Introduction

Embark on a captivating journey into the dynamic realm of trading weekly options credit spreads. This innovative strategy grants traders the potential to enhance their returns while managing risks. Whether you’re a seasoned trader or just starting your options trading adventure, this comprehensive guide will equip you with the knowledge and insights necessary to navigate this exciting market segment.

Image: optionstradingiq.com

Understanding Weekly Options Credit Spreads

A weekly options credit spread involves selling an out-of-the-money (OTM) call option (or put option) while simultaneously buying another OTM call option (or put option) further away from the strike price. The difference between the premiums collected from selling the first option and the premiums paid to buy the second option constitutes the net premium or credit received by the trader.

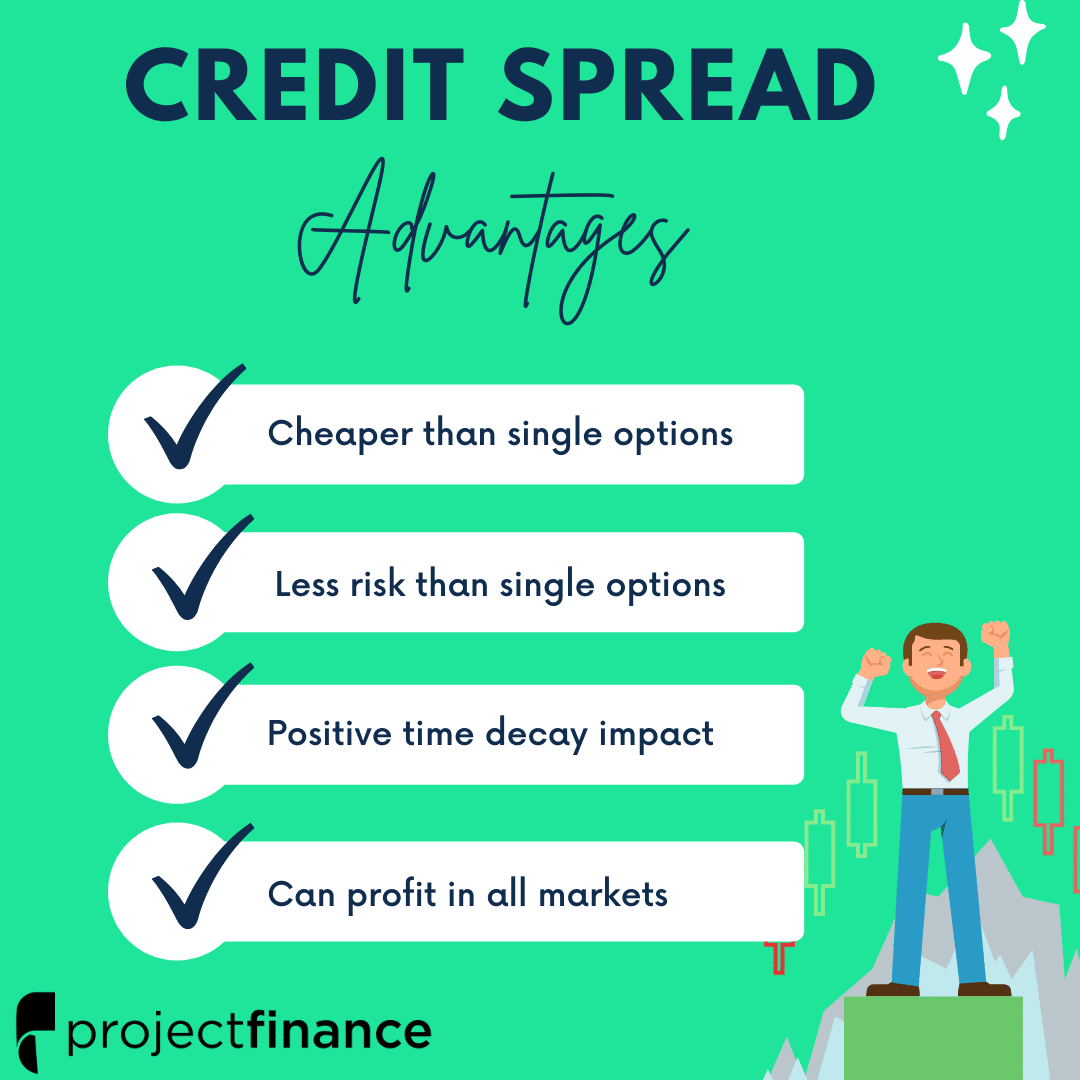

Advantages of Trading Weekly Options Credit Spreads

- Reduced Margin Requirements: Weekly options have lower margin requirements compared to monthly options, minimizing the capital needed to initiate trades.

- Accelerated Returns: The short time-to-expiration of weekly options allows traders to realize gains or losses more quickly.

- Enhanced Volatility: Weekly options often exhibit higher volatility due to their shorter timeframes, offering opportunities for traders to exploit market fluctuations.

- Risk Management: Credit spreads inherently limit the potential loss to the premium received. By selling the OTM option, traders define and cap their downside risk.

Mechanics of Weekly Options Credit Spreads

Consider the following example:

- Sell one weekly AMD call option with a strike price of $105 for $0.50

- Buy one weekly AMD call option with a strike price of $110 for $0.25

At expiration, the net premium collected is $0.25. The maximum profit potential is the net premium collected, while the maximum loss is unlimited.

Image: www.projectfinance.com

Factors to Consider When Trading Weekly Options Credit Spreads

- Volatility: Higher volatility increases option premiums, benefiting traders selling credit spreads.

- Time Decay: Options lose value as they approach expiration, making it crucial to close positions before significant time decay occurs.

- Implied Volatility (IV): Higher IV indicates the market’s perception of higher volatility, leading to increased option premiums.

- Market Direction: Successful credit spread trades rely on the underlying staying within a specific price range.

- Risk Management: Determine the potential risk and reward before entering into a trade, and adjust positions accordingly.

Strategies for Trading Weekly Options Credit Spreads

- Bull Call Spread: Sell a lower-strike call option and buy a higher-strike call option. Profit if the underlying rises moderately.

- Bear Call Spread: Sell a higher-strike call option and buy a lower-strike call option. Profit if the underlying declines or stays below a certain level.

- Bull Put Spread: Sell a higher-strike put option and buy a lower-strike put option. Profit if the underlying rises moderately.

- Bear Put Spread: Sell a lower-strike put option and buy a higher-strike put option. Profit if the underlying declines or stays above a certain level.

Trading Weekly Options Credit Spreads

Image: www.youtube.com

Conclusion

Trading weekly options credit spreads empowers traders with a versatile tool to generate income and manage risks. By understanding the mechanics, factors to consider, and implementing effective strategies, traders can enhance their profitability in this exciting segment of the options market. Remember, responsible trading requires thorough research, sound risk management, and a commitment to continuous learning.