In the fast-paced world of finance, the ability to capitalize on market opportunities quickly and efficiently is paramount. Next day options trading presents an enticing avenue to harness short-term price movements and generate potential profits.

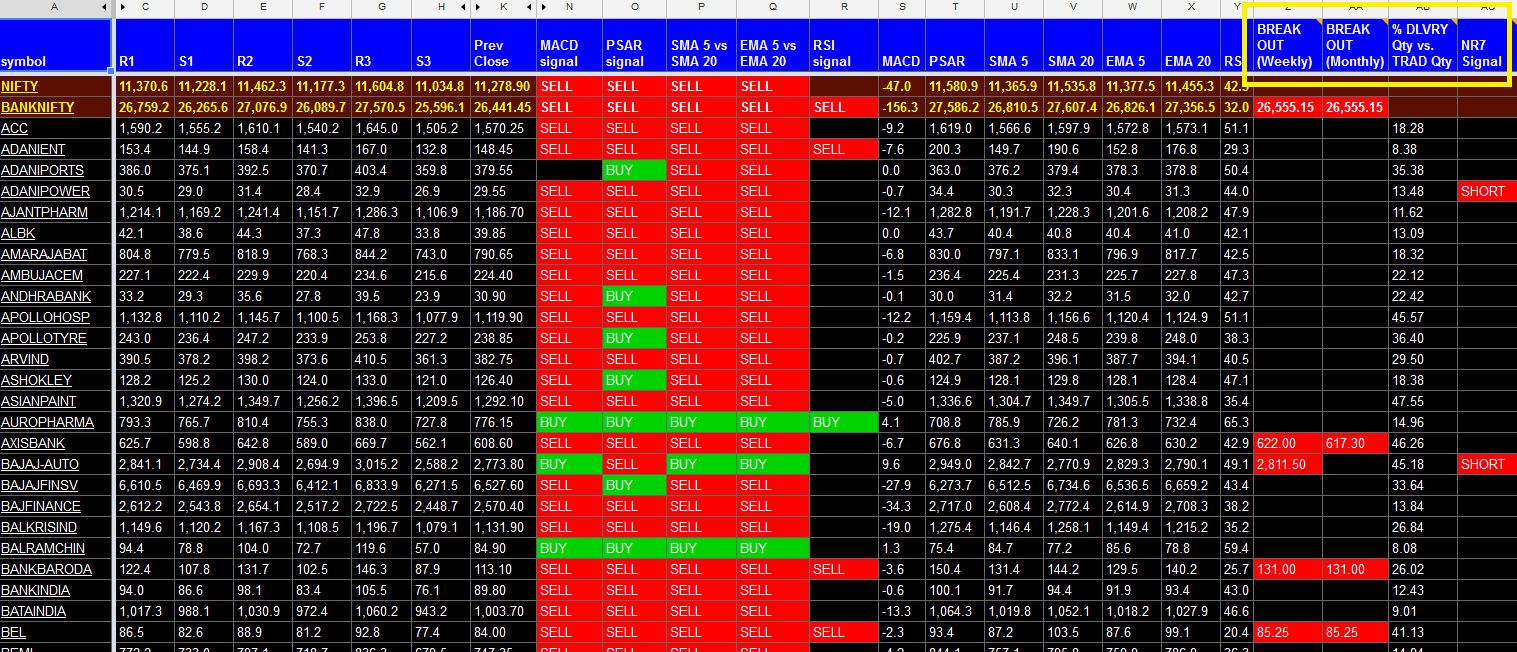

Image: dailytrademantra.com

Understanding Next Day Options Trading

Next day options trading involves buying or selling options contracts based on the projected price movement of the underlying asset on the following trading day. Traders speculate on the direction of the market and aim to profit from price fluctuations within a short time frame.

Options contracts represent the option to buy (call option) or sell (put option) a specified number of shares of an underlying asset at a fixed strike price on or before a predetermined expiration date.

Maximizing Your Next Day Trading Strategy

- Identify Bullish and Bearish Market Trends: Conduct thorough market research to determine potential profitable opportunities. Focus on assets exhibiting strong uptrends or downtrends.

- Set Clear Entry and Exit Points: Establish clear target prices and stop-loss levels to minimize potential losses and maximize gains.

Utilize Technical Analysis: Employ technical indicators such as moving averages, Bollinger Bands, and MACD to identify potential price breakout points and overbought/oversold conditions.

Manage Risk Prudently: Limit your trades to a small portion of your capital to protect against market volatility.

Stay Updated: Monitor news, economic data, and market sentiment to stay abreast of factors that may influence asset prices.

Tips from Experienced Traders:

“Successful next day options trading demands discipline and rapid decision-making. Set clear entry and exit points and avoid emotional trading,” advises John, a seasoned market analyst.

“Embrace volatility as an opportunity to profit. Remember that higher volatility often translates into elevated premiums, enhancing your potential returns,” says Mary, a renowned options trader.

Image: www.analyticssteps.com

FAQs on Next Day Options Trading:

- What is an at-the-money option? An option with a strike price identical to the current market price of the underlying asset.

- What are the risks involved in next day options trading? Significant price fluctuations, volatility, and limited time frames can lead to potential losses.

- How do I start next day options trading? Open an account with an online brokerage that offers options trading services.

Next Day Options Trading

Image: www.pearsoned.co.uk

Conclusion:

Next day options trading offers traders the potential to profit from short-term price movements. However, success in this endeavor hinges on a comprehensive understanding of the markets, sound trading strategies, and a disciplined approach to risk management. By assimilating the insights presented in this article, you can increase your knowledge, enhance your trading skills, and harness the potential of next day options trading.

Are you ready to explore the world of next day options trading and unlock its potential for financial success?