Introduction

In the financial markets, understanding the inner workings of index options is crucial. Credit index options, in particular, offer a unique way to manage risk and speculate on the movements of credit markets. Join me as we delve into the world of credit index options trading, exploring its intricacies and empowering you with essential knowledge.

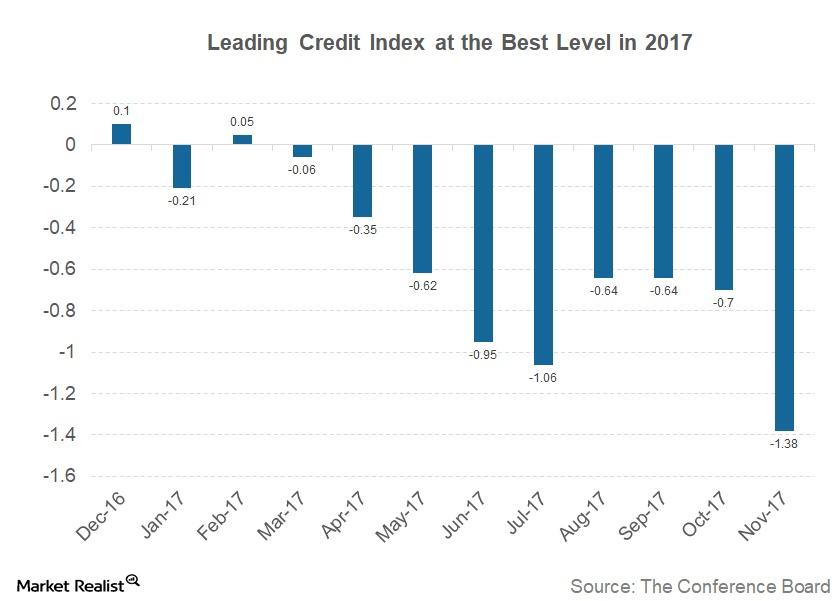

Image: marketrealist.com

Credit index options are financial instruments that grant the buyer the right, but not the obligation, to trade or settle a specified credit index at a predetermined price on a future date. The underlying asset, typically a credit index, reflects the overall health and performance of a specific bond or loan market.

Credit Index Basics

Definition

A credit index is a statistical measure that represents the performance of a group of bonds or loans. It tracks changes in the value of these assets, providing a gauge of the risk and return associated with credit markets.

Historical Evolution

Credit indices have evolved since the late 20th century. Initially, they were used primarily to measure the overall riskiness of fixed-income portfolios. However, their versatility and usefulness in managing credit risk have led to their widespread adoption in various financial applications.

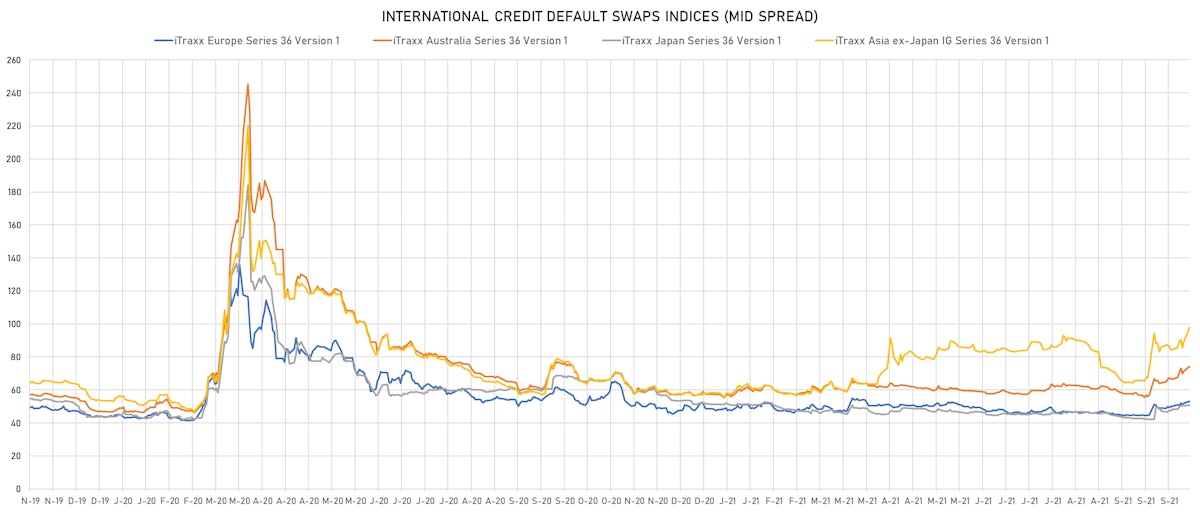

Image: needcircle.com

Options on Credit Indices

Options contracts grant their holders the right to buy (call option) or sell (put option) an underlying asset at a predefined strike price on or before a specified expiration date. In the context of credit index options, the underlying asset is a credit index. This allows investors to speculate on or hedge against future movements in the credit markets.

Credit index options are traded on exchanges, where buyers and sellers meet to determine the price of the contract. The price of an option is influenced by various factors, including the credit-risk environment, time to expiration, strike price, and supply and demand dynamics in the market.

Recent Trends in Credit Index Options

Recent market volatility and concerns about inflation have renewed interest in credit index options. As investors seek to manage risk amidst uncertain conditions, credit index options provide a valuable tool for diversification and hedging purposes.

Advancements in technology have also facilitated the growth of credit index options trading. Electronic trading platforms and automated execution have increased efficiency and liquidity in the market, enhancing the trading experience for both institutional and retail participants.

Expert Advice for Successful Trading

Seasoned options traders offer valuable advice for enhancing your chances of success in credit index options trading:

- Thorough Research: Understand the underlying credit index, its components, and historical behavior. This empowers you to make informed decisions.

- Risk Management: Employ proper risk management strategies, including position sizing and stop-loss orders, to mitigate potential losses.

- Technical Analysis: Use technical analysis tools to identify price patterns and trends in credit index options, aiding in trade timing and execution.

Frequently Asked Questions

Q: What are the main types of credit index options?

A: Credit index call options give the buyer the right to buy the underlying index, while credit index put options give the buyer the right to sell the underlying index.

Q: How is the price of a credit index option determined?

A: The price of a credit index option depends on factors such as the current level of the index, strike price, time to expiration, implied volatility, and interest rates.

Q: What are some of the risks involved in credit index options trading?

A: Credit index options trading involves risks such as adverse movements in the underlying index, interest rate changes, and liquidity considerations.

Credit Index Options Trading

Image: www.phipost.com

Conclusion

Credit index options offer a powerful and flexible instrument for speculative and hedging strategies. By understanding the concepts, trends, and tips presented in this article, you are well-equipped to navigate the world of credit index options trading. Knowledge is power, so continue to delve deeper into the intricacies of this market and enhance your financial literacy.

Are you ready to explore the exciting world of credit index options trading? If so, equip yourself with the knowledge and strategies necessary to make informed decisions in this dynamic market.