Introduction

Image: www.youtube.com

In the dynamic world of options trading, leveraging the power of technology can significantly enhance your decision-making and trade execution. Among the various tools at your disposal, Microsoft Excel stands out as a versatile and customizable platform that can transform the way you analyze and manage your options positions. By harnessing the capabilities of Excel, traders can streamline their workflows, automate tedious calculations, and gain deeper insights into their trading strategies.

Understanding Forms Excel for Options Trading

Forms Excel, a built-in feature in Microsoft Excel, allows you to create dynamic and interactive forms that simplify data entry and enhance usability. By utilizing Forms Excel, options traders can design custom templates that guide them through the process of capturing essential trade details, analyzing option characteristics, and evaluating risk-return profiles. Forms Excel empowers traders to gather and organize data efficiently, minimizing errors and enabling faster decision-making.

Benefits of Using Forms Excel for Options Trading

The incorporation of Forms Excel into your options trading toolkit offers a multitude of benefits, including:

-

Data Accuracy: Forms Excel validates user input, ensuring the accuracy and consistency of data entered into the spreadsheet. This feature eliminates human errors that can compromise trading decisions and lead to losses.

-

Reduced Manual Labor: Automated calculations and seamless data entry significantly reduce the manual labor involved in options trading. Traders can focus on higher-value tasks, such as strategy development and risk management, freeing up valuable time.

-

Improved Organization: Forms Excel promotes a structured approach to data organization, providing traders with a centralized repository of all relevant trade details. This enhanced organization facilitates quick access to historical data, enabling traders to identify patterns and make informed judgments.

-

Collaboration: Forms Excel forms can be shared with other traders or analysts, fostering collaboration and shared insights. Teams can work together to refine strategies, share trading ideas, and make collective decisions.

-

Customization: The customization options in Forms Excel allow traders to tailor templates to their specific trading needs. This flexibility ensures a seamless integration with existing workflows and preferences.

How to Use Forms Excel for Options Trading

Implementing Forms Excel into your options trading process involves the following steps:

-

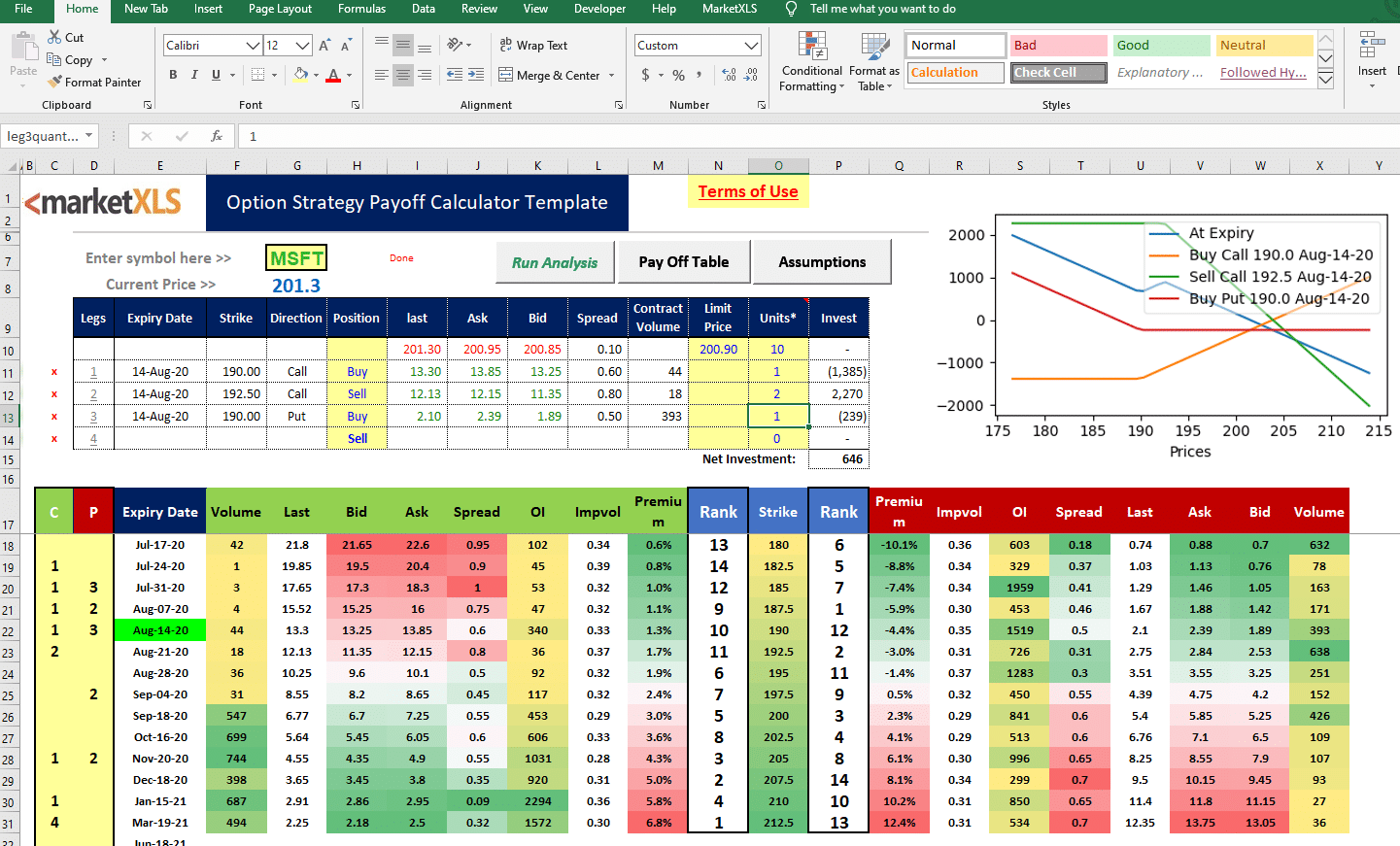

Create a Standard Template: Design a template that captures all necessary trade parameters, such as underlying asset, expiration date, strike price, and trade type.

-

Automate Calculations: Use formulas to automate complex calculations, such as option premiums, breakeven points, and profit/loss scenarios.

-

Incorporate Risk Parameters: Define risk tolerance levels and create conditional formatting rules to highlight trades that exceed defined risk thresholds.

-

Share and Collaborate: Export the form as an interactive PDF or share it online to facilitate collaboration with colleagues or analysts.

Conclusion

Forms Excel has the potential to revolutionize your options trading experience by simplifying data management, automating calculations, and enhancing collaboration. By leveraging its powerful capabilities, traders can make more informed decisions, optimize their trading strategies, and achieve greater success in the dynamic options market. Embrace the benefits of Forms Excel today and elevate your options trading to the next level.

Image: marketxls.com

Forms Excel For Options Trading

Image: www.pinterest.com