In the realm of finance, time is of the essence. Access to real-time data can be a pivotal advantage, especially in the dynamic world of options trading. Through the seamless integration of options trading data APIs, traders and investors can now gain an unprecedented edge in the markets.

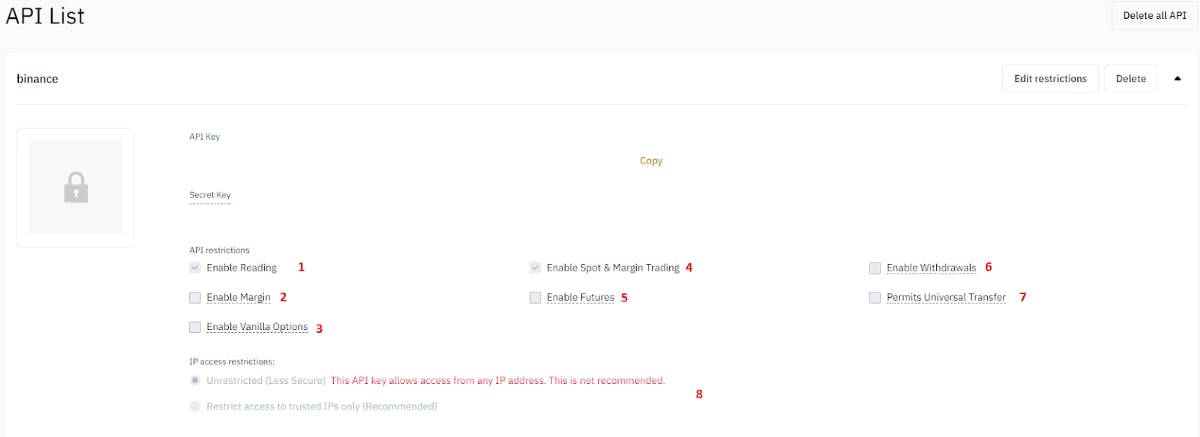

Image: 3commas.io

Harnessing the power of these APIs, we uncover valuable insights and actionable intelligence. The wealth of data they provide empowers traders with comprehensive market data, including historical and implied volatility, option greeks, Greeks at different strikes and expirations, and real-time quotes. With this granular level of information at their fingertips, traders can make informed decisions, optimize their trading strategies, and stay ahead of the market’s ever-changing landscape.

Empowering Traders with Real-Time Insights

Options trading data APIs act as the conduit for streaming real-time market data, instantaneously delivering critical information to traders. These APIs provide up-to-the-second updates on option quotes, bid-ask spreads, and market depth, enabling traders to identify market opportunities and execute trades with greater precision. By tapping into this real-time data stream, traders can stay abreast of market fluctuations, react swiftly to changing dynamics, and seize profitable trading opportunities that might otherwise slip through their grasp.

Streamlining the data acquisition process, options trading data APIs eliminate the need for manual data collection and aggregation. This automation not only saves traders valuable time but also eliminates the potential for human error, ensuring that they always have access to the most accurate and up-to-date market information.

Unlocking a Wealth of Historical Data

The value of options trading data APIs extends beyond real-time data. They also provide a comprehensive historical database, allowing traders to analyze past market behavior and identify patterns and trends that can inform their future trading decisions. By leveraging historical volatility data, traders can gain insights into the market’s risk profile and make informed judgments about the appropriate option strategies for their unique risk tolerance and investment goals.

Furthermore, historical data provides valuable insights for backtesting and optimizing trading strategies. Traders can simulate different trading scenarios using historical data to refine their strategies and identify areas for improvement, thereby enhancing their overall trading performance.

Integrating with Trading Platforms

Seamless integration is paramount for traders to effectively utilize options trading data APIs. Leading API providers offer seamless compatibility with popular trading platforms, enabling traders to integrate the data stream directly into their preferred trading environment. This integration allows traders to overlay market data onto their charts, conduct technical analysis, and execute trades directly from the trading platform, streamlining their workflow and enhancing their trading efficiency.

Not only do options trading data APIs empower traders with real-time data, historical insights, and platform integration, but they also play a pivotal role in facilitating algorithmic trading and automated execution. By providing a programmatic interface, these APIs enable developers to create automated trading algorithms that can analyze market data, identify trading opportunities, and execute trades based on predefined criteria. This advanced level of automation frees up traders from the burden of manual trade execution, allowing them to focus on strategy development and market analysis, thus maximizing their trading potential.

