Options trading is a versatile investment strategy that involves the buying and selling of option contracts. These contracts give traders the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a specified price on a specified date. To enhance trading flexibility and efficiency, options traders can utilize a valuable financial tool known as an options trading credit. This article delves into the world of options trading credit, shedding light on its definition, advantages, mechanics, and practical applications.

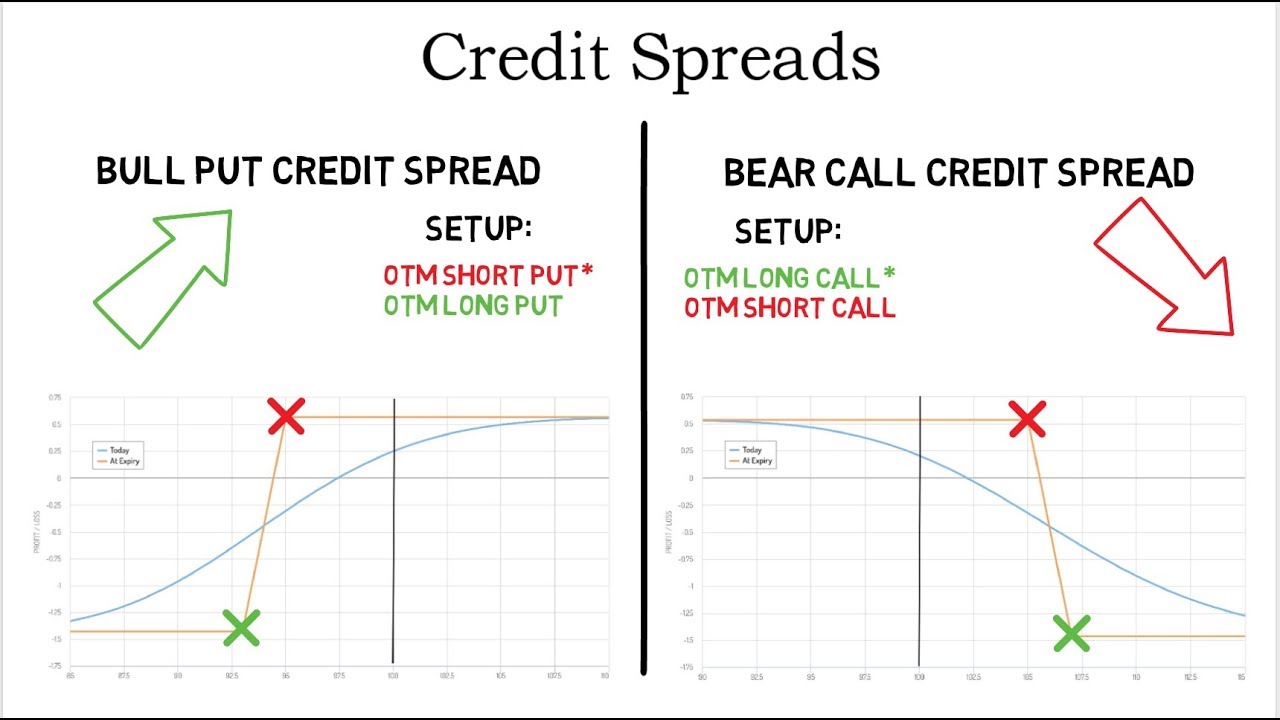

Image: knowmadicresearch.com

Defining Options Trading Credit

Options trading credit refers to a temporary margin extension granted by a brokerage firm to option traders, enabling them to increase their trading power beyond their brokerage account balance. This credit allows traders to purchase additional option contracts while their existing options positions pending settlement or closure. The credit is generally a loan or line of credit applied against the trader’s brokerage account, providing them with the capital to sustain or expand their trading activities.

Advantages of Options Trading Credit

Options trading credit offers several potential advantages for traders:

- Increased Trading Power: Credit provides traders with amplified buying power, allowing them to acquire larger volumes of options contracts and potentially enhance their trading performance.

- Enhanced Returns: By accessing more capital, traders can seize profitable trading opportunities, potentially leading to increased returns on investment.

- Reduced Risk: Access to a larger pool of capital can provide traders with a buffer against losses, as they have the resources to adjust or hedge their positions in dynamic market conditions.

Mechanics of Options Trading Credit

Options trading credit is typically provided by brokerage firms and regulated by the relevant financial regulatory authorities. The amount of credit extended to traders varies depending on factors such as the trader’s account balance, trading history, and the firm’s risk assessment.

