An Introduction to the Dilemma of Negative Equity

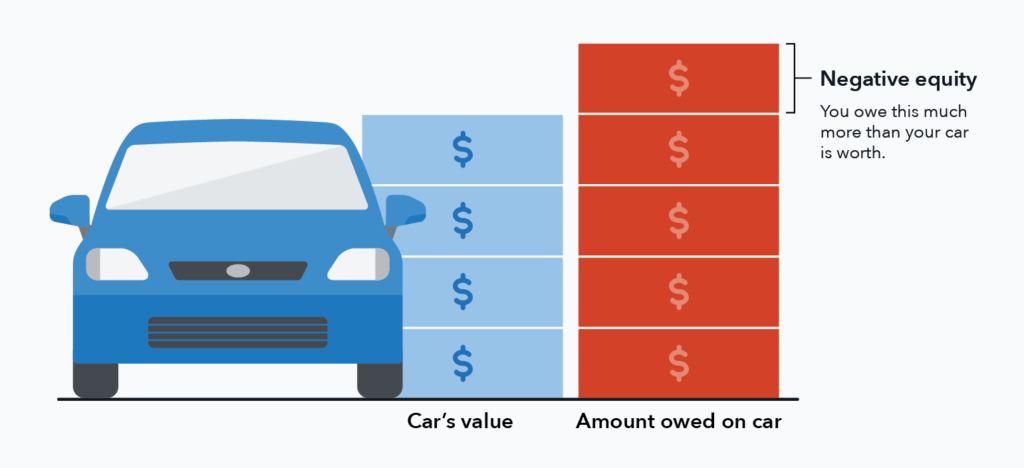

Negative equity occurs when the outstanding balance on a vehicle loan exceeds the current market value of the car. This situation can arise devido to several factors, such as:

Image: www.youtube.com

- Depreciation in the vehicle’s value over time

- Taking out a loan for more than the car’s actual worth

- Rolling over negative equity from a previous loan

If you find yourself in this predicament, you may feel trapped and unsure of how to proceed. However, there are options available to help you manage negative equity and trade in your car.

Options for Trading Car with Negative Equity

There are several ways to trade in a car with negative equity. Each option has its own advantages and disadvantages, so it’s important to consider your financial situation and goals before making a decision.

1. Rollover Negative Equity into a New Loan

One option is to roll over the negative equity into a new loan. This means that the amount you owe on your current loan will be added to the loan amount for your new car. This can be a good option if you have good credit and can qualify for a low interest rate. However, it is important to realize that you will be paying interest on the negative equity, which will increase the total cost of your new car.

2. Trade In Your Car to a Dealership

Another option is to trade in your car to a dealership. The dealership will give you a trade-in value for your car, which will be subtracted from the amount you owe on your loan. If the trade-in value is less than the amount you owe, you will need to pay the difference in cash. Trading in your car to a dealership is a convenient option, but you may not get as much for your car as you would if you sold it privately.

Image: canadianautobrokers.ca

3. Sell Your Car Privately

Selling your car privately is another option if you have the time and effort to do so. You can list your car for sale online or in local newspapers and magazines. If you sell your car for more than the amount you owe on your loan, you can use the proceeds to pay off the loan and keep the remaining balance. Selling your car privately can be a good way to get the most money for your car, but it can also be more time-consuming and challenging.

Expert Advice for Trading in a Car with Negative Equity

Once you have considered your options, it is also advisable to seek advice from automotive or financial experts. Their insights include:

- Consider your financial goals and long-term plans.

- Research your options and compare different loan offers.

- Negotiate with the dealership to get the best possible trade-in value.

- Explore refinancing options to lower monthly payments.

- Make extra payments on your loan to reduce the principal balance faster.

FAQs on Trading Car with Negative Equity

Q: Is it possible to trade in a car with negative equity?

A: Yes, it is possible to trade in a car with negative equity, but it may require additional financial steps.

Q: What are the options for trading in a car with negative equity?

A: The options include rolling over the negative equity into a new loan, trading in the car to a dealership, or selling the car privately.

Q: How can I get the most money for my car when trading it in?

A: You can get the most money for your car by selling it privately. However, this option requires more time and effort.

Q: What are some tips for negotiating with a dealership?

A: Some tips for negotiating with a dealership when trading in a car with negative equity include researching your options, being prepared to walk away, and getting a pre-approval for financing.

Options For Trading Car With Negative Equity

Image: www.chase.com

Conclusion

Trading in a car with negative equity can be a challenging experience, but it is one that can be managed with the right strategy. By researching your options, understanding the benefits and drawbacks of each, and seeking expert advice when needed, you can make an informed decision that meets your financial needs and goals.

So, are you ready to explore your options for trading in a car with negative equity? Remember, you’re not alone in this situation. With careful planning and execution, you can successfully navigate this financial challenge and move on to your next automotive adventure.