Overview:

In the realm of financial markets, credit check options trading stands out as a sophisticated strategy that has the potential to generate substantial returns while mitigating downside risks. This intricate investment technique involves using credit checks as the underlying asset for options contracts, providing investors with a variety of opportunities to profit from market fluctuations.

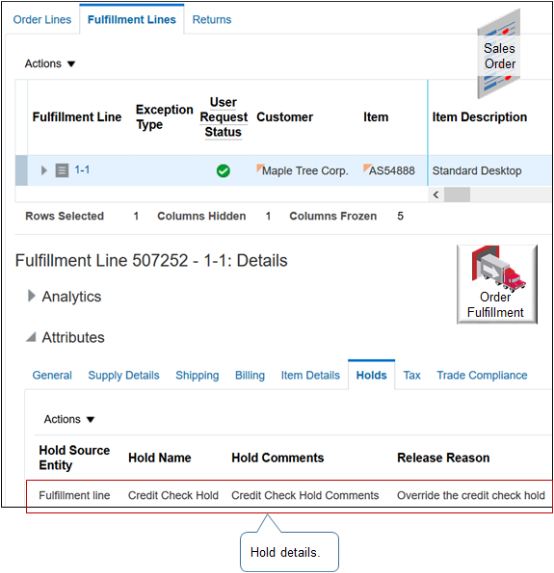

Image: docs.oracle.com

Understanding Credit Check Options

A credit check is essentially an evaluation of a borrower’s creditworthiness, typically conducted by credit bureaus such as Equifax, Experian, and TransUnion. By analyzing an individual’s past financial behavior, credit reports assign a credit score that serves as a benchmark for lenders and financial institutions. Credit check options derive their value from these credit scores, which fluctuate based on factors like payment history, debt levels, and credit inquiries.

Advantages of Credit Check Options Trading

-

Diversification: Credit check options offer a distinct asset class that can help diversify portfolios and reduce overall market volatility.

-

Hedging: Investors can use these options to hedge against potential risks associated with credit-sensitive investments or economic downturns.

-

Income Generation: Options contracts can provide regular income through premiums, dividends, or interest payments.

-

Tailored Exposure: Credit check options allow investors to tailor their exposure to specific credit quality levels, from high-yield to investment-grade bonds.

Types of Credit Check Options

-

Call Options: Give buyers the right, but not the obligation, to purchase credit checks at a predetermined price on or before a specified date.

-

Put Options: Grant buyers the right, but not the obligation, to sell credit checks at a predetermined price on or before a specified date.

-

Credit Default Swaps (CDS): Insurance-like contracts that protect buyers against the risk of default on underlying credit instruments.

