In the realm of options trading, precision and strategic decision-making are paramount. Microsoft Excel, with its versatile spreadsheet capabilities and powerful analysis tools, emerges as an indispensable tool for traders seeking to maximize their returns.

Image: db-excel.com

Whether you’re a seasoned pro or a novice seeking a competitive edge, harnessing the power of Excel can transform your options trading strategies. This comprehensive guide will navigate the intricacies of using Excel for options trading, empowering you with the knowledge and skills to streamline your workflows and achieve optimal outcomes.

Excel as a Strategic Tool for Options Traders

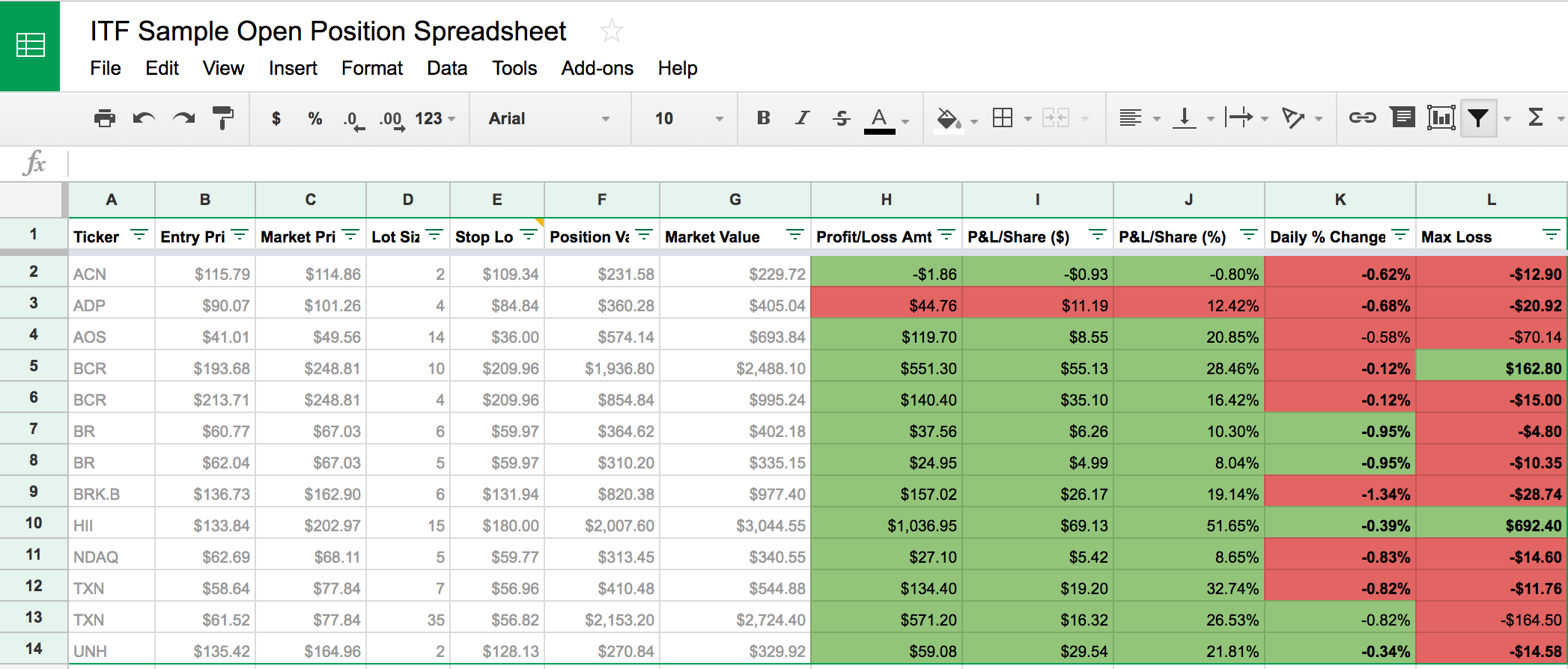

Excel’s primary strength lies in its ability to organize and analyze vast amounts of data. By leveraging Excel’s customizable spreadsheets, traders can effortlessly create tailored workbooks incorporating historical price data, market news, and customizable formulas to gauge market trends and identify lucrative opportunities.

Beyond data management, Excel empowers you with robust analytical tools such as pivot tables and charts. These features enable you to decipher complex data sets, draw out meaningful insights, and make informed trading decisions based on a data-driven approach.

Crafting Excel-Based Options Trading Strategies

To harness Excel’s full potential for options trading, a structured approach is essential. Here’s a step-by-step guide:

- Importing Data: Gather historical price data, market news, and other relevant information, and import it into an Excel spreadsheet.

- Market Analysis: Use charts and pivot tables to analyze the data, identifying trends, patterns, and potential trading opportunities.

- Strategy Development: Define your options trading strategy, considering entry and exit points, strike prices, expiration dates, and risk management parameters.

- Formula Creation: Create custom Excel formulas to calculate critical metrics such as option premiums, profit/loss scenarios, and breakeven points.

- Scenario Planning: Model various trading scenarios using Excel’s “what-if” analysis tool, adjusting inputs to assess potential outcomes before executing trades.

Expert Tips and Advice for Excel-Based Options Trading

To enhance your Excel-based options trading strategies, consider the following expert advice:

- Master Excel’s Formula Library: Familiarize yourself with Excel’s comprehensive formula library, including functions specifically designed for financial analysis and options trading.

- Automate Your Workflows: Take advantage of Excel’s automation features, including macros and add-ins, to streamline your data analysis and reporting processes.

- Collaborate with Other Traders: Excel allows you to share spreadsheets with colleagues, enabling collaborative analysis and strategy refinement in real time.

- Stay Updated with Market Trends: Connect your Excel spreadsheets to real-time data sources to stay on top of market movements and make informed trading decisions.

Image: warsoption.com

Frequently Asked Questions (FAQs) on Excel for Options Trading

- Q: Is Excel essential for options trading?

A: While not strictly necessary, Excel offers powerful tools and features that can significantly enhance your options trading strategies and analysis. - Q: Are there any specific Excel skills required for options trading?

A: A basic understanding of Excel spreadsheet fundamentals and financial analysis functions is beneficial. - Q: How do I get started with using Excel for options trading?

A: Start by creating a custom workbook and importing relevant data. Use Excel’s analytical tools and formulas to explore market trends and potential trading opportunities. - Q: Is it possible to automate Excel-based options trading strategies?

A: Yes, Excel’s automation features allow you to automate specific tasks, such as data extraction and calculation updates.

Using Excel For Options Trading

Image: huimin-frenz.blogspot.com

Conclusion

Harnessing the power of Excel can revolutionize your options trading strategies. By leveraging its spreadsheet capabilities, analytical tools, and automation features, you can streamline data analysis, develop more robust trading strategies, and make informed decisions to enhance your profitability and competitive edge.

Embrace Excel as your trusted companion in the world of options trading and unlock the potential for optimal outcomes. Are you ready to elevate your trading strategies and attain a higher level of success with Excel?