Step into the World of Options

Have you ever dreamt of owning a piece of a global corporation without investing a fortune? Options trading, offered through platforms like RBC Direct Investing, offers an exciting avenue to do just that for investors of all levels. Like any financial instrument, options come with their own set of complexities. Yet, with the right knowledge and guidance, they can become a potent tool in your investment arsenal. Let’s dive into the world of RBC Direct Investing options trading.

Image: brokerchooser.com

RBC Direct Investing: An Introduction

RBC Direct Investing (RBCDI) is a trusted and established online brokerage service provided by Royal Bank of Canada. With user-friendly platforms and personalized guidance, RBCDI empowers investors with the resources they need to navigate the financial markets confidently. Among its offerings, options trading stands out as a sought-after avenue for both seasoned traders and investors seeking diversification.

Understanding Options

An option is a financial contract granting the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a certain number of shares of an underlying security at a predetermined price on or before a specified date. This flexibility provides investors with unique opportunities:

- Control over Investments: Exercise your option to seize opportunities or mitigate risks in changing markets.

- Enhanced Returns: Potential to amplify your returns beyond what traditional investments can offer.

- Hedging Strategies: Use options to protect your existing portfolio from potential losses.

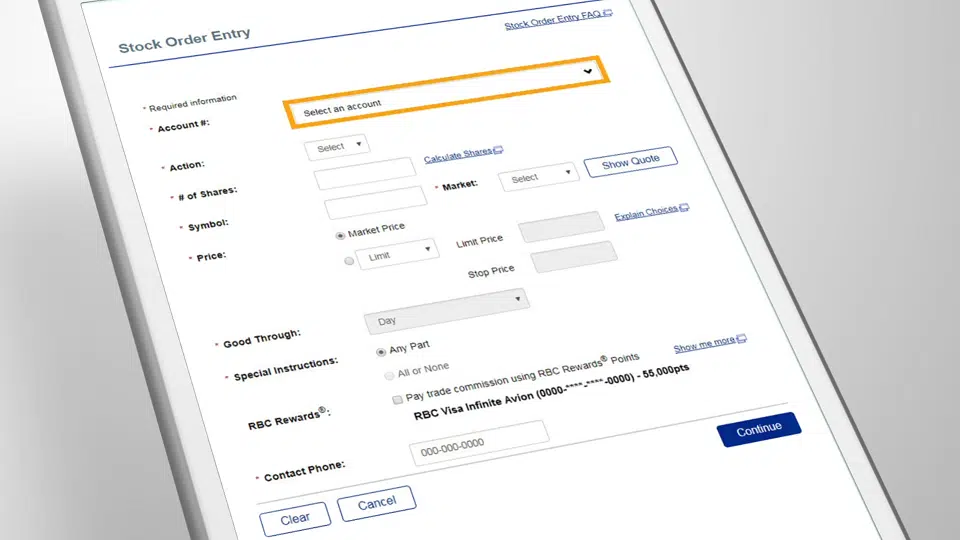

RBCDI Options Trading Platform

RBCDI offers a user-friendly options trading platform tailored to the needs of both experienced traders and beginners. These platforms offer a real-time view of market data, sophisticated tools for strategy development, and access to educational resources.

Image: www.stocktrades.ca

Tips and Expert Advice

To embark successfully on your options trading journey with RBCDI, consider these tips:

- Educate Yourself: Thoroughly research options trading fundamentals and strategies.

- Start Small: Familiarize yourself with the risks involved and initially trade with smaller amounts.

- Seek Professional Advice: Consult with a financial advisor to tailor options strategies to your investment goals and risk tolerance.

FAQs on RBCDI Options Trading

Q: What is the difference between call and put options?

A: A call option gives the buyer the right to buy the underlying security, while a put option gives the buyer the right to sell.

Q: How do I choose the right strike price for an option?

A: The strike price should reflect your market expectations and risk tolerance. Out-of-the-money options carry higher risk but potentially higher returns, while in-the-money options offer lower risk and lower returns.

Q: What is the assignment process?

A: When the option is exercised, the seller is obligated to either buy (in the case of a call) or sell (in the case of a put) the underlying security at the agreed-upon price.

Rbc Direct Investing Options Trading

Conclusion

Options trading with RBC Direct Investing unlocks a world of opportunity for investors seeking flexibility, control, and potential for enhanced returns. By gaining a solid understanding of the basics, embracing expert advice, and navigating the intricacies of its platform, you can confidently embark on this exhilarating financial frontier.

Interested in exploring the world of RBC Direct Investing options trading? Reach out today for personalized guidance and access to a platform tailored to your investment goals and experience level. Embrace the power of options trading and unlock a new level of financial empowerment.