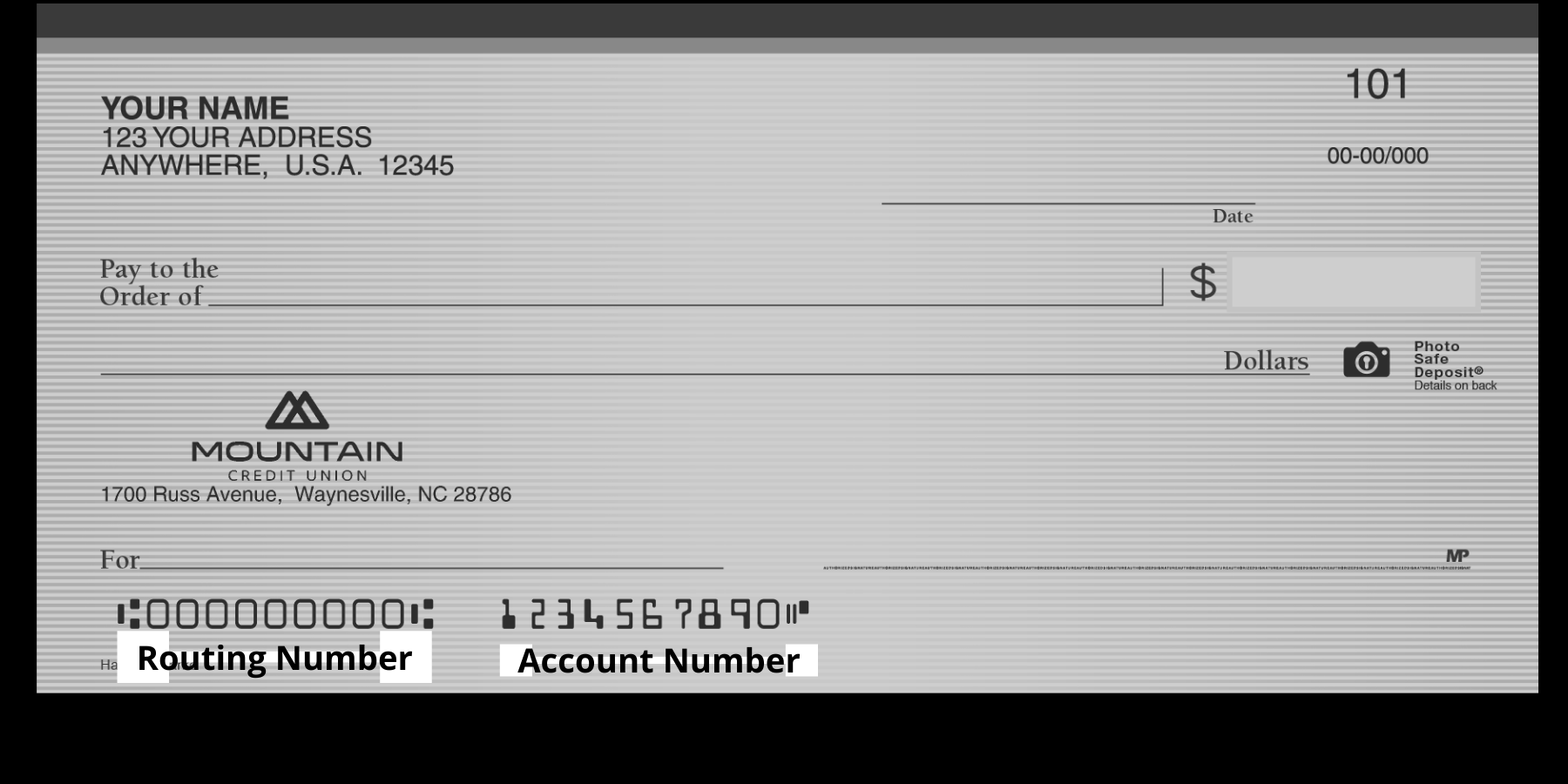

Image: www.mountaincu.org

Trading Strategies

-

Long Calls: Investors buy credit check call options when they expect credit scores to improve, aiming to profit from potential gains in the underlying asset.

-

Long Puts: Investors buy credit check put options when they anticipate a decline in credit scores, attempting to capture downside movements in the market.

-

Short Calls: Investors sell credit check call options when they believe credit scores will not rise significantly, benefiting from decay in option premiums.

-

Short Puts: Investors sell credit check put options when they expect credit scores to remain stable or improve, profiting from limited downside potential.

Risk Management:

-

Credit Quality: Investors should carefully assess the credit quality of the underlying credit checks to minimize exposure to high-risk issuers.

-

Expiration Dates: Understanding option expiration dates and their implications is crucial for managing risk and determining profit potential.

-

Trading Size: Limit the size of trades to prevent excessive losses and ensure adequate risk management.

-

Market Volatility: Monitor market conditions and adjust trading strategies accordingly to account for fluctuations in credit check prices.

Credit Check Options Trading

Image: help.exatouch.com

Conclusion:

Credit check options trading presents a powerful tool for investors seeking to tap into the growing market for credit derivatives. By grasping the concepts, strategies, and risks involved, investors can harness the potential of this sophisticated investment vehicle to enhance their portfolios and navigate the complex landscape of financial markets. However, thorough research and a well-informed approach are essential for maximizing returns and mitigating pitfalls in this dynamic and rewarding field.