Introduction

Are you ready to take your futures trading to the next level? Options on futures contracts provide the versatility and leverage to enhance your strategies and potentially increase your profits. This comprehensive guide will empower you with the knowledge and techniques necessary to navigate the world of options on futures contracts, unlocking a vast array of trading opportunities.

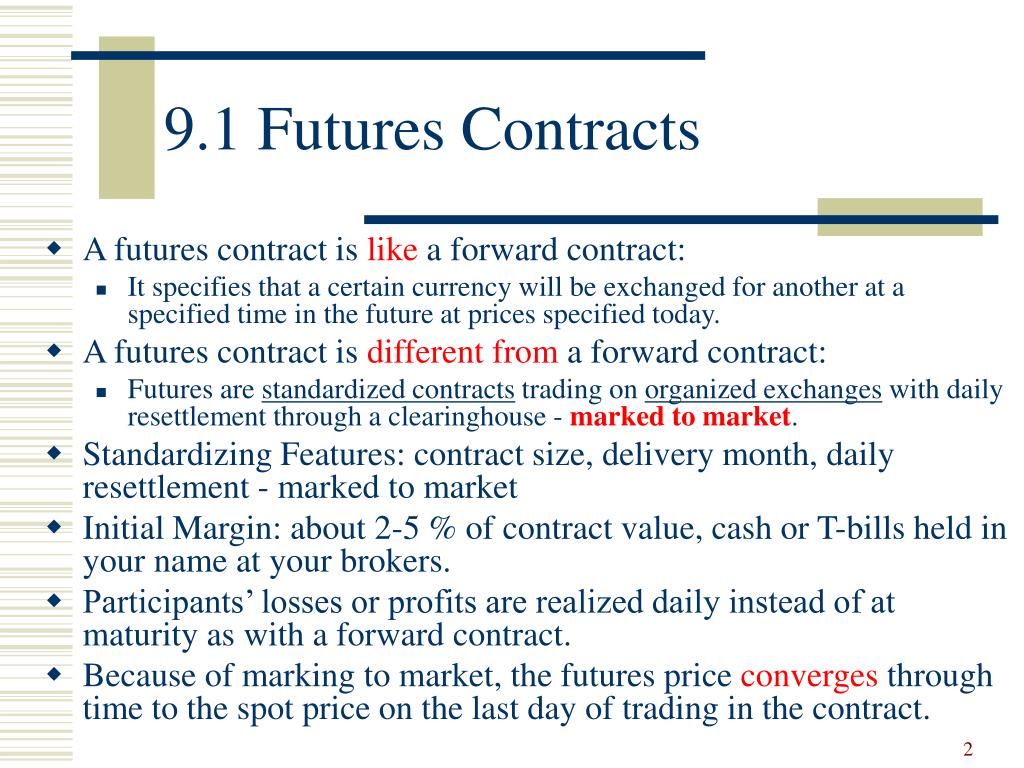

Image: www.slideserve.com

The Basics of Options on Futures

An option on futures is a contract that grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) a futures contract at a predetermined price (strike price) on or before a specified date (expiration date). Unlike futures contracts, which entail an obligation to buy or sell, options provide flexibility and allow traders to profit from price movements without the associated risks.

Advantages of Options on Futures

- Leverage: Options offer significant leverage, amplifying potential returns compared to trading futures directly.

- Risk Management: They provide a cost-effective way to hedge against price risks and protect existing positions.

- Versatility: Options can be used in various strategies, including speculation, income generation, and position protection.

Understanding Options Terminology

- Premium: The price paid by the buyer to acquire the option.

- Strike Price: The agreed-upon price at which the underlying futures contract can be bought (call option) or sold (put option).

- Expiration Date: The date on which the option contract expires.

- Call Option: Grants the buyer the right to buy the underlying futures contract.

- Put Option: Grants the buyer the right to sell the underlying futures contract.

Image: learn.bybit.com

Types of Option Trading Strategies

1. Call Option Strategies

- Long Call: Purchase a call option with the expectation of an upward price movement.

- Short Call: Sell a call option to collect premium, but face the risk of unlimited losses if the price rises significantly.

2. Put Option Strategies

- Long Put: Purchase a put option with the expectation of a downward price movement.

- Short Put: Sell a put option to collect premium, but face the risk of unlimited losses if the price falls substantially.

3. Combination Strategies

- Straddle: Simultaneous purchase of both a call and a put option with the same strike price and expiration date.

- Strangle: Purchase or sell both a call and a put option, but with different strike prices.

Risk Management in Options Trading

- Delta Neutral: Adjust your portfolio to reduce your exposure to price fluctuations.

- Hedging: Use options to protect your existing futures positions from adverse price movements.

- Stop Loss Orders: Establish pre-set exit points to limit potential losses.

Options On Futures Contracts A Trading Strategy Guide

Image: fintrakk.com

Conclusion

Options on futures contracts offer a powerful tool for traders seeking to enhance their futures trading. By understanding the basics, applying the strategies discussed, and managing risk effectively, you can unlock the potential of options trading and elevate your profitability in the dynamic futures market. Remember to conduct thorough research, trade with caution, and always adhere to sound risk management practices.