Have you ever wondered how the financial world can turn a seemingly “negative” situation into an opportunity for profit? Enter the enigmatic realm of negative credit options trading. This strategy, often overlooked by novice investors, presents a unique path to potential gains amidst market volatility. In this comprehensive guide, we will delve into the intricacies of negative credit options, empowering you with the knowledge to navigate this intriguing financial landscape.

Image: optionalpha.com

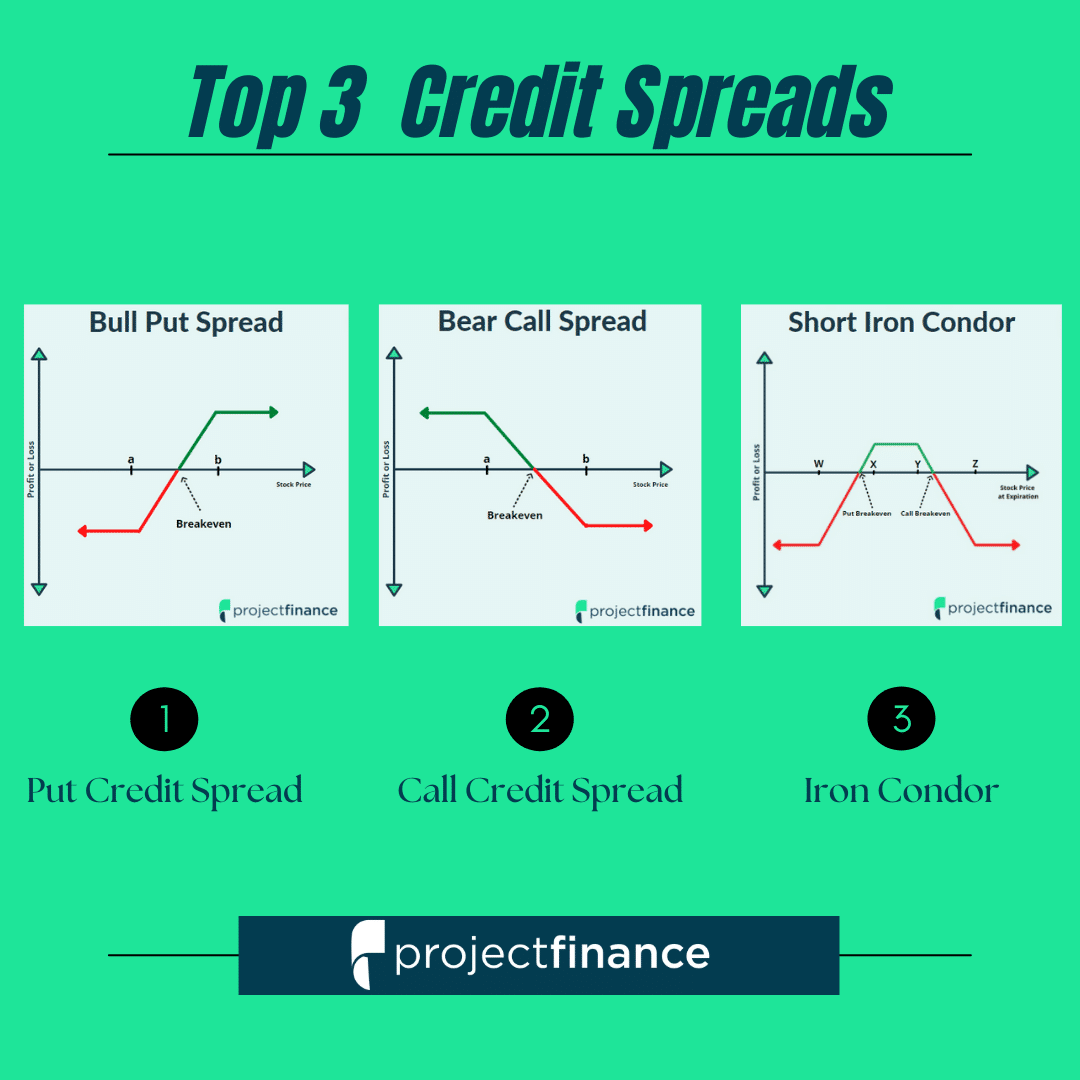

Negative Credit Options: A Basic Overview

Negative credit options, also known as credit put options, are a type of financial derivative that derives its value from the default risk associated with a bond or loan. Unlike traditional call options, which grant the buyer the right to purchase an underlying asset, negative credit options empower the holder to sell a specific bond or loan at a predetermined price on or before a specified date. By transferring the risk of credit deterioration to the option buyer, the seller of a negative credit option generates a premium in exchange for taking on the potential obligation to purchase a distressed asset.

The tantalizing allure of negative credit options lies in their ability to amplify returns during periods of heightened market volatility. When credit spreads widen, indicating an increased likelihood of a bond default, the value of a negative credit option soars, potentially enriching its holder. However, the inherent risk associated with this strategy must not be overlooked, as the obligation to purchase a defaulted asset can materialize unexpectedly.

Navigating the Nuances of Negative Credit Option Trading

Delving deeper into the intricacies of negative credit options trading, an understanding of its subtle nuances is paramount. The payoff structure of these options typically follows a nonlinear trajectory, where significant gains can be realized under specific market conditions.

-

Profitable Scenario: Prosperity shines upon negative credit option holders when the underlying bond or loan experiences a significant decline in value due to adverse market events. As fear engulfs the market, credit spreads amplify, and the value of the option spirals upward, rewarding the holder with substantial profits.

