In the fast-paced world of options trading, embracing the strategic nuances of credit spreads on weekly options can unlock doors to enhanced profitability.

Image: optionstradingiq.com

My journey into the realm of weekly credit spreads began with an intriguing trade that capsized conventional wisdom. As I delved deeper into this specialized strategy, I discovered its immense potential for generating income while managing risk.

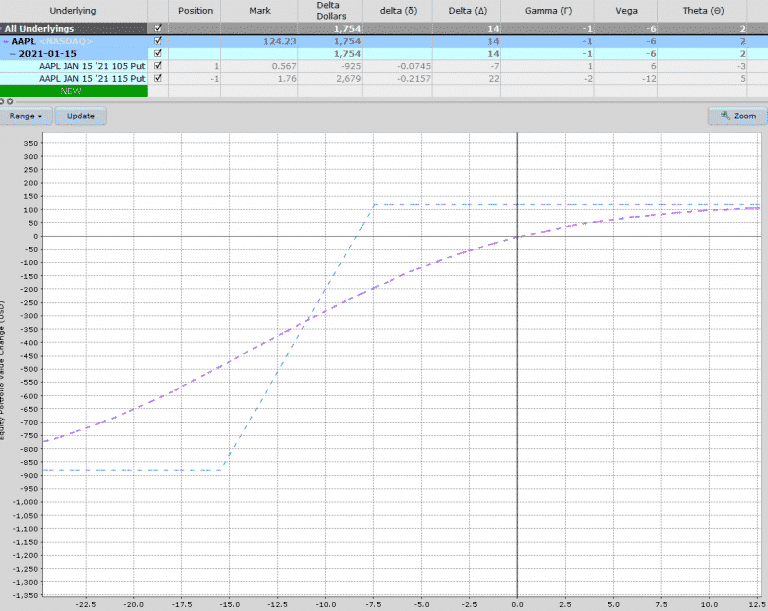

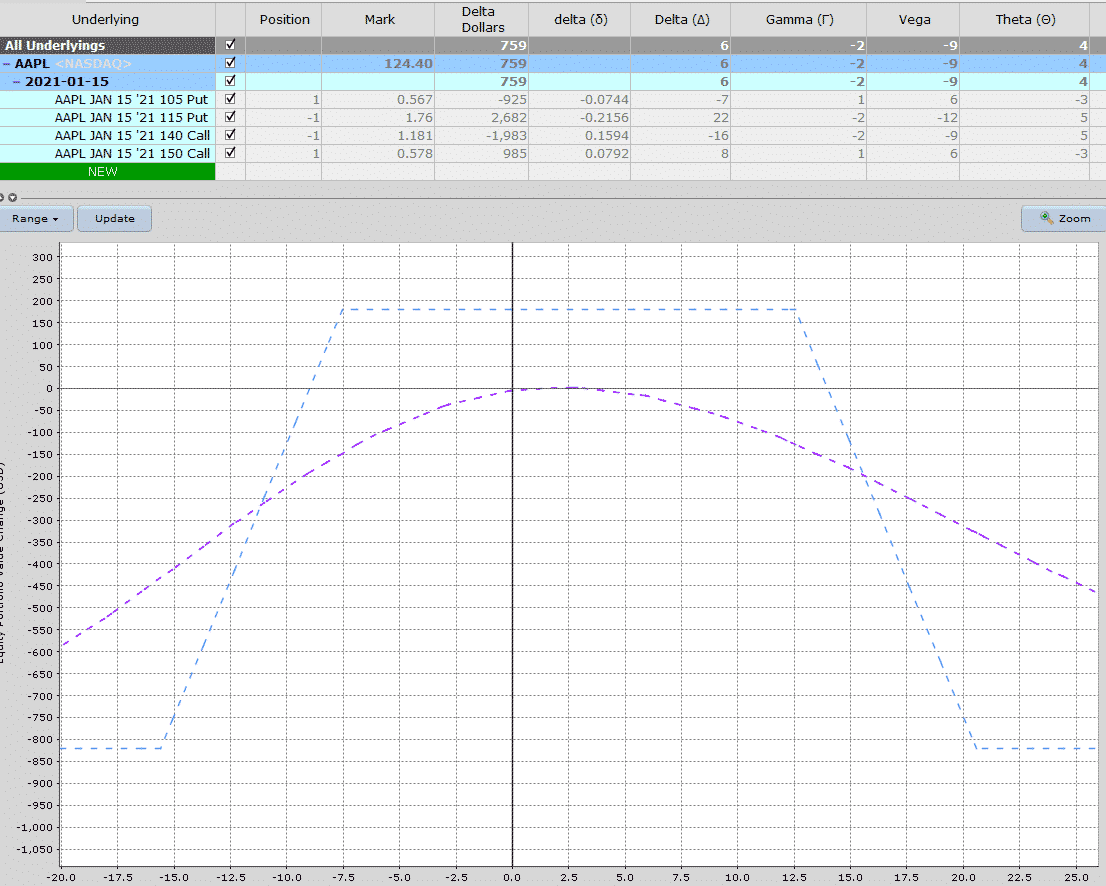

Understanding Credit Spreads on Weekly Options

A credit spread involves selling an option (bear spread) or buying an option (bull spread) at a higher price while simultaneously buying or selling another option of the same underlying asset at a lower price.

Weekly options, which expire every Friday, provide an amplified element of time decay compared to their monthly counterparts. This time decay becomes a crucial factor in credit spread strategies, as it diminishes the option’s value as it approaches expiration.

Benefits of Trading Credit Spreads on Weekly Options

Enhanced Income Generation: Credit spreads create a limited profit potential while offering reduced risk compared to naked options trading. By capturing the premium difference between the options sold and bought, traders can potentially generate income regardless of the underlying asset’s price movements.

Time Advantage: Weekly options’ shorter lifespan concentrates time decay, allowing traders to exploit the rapid loss of value as expiration approaches. This can be leveraged to maximize profit in a shorter period.

Tips and Expert Advice for Successful Trading

Execute Prudent Strategy Selection: Choose credit spreads with a narrow width and sufficient liquidity to mitigate risk while still capturing meaningful premiums.

Meticulous Risk Management: Set clear profit targets and stop-loss levels to protect against adverse market movements. Carefully calculate the potential profit and loss before executing any trade.

Leverage Market News and Data: Keep abreast of economic announcements and market trends that may impact the underlying asset’s price. Incorporate this information into your trading decisions to enhance accuracy.

Image: www.youtube.com

FAQs on Weekly Credit Spreads

Q: What is the ideal market condition for trading credit spreads?

A: Credit spreads perform optimally in markets with defined trends and moderate volatility. Avoid trading in highly volatile or sideways-trending markets.

Q: How should I determine the optimal width for a credit spread?

A: The spread’s width should be tailored to your risk tolerance and profit target. Wider spreads offer higher potential returns but also increase risk, while narrower spreads provide lower returns with reduced risk.

Trading Credit Spreads On Weekly Options

Image: optionstradingiq.com

Conclusion

Trading credit spreads on weekly options presents a formidable opportunity for both novice and seasoned traders to earn income and enhance their portfolio performance. By embracing the intricate strategies outlined in this article, you can navigate the nuances of this specialized trading arena and reap its potential rewards.

Are you ready to delve into the captivating world of weekly credit spreads and unlock its profit potential? Share your thoughts and experiences in the comments section below.