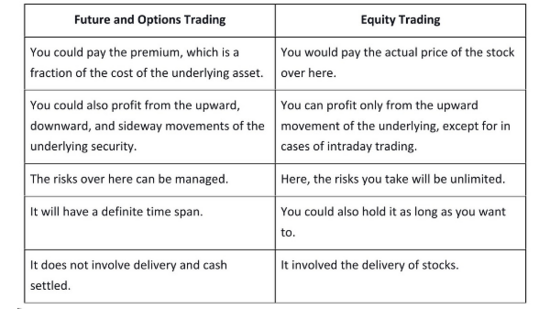

Are you curious about options trading but uncertain where to start? Equity option trading can be a lucrative but intimidating endeavor for newcomers. Understanding the fundamentals of options is crucial for navigating this complex market. This comprehensive guide will provide you with an accessible introduction to equity option trading, empowering you to delve into this dynamic and potentially rewarding investment strategy.

Image: traderfactor.com

What Are Equity Options?

Equity options are financial contracts that give the buyer the right, but not the obligation, to buy or sell a specific amount of an underlying asset at a predefined price by a certain date. These contracts derive their value from the underlying asset’s price and can be used for a variety of purposes, including hedging, income generation, and speculation. Buying an option means acquiring the right to execute the contract, while selling an option involves granting that right to someone else.

Types of Equity Options

There are two main types of equity options: calls and puts. Call options grant the buyer the right to buy the underlying asset, while put options confer the right to sell it. Each type of option can be further classified into two categories:

- American options can be exercised at any time before their expiration date.

- European options can only be exercised on their expiration date.

How Equity Options Work

When you buy an equity option, you pay a premium to the seller in exchange for the option contract. The premium represents the maximum amount you can lose on the trade. If the underlying asset’s price moves in your favor, the value of your option increases, giving you the potential to profit by selling it or exercising it.

Conversely, if the underlying asset’s price moves against you, the value of your option decreases, and you may lose the entire premium paid. It’s important to note that options have a limited lifespan, and if the underlying asset’s price does not move in your desired direction by the expiration date, the option becomes worthless.

Image: howtotradeblog.com

Strategies for Equity Option Trading

There are numerous strategies for trading equity options, each with its own risk and reward profile. Some common strategies include:

- Covered Call Writing: Selling a call option while holding the underlying asset stock.

- Buy-Write: Simultaneously buying a stock and selling a call option with the same underlying asset.

- Vertical Spreads: Buying and selling two options of different strike prices and expirations.

- Bull Call Spread: Buying a call option and selling a higher-strike-price call option with the same expiration date.

Equity Option Trading Level

Image: www.hindustantimes.com

Conclusion

Understanding equity option trading can open up a world of investment opportunities. Whether your goal is capital growth, income generation, or hedging against risk, options offer a versatile and potentially lucrative tool. Remember to approach options trading with a clear understanding of the risks involved and consult with a financial advisor before making any trades. Embark on your journey into the world of equity options with knowledge and confidence, and you may unlock the full potential of this dynamic investment strategy.