Understanding the Stock vs Option Spectrum: A Distinctive Gamble in the Financial Arena

Investors seeking lucrative opportunities often find themselves grappling with the decision of venturing into the realm of stocks or options. While both avenues offer access to the alluring world of financial markets, they require distinctly different strategies. This article delves into the intricate tapestry of stock and option trading, elucidating their inherent characteristics, showcasing their pros and cons, and empowering investors with the knowledge to forge prudent choices that align with their financial goals and risk appetite.

Image: www.quora.com

Breaking Down the Essence of Stock Trading: An Ownership Stake in Corporate Fortunes

Stock trading, an age-old pursuit in the financial realm, revolves around the purchase and sale of company shares, also known as stocks. By acquiring stocks, investors assume the mantle of partial ownership in the issuing corporation. This ownership stake entitles them to a proportionate share of the company’s profits, commonly distributed in the form of dividends. Additionally, stock ownership offers the potential for capital appreciation, as the value of the stock may increase over time, resulting in a lucrative return on investment.

Pros of Stock Trading: A Pathway to Potential Profits and Ownership Perks

- Ownership and Dividends: Stocks represent a form of ownership in a company, bestowing upon their holders the right to partake in its profits through dividends.

- Capital Appreciation: The value of stocks can appreciate over time, potentially leading to handsome capital gains for investors.

- Liquidity: Stocks are traded on regulated exchanges, ensuring a high degree of liquidity and enabling investors to enter or exit positions with relative ease.

Cons of Stock Trading: Navigating the Ebb and Flow of Market Volatility

- Market Volatility: Stock prices are subject to market fluctuations, which can lead to substantial losses if the market takes an unfavorable turn.

- Limited Upside: Unlike options, the potential upside of stock investments is limited, as the stock price cannot rise beyond the company’s intrinsic value.

Image: ca.rbcwealthmanagement.com

Options Trading: A Derivative Gamble with Precise Profit Targets – Delving into the Realm of Calculated Risks

Options trading, a sophisticated financial instrument, operates in a distinct realm from stock trading. Options confer upon the holder the right, but not the obligation, to buy or sell an underlying asset (typically a stock) at a predetermined price within a specific timeframe. Options confer a degree of leverage, allowing investors to potentially magnify their returns with a relatively modest investment.

Options Trading Benefits: Navigating Risk and Leveraging Market Moves

- Limited Risk: Options offer limited risk, as the most an investor can lose is the premium paid for the option contract.

- Leverage: Options provide leverage, enabling investors to control a substantial number of shares with a relatively small investment.

- Flexibility: Options offer a range of strategies to cater to varying market scenarios and investor preferences.

Drawbacks of Options Trading: Treading the Delicate Balance of Volatility and Time Decay

- Time Decay: The value of options erodes over time, even if the underlying asset’s price remains unchanged.

- Complexity: Options trading can be complex, requiring a thorough understanding of options pricing and market dynamics.

- Liquidity: Options markets may be less liquid than stock markets, making it challenging to enter or exit positions at desired prices.

Comparing Stocks vs Options: Unveiling the Underlying Investment Philosophies

To discern which investment vehicle aligns better with their financial objectives, investors must scrutinize the fundamental differences between stocks and options:

