Immerse yourself in the captivating world of options trading, where opportunities abound for savvy investors. In this article, we will unravel the intricate tapestry of all types of options trading, empowering you with the knowledge to navigate this dynamic financial landscape like a seasoned professional.

Image: stockstotrade.com

Delving into Option Contracts

Options, the quintessential financial instruments, grant traders the right but not the obligation to buy (call) or sell (put) an underlying asset at a predetermined price, known as the strike price, on or before a specified date, the expiration date.

Types of Options Trading

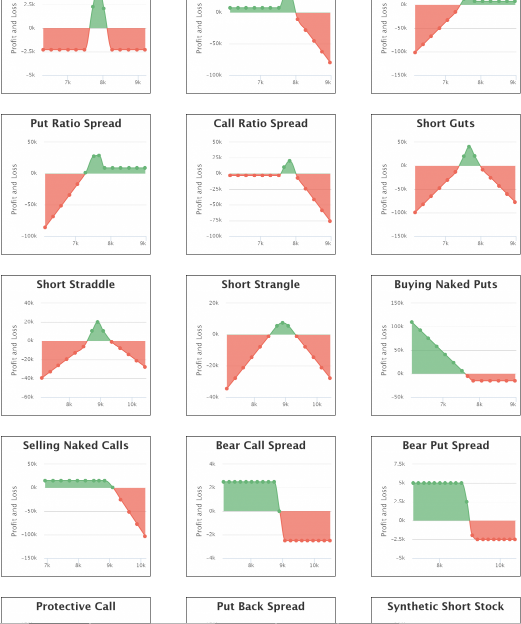

The options market offers a diverse range of strategies tailored to cater to various risk appetites and financial goals. Here are the main types of options trading:

Covered Call Writing

Covered call writing involves selling call options against an underlying asset that you already own. This strategy generates income by collecting premiums but exposes you to the risk of being forced to sell your asset at the strike price if the option is exercised.

Image: 1investing.in

Protective Put Writing

Protective put writing shields against the downside risk associated with holding an underlying asset. By selling put options, you gain income in the form of premiums while limiting your potential losses in case the asset’s price declines.

Bull Calls

Bull calls are employed when you anticipate a rise in the underlying asset’s price. Purchasing a call option grants you the right to buy the asset at the strike price, potentially profiting from its appreciation.

Bear Puts

Bear puts are suitable for investors who foresee a decline in the underlying asset’s price. Owning a put option allows you to sell the asset at the strike price, profiting from its depreciation.

Iron Condor

Iron condors are advanced strategies comprising the simultaneous sale of a bull put spread and a bear call spread with different strike prices. They are designed to profit from low volatility and small price movements.

Latest Trends and Developments in Options Trading

The options market is constantly evolving, driven by macroeconomic factors, technological advancements, and regulatory changes. Here are some notable trends to watch out for:

- Increased Volatility: Geopolitical uncertainty and economic headwinds are elevating volatility levels, making options trading more challenging but also potentially more rewarding.

- Technological Innovations: Fintech platforms and artificial intelligence are revolutionizing options trading by enhancing accessibility, improving execution speeds, and providing sophisticated analytics.

- Regulatory Developments: Governments are implementing new regulations to enhance market transparency and protect investors, impacting options trading practices.

Expert Advice and Tips for Options Traders

Seasoned options traders have accumulated a wealth of wisdom and insights that can help you maximize your trading success.

Here are some tips from the pros:

- Manage Risk: Options trading involves inherent risk, so it’s crucial to understand and manage your risk tolerance. Start small and gradually increase your exposure as you gain experience.

- Research the Underlying: Conduct thorough research on the underlying asset before trading options. Consider its market dynamics, intrinsic value, and historical performance.

- Use Leverage Wisely: Leverage in options trading can amplify both profits and losses. Use it judiciously to enhance potential returns while limiting downside risk.

- Consider Implied Volatility: Implied volatility is a critical factor in options pricing. Understand its relationship with the underlying asset’s price and use it to make informed trading decisions.

- Seek Professional Guidance: If you’re new to options trading or uncertain about your strategies, consult a financial advisor or experienced trader for guidance.

FAQs on Options Trading

Let’s address some common questions that might be on your mind:

- Q: Who is options trading suitable for?

- A: Options trading can be appropriate for experienced traders who understand the potential risks and rewards. It’s not recommended for novice investors.

- Q: What is the difference between call and put options?

- A: Call options give you the right to buy, while put options give you the right to sell the underlying asset at the strike price.

- Q: How do options expire?

- A: Options expire on a predetermined date. If they are not exercised before then, they become worthless.

All Types Of Options Trading

Conclusion

The world of options trading is a fascinating and dynamic one, offering diverse opportunities for investors seeking growth and income generation. By mastering the various types of options trading, staying abreast of industry trends, and heeding the advice of experts, you can navigate this financial landscape with confidence and unlock the full potential of these powerful financial instruments.

Are you ready to embark on your journey into the vibrant realm of options trading? Delve deeper into the intricacies of this captivating financial arena and discover the wealth of possibilities that await.