potentially leading to a profitable trade for the trader.

Option Trading Time Value

Conclusion: Empowering Traders with the Knowledge of Time Value

In the vast landscape of option trading, a thorough understanding of time value is paramount for achieving consistent success. By leveraging the insights provided in this comprehensive guide, traders can make informed decisions, adjust their strategies, and maximize their potential returns. Remember, time is of the essence in option trading, and grasping its value will propel you towards financial prosperity. Continue to seek knowledge, refine your skills, and embrace the transformative power of time value in your trading endeavors.