- Interest Charges: Traded on margin, options trading credit may incur interest charges, similar to loans.

- Settlement: Upon settlement or closure of options positions, the trader’s brokerage account is typically charged (or credited) with the difference between the total credit used and the actual cost (or proceeds) of the executed trades.

- Regular Review: Brokers regularly review the trader’s account standing and may request additional collateral or margin.

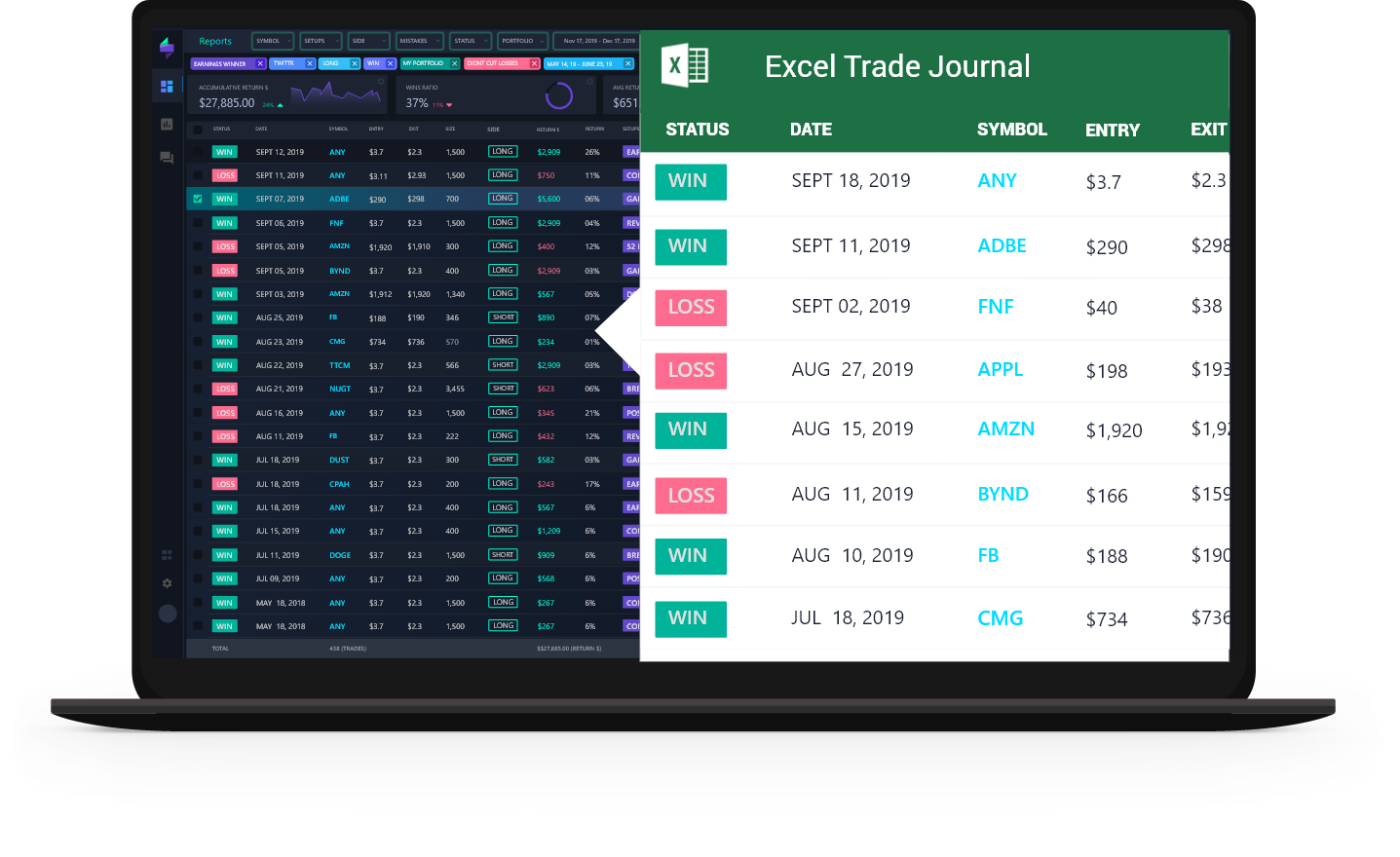

Image: tradersync.com

Practical Applications

Options trading credit can be used in various practical scenarios:

- Covering Margin Calls: Traded on margin, traders may receive margin calls if their portfolio value falls. Options trading credit can serve as a temporary cushion to meet margin requirements and avoid liquidation.