-

Breakeven Point: At the demarcation line where neither enchantment nor despair prevails, resides the breakeven point. When the underlying bond’s price holds steady or exhibits a moderate decline, the value of the negative credit option aligns with the premium paid at inception.

-

Unfavorable Outcome: When fortune eludes negative credit option holders, they may encounter an adverse outcome if the underlying bond rallies, effectively narrowing credit spreads. Such a turn of events can lead to a loss of the premium invested, culminating in a somber realization of the risks inherent in this strategy.

Unveiling the Advantages and Caveats of Negative Credit Option Trading

Like a double-edged sword, negative credit options trading offers both potential rewards and inherent risks, each facet requiring careful consideration.

-

Boon:

- Magnified Returns: During times of turmoil and market uncertainty, negative credit options can amplify returns, outperforming traditional investment strategies.

- Diversification: Introducing negative credit options into an investment portfolio can enhance diversification, mitigating overall risk exposure.

-

Bane:

- Execution Risk: The obligation to purchase a distressed asset if the underlying bond defaults poses a significant risk, potentially marring the allure of potential profits.

- Implied Volatility: Negative credit options are heavily influenced by implied volatility, making precise prediction of their value an elusive endeavor.

Image: fabalabse.com

Negative Credit Options Trading

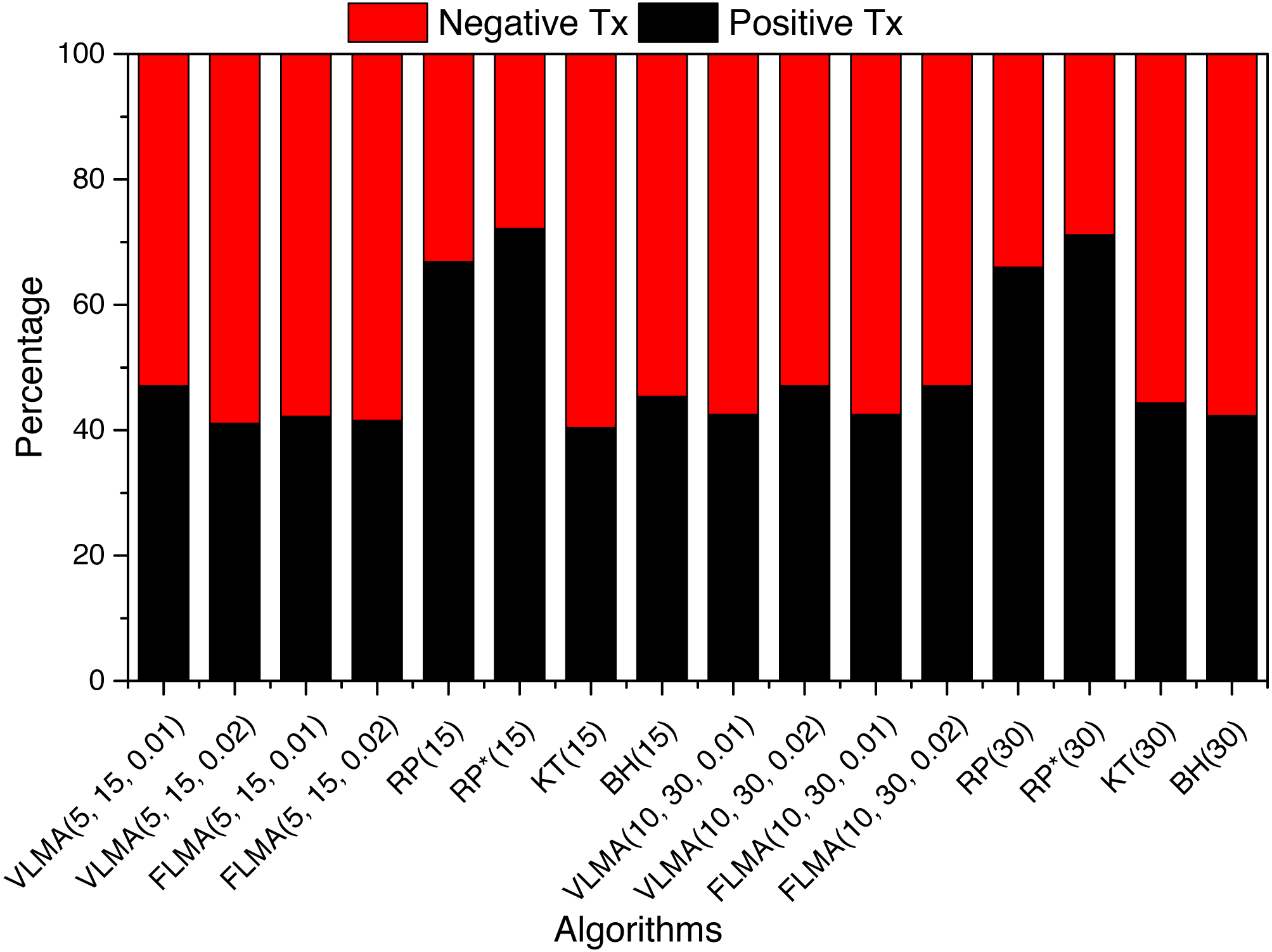

Image: peerj.com

Conclusion

Negative credit options trading presents a fascinating opportunity to capitalize on market volatility while simultaneously embracing its inherent risks. Whether you are a seasoned investor seeking diversification or a novice intrigued by the potential rewards, the decision to engage in this strategy should be guided by a thorough evaluation of your investment goals and risk tolerance. As you traverse the enigmatic realm of negative credit options, remember to conduct meticulous research, consult seasoned professionals, and approach the endeavor with both anticipation and prudent caution.