Mark Minervini is a legendary trader, renowned for his exceptional success in option trading. His innovative strategies and unwavering discipline have earned him a cult-like following among aspiring traders. This article delves into the intricacies of Minervini’s option trading approach, providing practical insights and strategies to help you navigate the complex world of options.

Image: alphatrends.net

Introduction to Option Trading: Understanding the Basics

Options are financial instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a certain time window. Understanding the different types of options, including calls and puts, as well as the key concepts of strike price, expiration date, and premium, is essential for successful option trading.

Minervini’s Trading Methodology: A Disciplined Approach

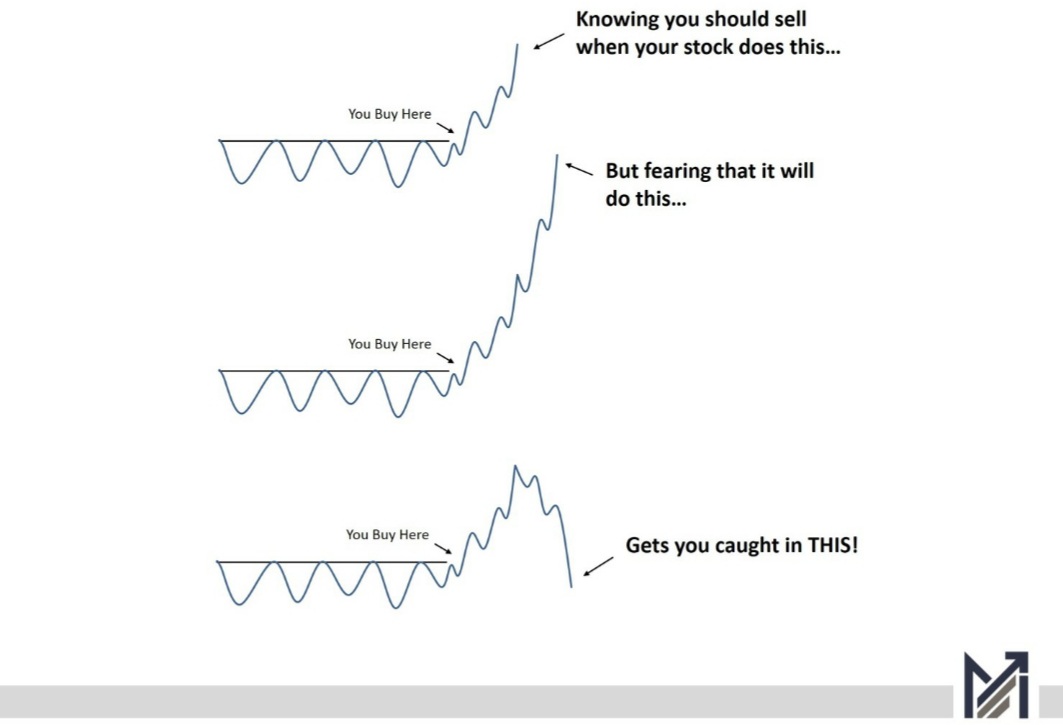

Minervini’s trading methodology revolves around identifying setups with high probability of success and then managing risk meticulously. He adheres to strict rules based on market behavior and technical analysis, minimizing the impact of emotions and biases on trading decisions.

Key Principles of Minervini’s Option Trading Approach

- Trend Following: Minervini focuses on trading stocks that are in strong uptrends or downtrends. He believes that identifying stocks with clear price momentum increases the likelihood of profitable trades.

- Technical Analysis: Minervini relies heavily on technical indicators and chart patterns to determine trading opportunities. He pays close attention to support and resistance levels, moving averages, and candlestick formations to identify potential entry and exit points.

- Risk Management: Risk management is paramount in Minervini’s trading approach. He utilizes position sizing, stop-loss orders, and hedging strategies to limit potential losses. He believes in protecting capital above all else.

- Position Selection: Minervini looks for stocks with strong fundamentals and a clear catalyst for the future price movement. He favors high-growth companies in emerging industries with a solid balance sheet and consistent earnings.

- Patience and Discipline: Minervini advocates the importance of patience and discipline in option trading. He emphasizes waiting for the right trading opportunity and avoiding emotional decision-making. He follows a strict trading plan and stays out of trades that do not meet his predefined criteria.

Image: twitter.com

Practical Strategies for Option Trading Success

- Bull Call Spread: This involves buying a call option with a higher strike price and selling a call option with a lower strike price with the same expiration date. It is a bullish strategy that profits when the stock price rises within a certain range.

- Bear Put Spread: The reverse of a bull call spread, involving selling a put option with a higher strike price and buying a put option with a lower strike price with the same expiration date. This strategy profits when the stock price falls within a specific range.

- Straddle: Buying both a call option and a put option with the same strike price and expiration date. This strategy profits from high market volatility, regardless of the direction of the stock price.

Mark Minervini Option Trading

Image: www.youtube.com

Conclusion: Empowering Traders with Confidence

Mark Minervini’s option trading approach empowers traders with the tools and mindset to navigate the complexities of the markets. By understanding the principles of trend following, technical analysis, risk management, position selection, patience, and discipline, aspiring traders can unlock the potential of option trading and pursue financial success. Embracing Minervini’s strategies and mindset can transform your trading journey, fostering confidence and paving the way towards long-term profitability.