Options trading, a multifaceted financial domain, has surged in popularity among savvy investors seeking to amplify both returns and risk mitigation. While the venture offers immense possibilities, it also necessitates a profound understanding of the various options trading types. This comprehensive guide will delve into the nuances of different options strategies, empowering you to navigate this dynamic arena with confidence.

Image: www.youtube.com

Deciphering Types of Options Contracts

Options trading encompasses two primary contract types: calls and puts. A call option grants the holder the right but not the obligation to purchase the underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). Conversely, a put option provides the holder the right to sell the underlying asset at the strike price on or before the expiration date.

These contracts are further classified into two categories: in-the-money, exercisable immediately for a profit, and out-of-the-money, exercisable only if the underlying asset’s price moves favorably before expiration. The interplay between these factors creates a vast array of options trading strategies.

Popular Options Trading Strategies

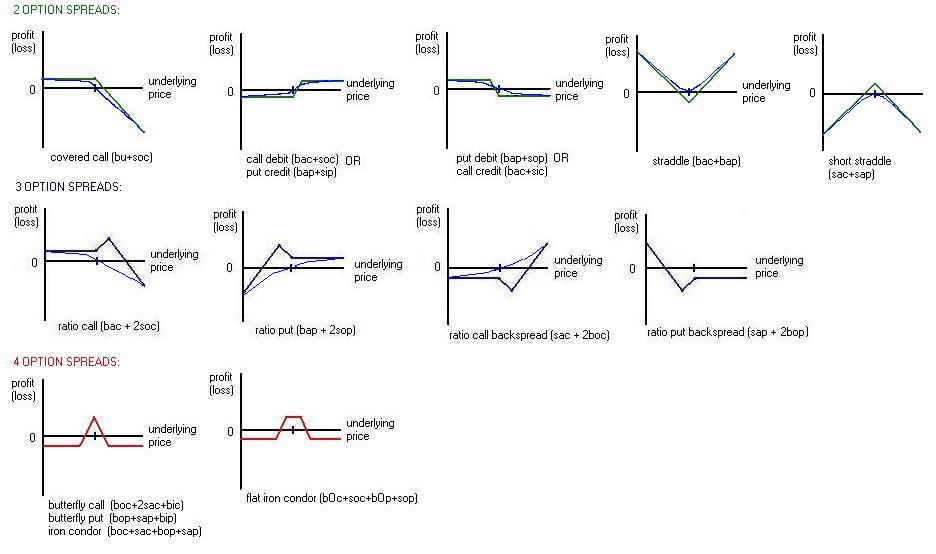

The multitude of options trading strategies can be bewildering. However, mastering a few fundamental approaches can propel you towards success:

- Covered Calls: Selling a call option against an underlying asset you already own, generating additional income while potentially limiting downside risk.

- Protective Puts: Hedging against potential losses by purchasing a put option on an underlying asset you own. This strategy lowers the chances of sustaining significant financial setbacks.

- Bull Call Spreads: Mixing calls of different strike prices to generate higher potential profits while limiting risk, benefiting from a significant upward movement in the underlying asset’s price.

- Iron Condors: Selling both a call and a put spread with different strike prices, benefiting from a relatively stable or range-bound underlying asset’s price.

Tips for Maximizing Options Trading Performance

Beyond understanding options types and strategies, seasoned traders offer invaluable insights:

- Comprehensive Research: Thoroughly research the underlying asset, historical market trends, and potential market drivers to make informed decisions.

- Selecting the Right Strategy: Choose strategies appropriate for your risk tolerance, investment goals, and market conditions.

- Efficient Risk Management: Employ stop-loss orders and position sizing to limit potential losses and protect your portfolio.

- Patience and Discipline: Options trading requires patience and discipline, waiting for favorable market conditions to execute trades.

Image: www.optionstar.com

Common FAQs on Options Trading

Unveiling the complexities of options trading, we address some Frequently Asked Questions:

- What determines the value of an option?

The value of an option is influenced by several factors, including the underlying asset’s price, time to expiration, volatility, and interest rates.

- Can you lose more money than you invest in options trading?

Options trading carries inherent risk. Depending on the strategy employed, it is possible to lose more than the initial investment.

- What is the difference between buying and selling options?

Buying an option gives you the right (not obligation) to exercise it, while selling an option obligates you to perform if it is exercised.

Different Kinds Of Options Trading

Image: stockstotrade.com

Conclusion: Embracing the Options Trading Realm

Mastering the intricacies of options trading requires dedication, research, and risk management. This guide equips you with a foundational understanding of different options types, strategies, and tips. Remember, knowledge is power in the financial realm. Stay curious, explore this dynamic field, and harness its potential in your pursuit of financial success.

Are you ready to venture into the world of options trading with confidence? Let us know in the comments below.