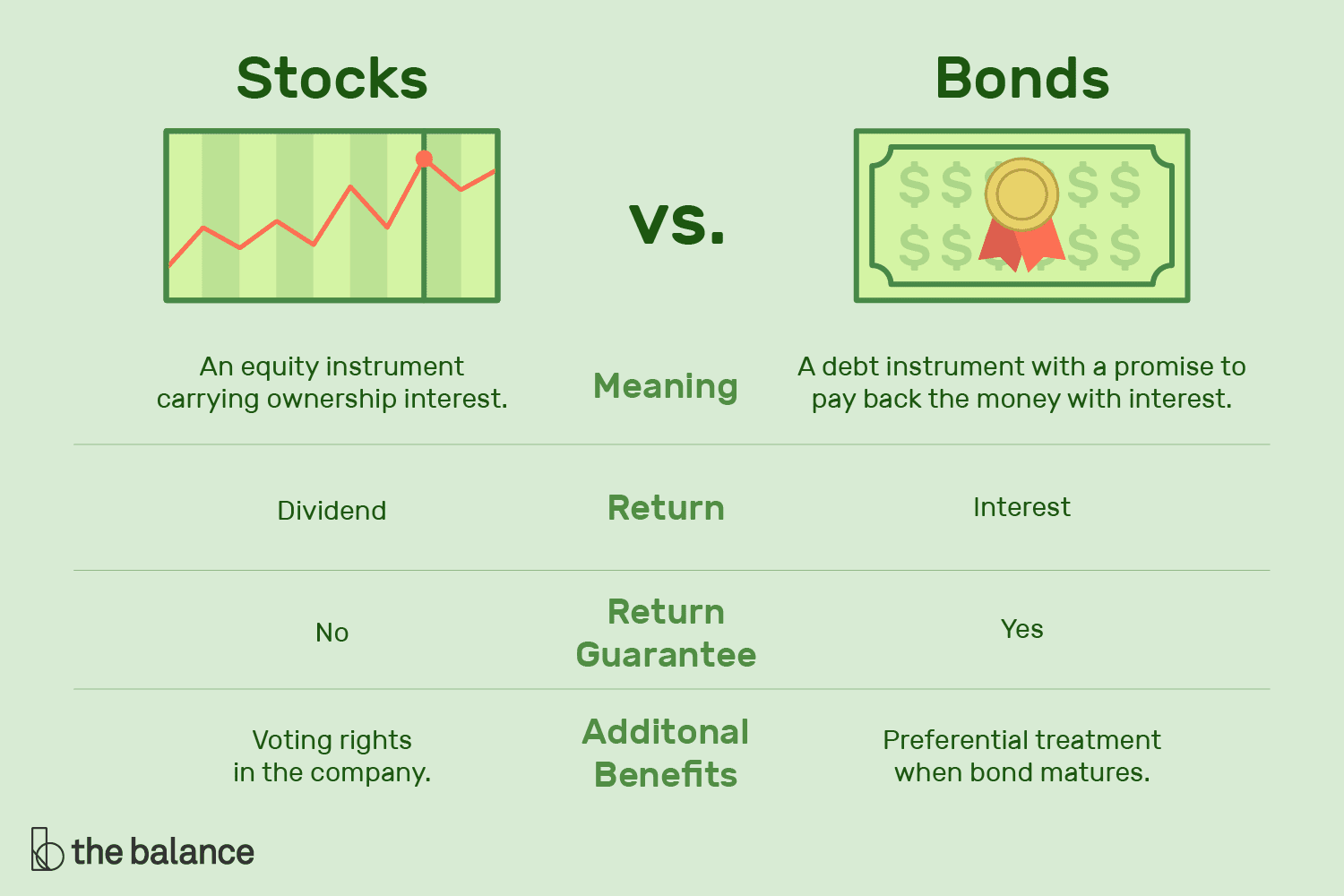

- Ownership: Stocks represent ownership in a company, while options confer a right to buy or sell an underlying asset.

- Return Potential: Stocks offer unlimited upside potential but carry the risk of substantial losses. Options offer limited upside potential but also limit the downside risk.

- Risk Profile: Stocks are generally considered less risky than options due to their underlying ownership nature. Options, however, offer the potential for higher returns with commensurate risk.

- Investment Horizon: Stocks are suitable for both long-term and short-term investments. Options, on the other hand, are typically employed for short-term to medium-term trading strategies.

Difference Between Trading Stocks And Options

https://youtube.com/watch?v=L0SNIE2TcFg

Making the Optimal Choice: Aligning Investment Strategies with Risk Appetite and Financial Objectives

The choice between stocks and options boils down to aligning an investor’s risk tolerance, investment horizon, and financial goals with the inherent characteristics of each instrument. Investors with a higher risk appetite seeking short-term gains may find options trading more alluring. Conversely, investors with a lower risk tolerance and a long-term investment horizon may find solace in the relative stability of stock trading. Ultimately, the ideal investment vehicle hinges upon the individual investor’s unique circumstances and financial objectives.