Image: www.tradingview.com

Tips for Utilizing Options Trading Data APIs

To fully harness the power of options trading data APIs, consider the following tips:

- Choose a reputable data provider: Opt for data providers with a proven track record of reliability and accuracy to ensure the integrity of your market data.

- Understand the pricing model: Data subscription plans vary in cost and features. Select a plan that aligns with your trading style and the depth of data you require.

- Familiarize yourself with the API documentation: Thoroughly review the API documentation to ensure proper implementation and utilization of the API.

- Conduct thorough testing: Before relying on the API in live trading, conduct thorough testing in a simulated environment to validate its functionality and accuracy.

- Stay informed about market news and events: Market news and events can significantly impact option prices. Stay abreast of these developments to interpret market movements.

By following these tips and integrating options trading data APIs into their trading workflow, traders can unlock a wealth of benefits and significantly enhance their trading performance.

Frequently Asked Questions

Q: What is the cost of options trading data APIs?

A: The cost of options trading data APIs varies depending on the data provider, the level of data coverage, and the frequency of updates. Some providers offer free or low-cost plans for basic data, while premium plans with more comprehensive data and features may incur higher fees.

Q: How should I choose the right options trading data API for my needs?

A: Consider factors such as the depth and accuracy of data provided, the API’s reliability and up-time, and its compatibility with your trading platform and trading style. Read reviews and compare different providers to find the best fit for your specific requirements.

Q: Are options trading data APIs easy to integrate with my trading platform?

A: Most reputable data providers offer well-documented APIs with clear instructions for integration. Many trading platforms provide built-in support for popular options trading data APIs, making the integration process straightforward.

Q: Can options trading data APIs help me make better trading decisions?

A: Options trading data APIs provide traders with valuable insights into market conditions, option pricing, and historical trends. By analyzing this data, traders can make more informed decisions, identify opportunities, and manage risk more effectively.

Options Trading Data Api

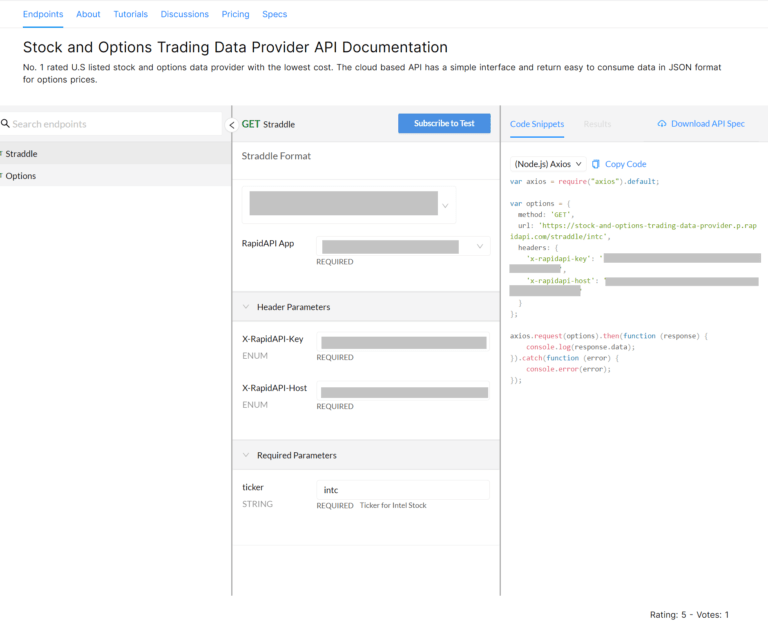

Image: rapidapi.com

Conclusion

Options trading data APIs have emerged as indispensable tools for traders seeking to stay ahead in the fast-paced and dynamic options market. By providing real-time data, historical insights, and automated execution capabilities, these APIs empower traders with a comprehensive understanding of market conditions and the ability to make informed trading decisions. Whether you are a seasoned trader or just starting out in the world of options, incorporating options trading data APIs into your trading workflow can elevate your performance to new heights.

Are you ready to unlock the full potential of your options trading? Embracing the power of options trading data APIs is the key to gaining a competitive edge and achieving your financial goals. Take the next step today and explore the world of options trading data APIs.