Options trading can be a complex and daunting undertaking, but with the right knowledge and strategies, it can be a powerful tool for generating income and managing risk. One of the most popular and versatile options strategies is the credit spread, which involves selling an option while simultaneously buying another option with a different strike price. Credit spreads can be used for a variety of purposes, including generating income, speculating on volatility, and hedging risk.

Image: www.reddit.com

In this article, we will dive deep into the world of credit spreads, exploring their definition, history, and practical applications. We will also discuss the latest trends and developments in credit spread trading and provide tips and expert advice to help you master this powerful strategy.

What is a Credit Spread?

A credit spread is a multi-leg options strategy that involves selling one option while simultaneously buying another option with a different strike price. The strategy is typically implemented by selling an out-of-the-money (OTM) option and buying a further OTM option, both with the same expiration date. The net premium received from selling the OTM option is used to finance the purchase of the further OTM option.

The profit potential for a credit spread is limited to the net premium received at the sale of the options. The maximum loss is limited to the difference between the strike prices of the two options, plus the net premium received.

Types of Credit Spreads

There are two main types of credit spreads:

- Bull call credit spread: This spread is created by selling an OTM call option and buying a further OTM call option.

- Bear put credit spread: This spread is created by selling an OTM put option and buying a further OTM put option.

The type of credit spread used will depend on the trader’s market outlook and risk tolerance.

Using Credit Spreads

Credit spreads can be used for a variety of purposes, including:

- Generating income: Credit spreads can generate income by selling premium for the OTM option. This strategy is typically used in a neutral market environment.

- Speculating on volatility: Credit spreads can be used to speculate on volatility by selling premium when volatility is low and buying premium when volatility is high. This strategy can be used in both bullish and bearish markets.

- Hedging risk: Credit spreads can be used to hedge risk by offsetting the potential losses from one position with the potential gains from another position. This strategy is typically used to reduce the overall risk of a portfolio.

Image: www.youtube.com

Tips for Trading Credit Spreads

Here are a few tips for trading credit spreads:

- Understand the risks: Before trading credit spreads, it is important to understand the risks involved. The maximum loss for a credit spread is limited to the difference between the strike prices of the two options, plus the net premium received.

- Choose the right strike prices: The strike prices of the options used in a credit spread will have a significant impact on the risk and reward potential of the trade. It is important to choose strike prices that are appropriate for your trading goals and risk tolerance.

- Manage your risk: Credit spreads can be a powerful tool for managing risk, but it is important to use them wisely. It is important to set stop-loss orders to limit your losses and to monitor your positions closely.

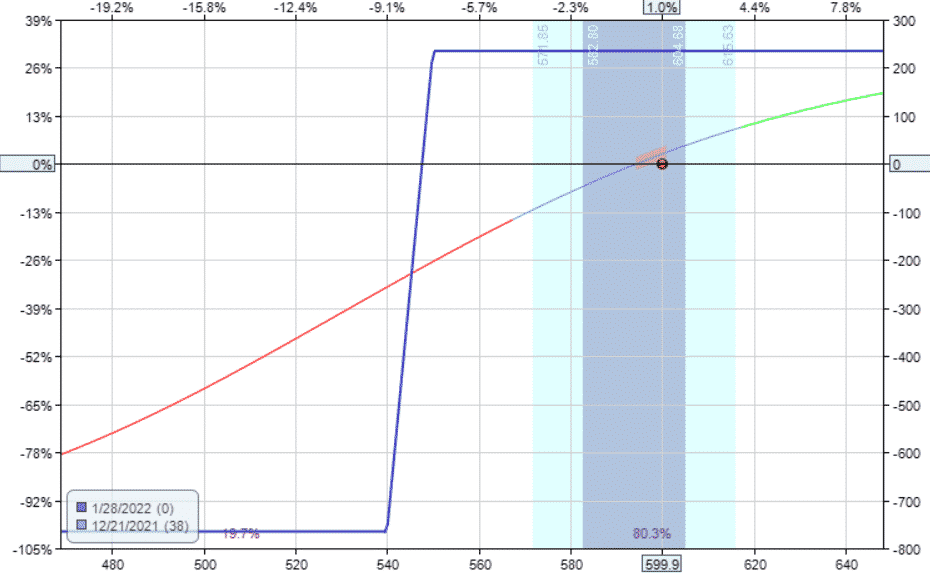

Options Trading Credit Spread

Image: optionstradingiq.com

Conclusion

Credit spreads are a versatile and powerful options strategy that can be used for a variety of purposes, including generating income, speculating on volatility, and hedging risk. By understanding the mechanics of credit spreads and the risks involved, you can use this strategy to enhance your trading profitability.

Are you interested in learning more about credit spreads? If so, I encourage you to do some additional research on the topic. There are many resources available online and in libraries that can help you to get started.