Navigating the Complexities of Options Trading with Credit Hurdles

For many aspiring investors, the world of options trading holds immense promise. These financial instruments offer the potential for high returns, but they also come with inherent risks that can be exacerbated by poor credit. If you’ve encountered the frustrating roadblock of denied options trading due to bad credit, this comprehensive guide will equip you with the knowledge and understanding you need to navigate this complex landscape.

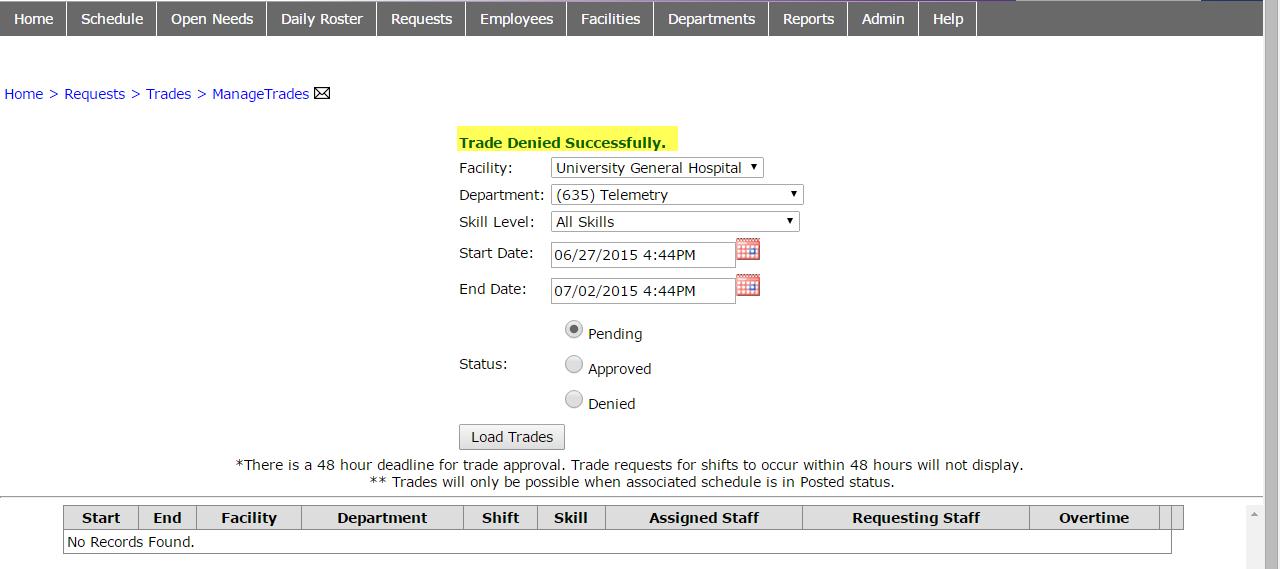

Image: capital.fs.app.medcity.net

Understanding Options Trading and Credit Considerations

Options trading involves the buying and selling of contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price on a specified date. To engage in options trading, brokers typically require a margin account, which serves as a form of collateral for your trading activities. Establishing a margin account requires a good credit history, as brokers assess your creditworthiness to determine your eligibility and risk tolerance.

The Impact of Bad Credit on Options Trading

Unfortunately, a poor credit score can significantly hinder your ability to open a margin account and trade options. Substandard credit poses a higher risk to brokers, leading them to be more cautious in approving such accounts. The exact criteria for denying options trading based on credit vary among brokers, but common factors include:

- Low credit scores

- Delinquent payments

- Bankruptcy

- High debt-to-income ratio

Exploring Alternative Options

While being denied options trading due to bad credit can be disheartening, it doesn’t mean you’re completely shut out of the world of investing. Let’s explore some alternative options that may still allow you to participate in the market:

Image: www.youtube.com

1. Cash Accounts:

Cash accounts do not require margin and, therefore, do not consider your credit history. However, trading in a cash account limits you to purchasing securities with the funds you have on hand. This limits your potential leverage and profit-making opportunities compared to margin accounts.

2. OTC Bulletin Board (OTCBB) Stocks:

These are over-the-counter (OTC) stocks that trade outside the major exchanges. They are typically less regulated, which means they can be more accessible even for investors with poor credit. However, OTCBB stocks also come with higher risks and may be more volatile.

3. Penny Stocks:

These are low-priced stocks of small companies that trade for less than $5 per share. While they offer the potential for high returns, they are extremely risky and should only be considered by experienced investors who can tolerate significant losses.

Expert Insights: Strategies for Success

Financial advisor and CNBC contributor Robert Pagliarini notes, “Having bad credit can make it more difficult but not impossible to start trading options. It’s important to take a conservative approach, understand the risks, and consider the alternatives available.”

Investment author and speaker Jonathan Breckon advises, “Don’t let poor credit deter you from investing. Explore the different options available, learn from experienced investors, and build a sound investment strategy that aligns with your financial goals and risk tolerance.”

Denied Options Trading Bad Credit

Image: www.dreamstime.com

Conclusion

Being denied options trading due to bad credit can feel like a setback, but it is not an insurmountable barrier to financial success. By understanding the reasons behind this denial, exploring alternative options, and seeking guidance from experts, you can navigate this challenge and pave your way towards financial empowerment. Remember that investing involves inherent risks, and it’s crucial to assess your financial situation, tolerance for risk, and investment goals before making any trading decisions.