- Strategic Positioning: Traders can use credit to adjust their portfolio, acquire new positions, and fine-tune their trades, maximizing market opportunities.

- Temporary Liquidity: Options trading credit offers short-term liquidity, allowing traders to finance their trading activities without liquidating core investments.

What Are Options Trading Credit

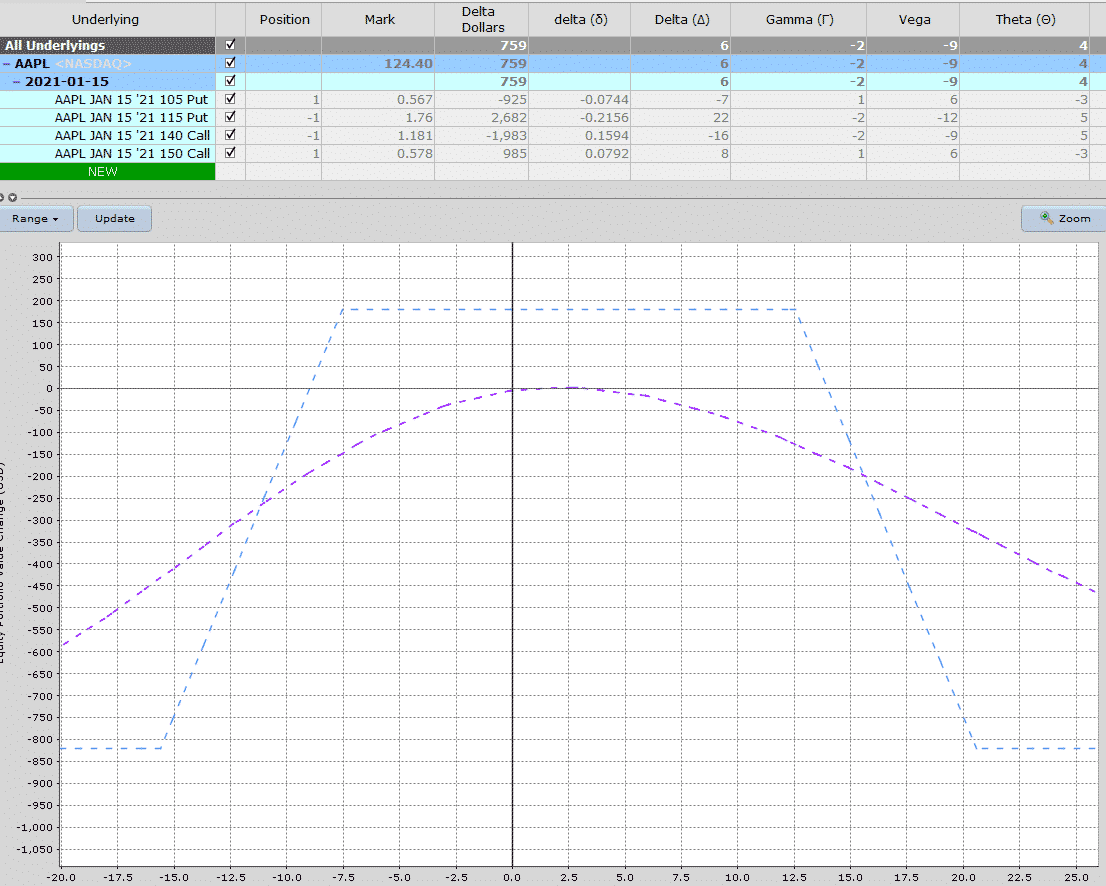

Image: optionstradingiq.com

Conclusion

Options trading credit provides options traders with increased flexibility, enhanced returns potential, and risk management benefits. It’s a powerful tool that can empower traders to optimize their trading stratégies. However, it’s crucial to utilize options trading credit responsibly, understanding its risks and limitations. By leveraging options trading credit judiciously, traders can navigate the complexities of market fluctuations and augment their trading performance.

We encourage you to consult reputable sources, seek professional financial advice, and thoroughly research before employing options trading credit. By exploring this financial tool, traders can unlock a world of opportunities and elevate their trading experience.