Trading equity options can be an incredibly rewarding endeavor, yielding substantial returns when executed skillfully. However, it’s essential to understand the intricate nuances of this financial instrument before delving into the market. In this comprehensive guide, we will delve into the definition, history, and intricacies of equity option trading, equipping you with the knowledge necessary to navigate this dynamic arena.

Image: www.cmcmarkets.com

Equity options are a type of derivative contract that grants the buyer the right, but not the obligation, to buy or sell an underlying security at a predetermined price on or before a specified expiration date. This flexibility allows investors to speculate on the future price movements of the underlying asset without committing to an immediate purchase or sale.

Meaning and Function of Equity Options

The true essence of equity option trading lies in its versatility. Buyers of call options anticipate an increase in the underlying asset’s value, while those purchasing put options speculate on a decline. This adaptability makes options trading an alluring proposition for both risk-averse and risk-tolerant investors.

Furthermore, options offer investors the ability to hedge against potential losses and leverage their market exposure. Seasoned traders employ options to refine their risk management strategies and amplify their portfolio’s overall performance.

A Historical Perspective on Equity Options

The history of equity option trading dates back to the late 19th century, with the introduction of standardized options contracts on the Chicago Board of Trade (CBOT) in 1973. Since their inception, options have gained immense popularity, evolving into a cornerstone of the global financial markets.

The emergence of electronic trading platforms in the 1990s further revolutionized the options market, increasing liquidity and reducing transaction costs. Today, equity options are traded on exchanges worldwide, with a vast array of underlying assets ranging from stocks and indices to currencies and commodities.

Understanding the Mechanics of Equity Option Trading

Equity options are characterized by several key elements that determine their value and trading behavior. These include:

- Underlying Asset: The security or asset to which the option pertains (e.g., a stock, index, or currency).

- Strike Price: The predetermined price at which the option can be exercised.

- Expiration Date: The date on which the option contract expires.

- Option Type: Call options grant the buyer the right to buy, while put options confer the right to sell the underlying asset.

- Premium: The price paid by the option buyer to acquire the contract.

The value of an equity option is influenced by various factors, including the volatility of the underlying asset, the time remaining until expiration, and the prevailing interest rates. Traders utilize complex mathematical models to determine the fair value of options contracts based on these parameters.

Image: www.mstock.com

Leveraging Equity Options for Strategic Trading

Equity options provide a diverse range of trading strategies to cater to varying risk appetites and market conditions. Among the most common strategies are:

- Long Call: Buying a call option with the expectation of a rise in the underlying asset’s price.

- Long Put: Purchasing a put option when anticipating a decline in the underlying asset’s value.

- Covered Call: Selling (writing) a call option against an existing position in the underlying asset.

- Protective Put: Buying a put option to hedge against potential losses in a long stock position.

Seasoned traders employ a combination of strategies to maximize their trading potential and manage risk.

Expert Advice and Tips for Successful Equity Option Trading

Navigating the dynamic landscape of equity option trading requires a blend of knowledge, experience, and prudent risk management. Here are some invaluable tips from market experts:

- Education is Paramount: Thoroughly comprehend the complexities of options trading before venturing into the market.

- Risk Management is Key: Never risk more than you can afford to lose, and employ stop-loss orders to limit potential losses.

- Monitor Market Trends: Stay abreast of economic and market news that may affect the underlying asset.

- Practice Makes Perfect: Simulate trading strategies using paper trading accounts before risking real capital.

- Seek Professional Guidance: Consult with a qualified financial advisor or broker for personalized advice and support.

Frequently Asked Questions on Equity Option Trading

To enhance your understanding, here are answers to some frequently asked questions regarding equity option trading:

- Q: What is the difference between a call and a put option?

- A: Call options grant the buyer the right to buy the underlying asset, while put options confer the right to sell.

- Q: How do I determine the profitability of an equity option?

- A: The profitability of an option depends on the price movement of the underlying asset and the change in the option’s premium.

- Q: What is the best strategy for equity option trading?

- A: The optimal strategy varies depending on individual risk tolerance, market conditions, and investment goals.

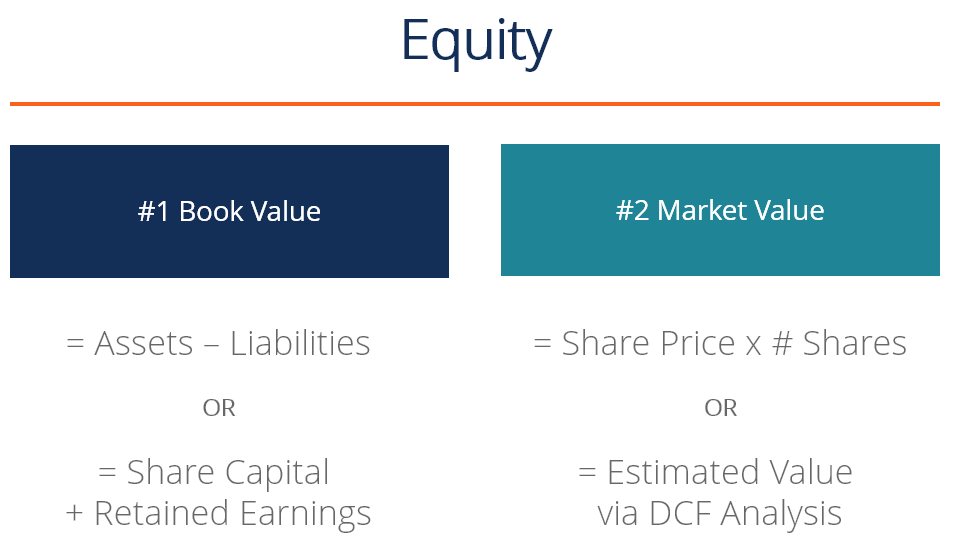

Equity Option Trading Definition

Image: corporatefinanceinstitute.com

Conclusion

Equity option trading offers a sophisticated and versatile tool for investors seeking to navigate the complexities of financial markets. By comprehending the intricacies of option contracts, wielding effective trading strategies, and adhering to prudent risk management principles, traders can unlock the full potential of this dynamic asset class. Whether you’re a seasoned investor or a novice venturing into the world of options, this comprehensive guide has laid the foundation for your journey toward informed and successful trading.

Are you ready to delve into the exciting realm of equity option trading? The knowledge and insights provided here will empower you to make informed decisions and harness the power of options to achieve your financial goals. Embrace the challenge, expand your horizons, and discover the transformative possibilities that await you in the world of equity option trading.